Chart of the week: Lloyds worth just 50p

30th November 2015 10:20

by John Burford from interactive investor

Share on

Anglo American digs an even deeper hole

It just keeps getting worse for this major miner. Last week, was refused permission to extend one of its Aussie mines, it will close a major coal mine next year, and China's growth continues its sharp decline, with demand for commodities falling.

And iron ore prices continue to test 10-year lows near $40 a metric tonne. Prices for coal - which is the devil fuel incarnate - are likewise in a steep bear trend, with thermal coal at an eight-year low.

Here is Anglo's sorry, stunning chart:

(click to enlarge)

In five years, the shares have lost almost 90% - this, in what has been a global growth phase for the economy. There has not even been a recession in these years. This is an extraordinary state of affairs - and incidentally, a vivid demonstration on how a buy-and-hold approach to investing can go horribly wrong.

But remember Baron Rothschild's aphorism: "The time to buy is when there's blood in the streets". I consider a 90% loss as good a definition of "blood in the streets" as an investor will find - so is it time to buy Anglo?

Usually, when a share loses this much value, the company is headed for extinction. But for this company, which has vast reserves of raw materials, is this a realistic prospect? In other words, will the world never need coal, steel, metals ever again? But the shares are surely priced for this scenario, are they not?

To my mind, either share prices in previous years were way over-stretched, or today's values are considerably beaten down. Dividends have been maintained and the company remains profitable, so far.

And, at such a lowly valuation, the company must be a takeover candidate (rumours are swirling).

I find myself in the unusual position of covering a beaten-down share which has the high potential to recover in the next few years. Of course, the price could fall even further below 400p but, in this type of situation, a step-by-step buying programme to gradually accumulate a holding would be a professional approach.

Lloyds bank is at its line in the sand

The taxpayer-rescued bank shares have gone nowhere in the past two years, while it has been building a terrific congestion zone that is now in danger of being a major top.

As you know, I have been very bearish on the financial sector and UK banks in general. My ongoing bear campaign in has hit a major downside target already.

But this chart should give the bulls pause:

(click to enlarge)

I have a superb lower tramline with multiple accurate touch points and the market is testing it once more. Sentiment is being undermined by the threat to its dividend from the current stress test which could require the bank to boost its capital ratios and reduce payouts. Also, banking sentiment in London is not being helped by Deutsche Bank's woes.

A sharp break of my lower tramline, which I expect, should propel shares down to the 50p region at least.

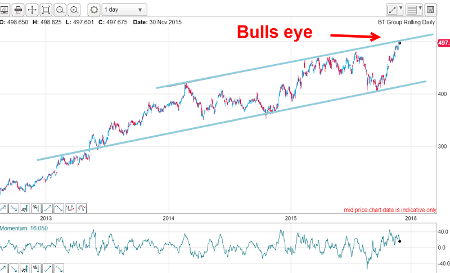

BT - an update

I covered on 9 November and this was the chart I showed:

(click to enlarge)

The blue line pair is my tramline set that has provided the up-sloping trading channel at least since 2013. The basic rule with tramlines is that the market will continue to bounce off the lower tramline (support) and upper tramline (resistance) as it works higher.

This will continue until the market pushes through one of the tramlines, in which case the line of support or resistance switches to the opposite polarity. And with the successful test of support of the lower tramline in the 400p area in August, the market was heading back towards the upper tramline and on towards 500p, which was my major target.

This is the latest chart:

(click to enlarge)

Lo and behold, my first target at 500p has been hit - a move of 35p, or 9%, from 9 November.

So what do I expect to happen now? Naturally, with the market over-bought (momentum reading is highly elevated) and with the resistance provided by my upper tramline, the market should pull back. That allows for short term traders to take at least some profits off the table.

Any decline to the mid-point of the trading channel in the 450p area should be met with solid support from the February-August congestion zone - and would present another buying opportunity.

But unless and until my lower tramline is violated, the trend remains solidly up.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.