13 top UK stocks for dividend growth

13th November 2015 09:00

by Heather Connon from interactive investor

Share on

Inflation over the 10 years to the end of 2014 averaged 2.7%; the real return on equities over the same period was about 5%, and on gilts about half that.

GDP growth has been well below 3% and house prices across the UK have risen by an average of less than 2% (although Londoners, of course, have done much better than that). So any company that has grown its dividends by at least 10% a year over the bulk of that period has been doing pretty well.

Analysis conducted by Interactive Investor's sister publication Money Observer shows that of the 573 companies that have been in the FTSE All-Share index over the past decade, an elite group of 13 have managed to grow their dividends by that amount in at least nine of those 10 years.

Overall, our dividend heroes averaged a 19.2% annual increase in dividends every year, with the leaders - chip-maker and - averaging a stellar 27.8% per year.

Top dividend growth stocks

While our rules allowed companies to miss the 10% target for one year in the decade, four of our heroes scored a full house of 10%-plus every single year.

They were: ARM Holdings, veterinary specialist , software business and the .

(Click to enlarge)

They range in size from the relatively tiny, such as support services group with a market value of just over £400 million, to the tobacco giant , which is worth more than £31 billion; they cover industries from the media (advertising group ) to fast food (Domino's). But the biggest sector, with four of the 13 companies, is support services.

Indeed, four of the other constituents also have a significant service element: , which provides payment services to companies and consumers; advertising giant WPP; NCC, which offers security and software services and ARM, which designs and then licences the chips in smartphones and other gadgets, rather than manufacturing them itself.

Services rule

The preponderance of service companies has some logic. Such businesses are generally not particularly capital intensive, relying instead on a skilled workforce to service their clients.

In theory, at least, that should leave more cash flow available to reward shareholders - although the experience of businesses such as and , both of which suffered from disastrous public contracts, shows that keeping customers satisfied is not always easy.

Just three businesses could fall under the manufacturing banner: , whose products include tactical control, navigation and communications systems for commercial and military aircraft, although it also has a sizeable service-based business; Dechra Pharmaceuticals, which supplies therapeutic products for animals - although its research and development activities are at least as important to its long-term success; and Imperial Tobacco, with its range of cigarettes and other tobacco products.

All are very specialist manufacturers: Dechra has tapped into a niche that is growing rapidly as we all spend more on our pets. While tobacco should be a commodity product - and a shrinking one at that, as health authorities across the world persuade us to give up smoking - Imperial's global reach and dominance of its key markets give it a particular strength.

Retailing gets just one entrant, in , although this firm also designs and manufacturers its distinctive clothing range, so it straddles manufacturing. Domino's, while classed in travel and leisure, is also a presence on the British high street, albeit through franchised stores.

The list is also notable for its absences. Imperial and Dechra apart, the sectors traditionally favoured by income-seekers - utilities, oil companies and pharmaceuticals - are missing.

That reflects the fact that these are generally operating in mature industries where growth is limited and that, while they may pay generous dividends, their pedestrian earnings growth means they are unable to meet the stretching target of our dividend heroes.

Many of the electricity and water companies, for example, promise merely to match inflation, which has been well below 10% for at least a quarter of a century. Banks and other financial companies would have earned a place at the start of our decade, but the financial crisis put paid to their ambitious dividend growth plans.

Those that missed

A number of companies came very close to joining the select group: missed out in two of the eight years, , the animal breeding expert, would have been in if we had rounded the 9.7%, 9.8% and 9.9% growth achieved in four of the years up to 10%; growth averaged more than 14% a year but it held its dividend one year, and in another the growth was 7.32%, impressive enough but below our target.

It has also paid 340p a share in special dividends in the past two years, making it a prized stock for many income-seekers; but special dividends are excluded from our calculations, as we are interested in sustainable income growth.

Our companies are not particularly high-yielding: indeed, the lowest, ARM Holdings, has a yield of just 0.72% and the highest, Imperial Tobacco, 3.82%.

Again, that is not surprising: companies that pay high dividends are unlikely to be able to increase them consistently by enough to make our list of dividend heroes. A high yield can also indicate a low dividend cover and thus limited capacity for growth.

Many of our heroes also have a relatively short history. That is understandable, as young, fast-growing businesses are likely to start off by paying relatively low dividends, keeping capital for expansion. When they do eventually start growing their dividends it will be from a low base, so it is easier to achieve the high rates of increase.

The key question for investors is whether these dividend heroes can continue their healthy growth into the future. There is certainly no guarantee of that.

The global economy is still sluggish and China shows signs of a marked slowdown, which will make life more difficult for many companies. The rise in the UK minimum wage could affect companies such as Mears and Domino's.

What their records do say, however, is that these companies are cash-generative and growing, and that they recognise the importance of rewarding their shareholders - three valuable characteristics in any investment portfolio.

The 13 dividend heros

ARM Holdings

The specialist chip-maker was spun out of the collaboration between Acorn Computers and Apple in 1990. Its technology quickly became the industry standard for mobile devices.

ARM has 1,100 licences with more than 300 companies, earning it royalties for the design and licencingof its smart chips: a much more effective business model than actually shipping the chips itself.

While its share price tends to rise and fall in line with the fortunes of , its most high-profile customer, it has customers from across the industry.

(Click to enlarge)

Domino's

The pizza delivery company arrived in the UK in 1995 and became the first home delivery company to float on the Alternative Investment Market (AIM) when it listed there in 1999.

The company has the UK franchise from US company Domino's Pizza International and operates here through franchising stores. Its growth has been impressive: its 2,000th store was opened in Hemel Hempstead in 2013, and it also has franchises in Germany and Switzerland.

NCC Group

Like numbers one and two, NCC has a relatively short corporate history, having formed in 1999 when the National Computing Centre sold its commercial divisions in a management buyout. It floated on Aim in 2004, moving to the main market three years later.

Its business is information assurance: its services include verification, security consulting, website performance, so ware testing and domain services - all fast-growing areas as computer use explodes.

While earnings were growing strongly - in the year to May 2013 they grew more than sixfold - recent results have been more pedestrian, although brokers are forecasting strong growth for the next two years.

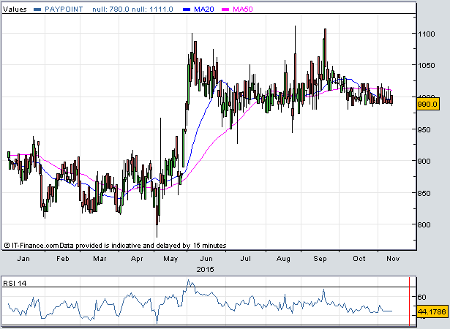

Paypoint

Another young company, Paypoint was formed less than two decades ago as a nationwide bill-paying network, offering outlets in the places that people use daily, with the aim of making it easier for them to manage their finances.

From that, it established an internet payment service provider, connecting merchants with banks, which was then rolled out to mobile through PayByPhone, now one of the world's leading mobile payments systems.

It is also the company behind the Collect+ service, which allows customers to collect and return online purchases. Earnings growth over the last five years has averaged 12%.

(Click to enlarge)

Burberry

Not long ago Burberry was a rather dull and pedestrian brand, but is now one of the world's leading fashion brands, focusing on what it describes as "authentic and distinctive products and continuous innovation in design and manufacturing".

The transformation owed much to Angela Ahrendts, who took over as chief executive in 2006 but was enticed away by Apple last year. Whether her successor, Christopher Bailey, can continue the growth remains to be seen.

Mears Group

Mears maintains local authority and other social housing and provides care services to around 30,000 people a year, helping them to remain in their own homes. While cash-strapped local authorities are having to trim their costs, this has proved a profitable niche for the company.

Diploma

has been around since 1931 but started a transformation in the early 1990s, when its traditional engineering and building industries went into decline.

It has now reinvented itself as an international group, providing specialist, technical products and services in three areas: life sciences, sealing products and controls.

It aims to continue its growth by acquiring other complementary businesses that fit with its existing specialist niches, investing to take them to a new level, and then growing both the new and existing operations.

Underlying revenue growth has been 9% over the past five years, while margins are a healthy 18 to 19%.

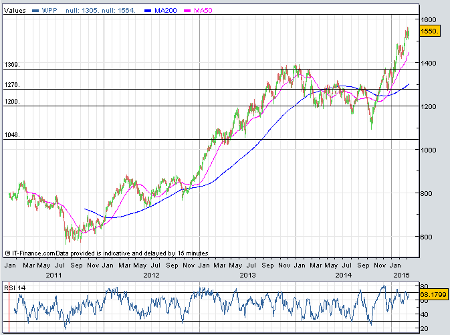

WPP

A world-leading advertising, marketing and communications business, WPP has also undergone a transformation since its chief executive Martin Sorrell took over a wire basket-maker, Wire and Plastic Products, in 1985.

It is now seen as a bellwether for the global economy, and Sorrell's colourful descriptions of the state of the recession - he likened its shape to a bath at one point - are pored over by analysts keen to extrapolate his comments to other parts of the economy.

(Click to enlarge)

Intertek

was spun out of the international trading company Inchcape in 1996, listing on the stock exchange again in 2002. It provides quality and safety services to companies in a range of industries - from nuclear to food manufacturing - across the world.

Among its services are audit and inspection, training and certification. Both revenues and earnings have grown by an average of almost 20% a year over the past five years, although recent results have shown falls in both; however, analysts are forecasting a return to growth.

RPS Group

RPS is an international development, energy and environmental consultancy company, with offices in the US, Canada, Malaysia and the Netherlands as well as in the UK. Among its services are advising on energy infrastructure and on transport links.

Dechra Pharmaceuticals

The British are not the only nation of animal lovers: across the globe, more and more people have pets - and are spending more and more on them. Dechra is tapping into that trend with its range of specialist veterinary pharmaceuticals.

Cobham

Cobham operates in three primary business sectors: aerospace systems, avionics and flight operations and services.

It designs and makes equipment, specialised systems and components used within the search and rescue, civil and defence aviation, marine, aerospace, homeland security and communication markets.

These are very specialist businesses, with high barriers to entry and a demanding client base that Cobham has shown it is expert at servicing.

Imperial Tobacco

One of the leading tobacco companies, Imperial has operations in 160 countries, with brands including Gauloises, Lambert & Butler and West.

While tobacco sales are declining in mature markets, they are still rising in emerging economies. The company is also focusing on consolidating its position in key markets, including the US and the European Union, where its market share is below 15%.

Its strategy reads like a primer for dividend generation: "Our focus on quality sustainable sales growth, combined with the efficient way in which we manage costs throughout our operations, delivers high operating margins.

"This generates the strong cash flows which we use to reward our shareholders and to reinvest in the business, pay down debt or return to shareholders."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.