Backing Vodafone to bounce

16th November 2015 13:35

by Lee Wild from interactive investor

Share on

Vodafone shares jumped 6% in the aftermath of last week's first-half results, and have outperformed the FTSE All-Share during the latest market sell-off. And there's reason to believe that they'll be worth more in the months ahead, according to the telecoms team at Barclays.

In the six months ended 30 September, generated organic, or like-for-like, growth in service revenue of 1%, the fifth consecutive quarter of improving revenue trends. Group revenue was up 2.8% to £20.3 billion, but down 2.3% on a reported basis.

And the telecoms giant returned to growth in organic cash profit, or EBITDA, up 1.9% at £5.8 billion. Full-year profit is now tipped by Vodafone to reach £11.7-£12 billion, up from the £11.5-£12 billion guidance given at the 2014 results in May.

"Our financial performance is beginning to reflect the positive impact of our Project Spring investment programme and better commercial execution," said Vodafone, "and in Europe we are also benefiting from some easing of regulatory pressures and a steady improvement in the macroeconomic environment."

Boss Vittorio Colao called it a "turning point" and expects progress to continue in the second half.

(click to enlarge)

Barclays makes some modest changes to underlying forecasts, although lower capital expenditure (capex) estimates are largely offset by a weaker euro. The broker trims expectations for revenue and cash profit in 2016 to £40.8 billion and £11.7 billion, respectively, and by 2.4% and 1.3% for 2017 to £41.4 billion and £12.1 billion.

But the numbers still stack up.

"We estimate Vodafone is trading on 7x Mar 17E EV/EBITDA [enterprise value/cash profits], and offers a 5.7% dividend yield," writes Barclays. "This compares to EU incumbent peers on 7x and 4.5% respectively. We estimate the share price is discounting 0% terminal growth at a 7.8% WACC [weighted average cost of capital] - and see this as too pessimistic."

As a result, the broker repeats its 'overweight' rating and 250p price target.

Dividend

Vodafone's two-year investment programme - Project Spring - is designed to expand 4G coverage in Europe and 3G and 4G coverage in Africa, Middle East and Asia-Pacific (AMAP) region. Upgrading networks and building its own fibre networks is also essential, but expensive.

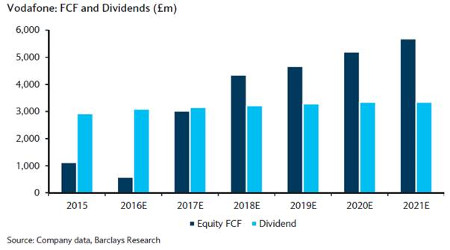

Heavy spending is currently holding back free cash flow (FCF) and affecting margins. However, free cash flow growth will pick up once capital expenditure begins to fall post Project Spring. If it does, Barclays thinks the dividend should be broadly covered in the year to March 2017 and well covered thereafter (see below).

(click to enlarge)

Vodafone will pay an interim dividend of 3.68p in February. That's up 2.2% year-on-year and in line with its intention to grow the full-year dividend annually.

Not everyone has been as positive on Vodafone shares in recent months, however. Comments here by chartists Alistair Strang and John Burford are both worth a read.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.