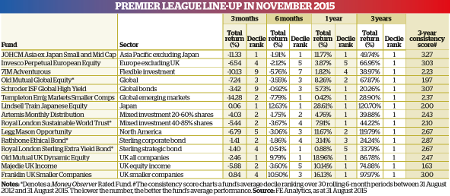

Global equity funds: Premier League Nov 2015 update

12th November 2015 10:00

by Rebecca Jones from interactive investor

Share on

Global sector

Old Mutual Global Equity

Another of our sister publication Money Observer's Rated Funds, , held onto its Premier League place from August, thanks largely to its sector-beating three-year total return of nearly 68%, which places it sixth among 230 funds in the global sector over the period.

However, its success is rooted in the stability of these returns. The fund achieved the second-best consistency score in the league between August 2012 and August 2015 (1.9).

Fund manager Ian Heslop claims this is no coincidence. He says: "The big issue we face is instability. The way we have blended types of stocks, recognised the different types of market we're in, and learned how markets evolve and what that requires in a portfolio, explains why we've outperformed consistently."

Heslop and his team never make any big macro or sector "bets", which he believes are often the downfall of active managers.

| Introduction |

| UK equity funds |

| Regional equity funds |

| Global equity funds |

| Bond funds |

| Mixed assets funds |

He says: "Active managers tend to underperform their indices because often they have highly concentrated exposure at the style level, and that's what we try to avoid."

That said, Heslop insists the fund is not a closet index tracker, having returned 3, 24 and 40% more than its benchmark over one, three and five years respectively.

Global Emerging Markets sector

Templeton Emerging Markets Smaller Companies

has also held onto its place in the league since the previous review. It was the best-performing fund in the global emerging markets sector over three years, with a return of 29%.

This is a fine achievement in a difficult period for emerging markets; the average gain in the global emerging markets sector over the same period was just 0.9%.

The trust's success rests on the skills of deputy managers Dennis Lim and Tom Wu and their experience investing in Asia, where 61% of the portfolio currently resides.

Templeton Emerging Markets Smaller Companies' main focus is on firms with a market cap of less than $2 billion (£1.3 billion), which means it is more likely to invest in local businesses than large multinational companies with operations in the region.

The fund has a well-diversified portfolio of more than 80 holdings - no position accounts for more than 5% of the total fund.

(click to enlarge)

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.