10 highly-rated shares you cannot ignore

2nd December 2015 13:12

by Ben Hobson from Stockopedia

Share on

In 1965, an American entrepreneur named Tom Monaghan hit on an idea for a chain of pizza restaurants. Starting with just three outlets, went on to become the biggest pizza chain in the world. A UK franchise opened in 1985 and floated on the stockmarket 14 years later. It was a huge success for investors, soaring from an IPO price of 17p to more than £10 today.

Domino's is a textbook example of how a winning format can be rolled out very profitably. But for anyone wanting a slice of the action over the past 10 years, the shares have rarely looked cheap to buy.

For traditional value investors, a price-to-earnings (PE) ratio often well in excess of 20 times has made Domino's the stockmarket equivalent of fine dining. Yet for Domino's and other shares like it, apparently expensive prices haven't damaged the investment case for buying them.

In fact, the stellar performance of the market's high-flyers reveals a blind spot in traditional value investing.

Why value investing can miss the best companies

Investors are often drilled on the importance of buying shares at attractive valuations. Warren Buffett captured the essence of this approach when he famously declared: "Whether socks or stocks, I like buying quality merchandise when it is marked down."

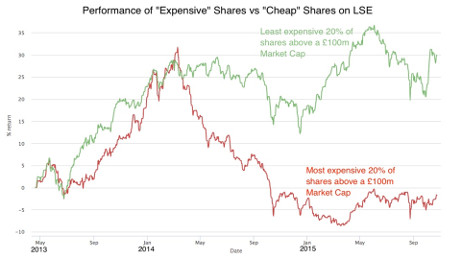

The power of value investing can hardly be overstated, and a quick look at the recent past shows why that is. Using Stockopedia ranking figures, the cheapest 20% of the stockmarket (green line) has outperformed the most expensive 20% (red line) by around 32% over the past two years.

(click to enlarge)

But while value certainly seems to pay off, this chart doesn't tell the whole story. In amongst the most expensive stocks is a set of 25 shares that have delivered a staggering 60% total return over the same period. That's more than double the average return of the value stocks.

They are some of the greatest performing shares on the London Stock Exchange, including Domino's, , , and . These companies have trounced the market for years, and it is likely that some of them will continue to do so.

The common factor here is that none of these shares look cheap, but all of them have strong quality characteristics and strong earnings and price momentum. This combination of factors forms a strategy that's been used by some of the greatest investors of all time. Investors like Richard Driehaus and William O'Neill have used it with huge success and won the respect of the investment industry as a result.

Signposts to quality and momentum

In the search for companies with strong quality and momentum, there are some straightforward places to start. In general terms a quality company is one that is highly profitable, with high industry leading margins, stable, growing and ideally accelerating sales and earnings. It will have a strong and improving financial track record, a robust dividend yield and no signs of accountancy or bankruptcy risk.

In turn, strong momentum will show up in stocks trading at a 52-week high and performing strongly against the rest of the market. These companies will often be beating broker estimates and seeing estimate upgrades and recommendation changes.

Screening the market for high-flyers

These measures offer a useful starting point in screening for stockmarket high-flyers. To simplify things, Stockopedia created a screen for Interactive Investor using StockRanks, which scores companies based on the strength of their quality, value and momentum.

In this case we looked for companies that rank among the highest in the market for their quality and momentum, but remain expensively priced.

| Name | Mkt Cap £m | QM Rank | PE | Sector |

|---|---|---|---|---|

| James Halstead | 991.1 | 99 | 29.3 | Consumer Cyclicals |

| Betfair | 3,407 | 99 | 42.7 | Consumer Cyclicals |

| Domino's Pizza | 1,727 | 99 | 35.3 | Consumer Cyclicals |

| Rightmove | 3,774 | 99 | 37.5 | Technology |

| SuperGroup | 1,334 | 99 | 27.9 | Consumer Cyclicals |

| Fevertree Drinks | 666.7 | 99 | 89.2 | Consumer Defensives |

| Moneysupermarket.Com | 1,738 | 98 | 26.9 | Technology |

| Next | 12,108 | 97 | 18.6 | Consumer Cyclicals |

| Abcam | 1,152 | 96 | 30.4 | Healthcare |

| Capita | 8,420 | 95 | 30 | Industrials |

Value investors will likely blanch at some of the racy PE ratios in this table. These stocks have consistently looked expensive. Yet their strong quality and momentum characteristics have contributed to a strong performance.

This group of shares has generated a theoretical 83.8% return over the past year. Clearly, under certain circumstances, ignoring PE ratios can be a completely rational thing to do - with a high probability of favourable outcome.

Shying away from expensive looking valuations can risk overlooking some of the best companies in the market. But it's important to remember that momentum can suddenly turn and quality can deteriorate. Expensive shares are very fragile because the market has high expectations for them. As a result, these kinds of shares tend to be more volatile than the market.

So, running a portfolio like this requires active management - regular portfolio rebalancing to keep jumping into the next set of high-flyers, before the previous set runs out of steam.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

About Stockopedia

● Interactive Investor readers can enjoy a 2 week free trial and £50 discount to Stockopedia using the coupon code iii014 -click here.

● To learn more about value investing strategies, you can download the FREE Stockopedia book, How to Make Money in Value Stocks

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

About the author.jpg)

Ben Hobson is Investment Strategies Editor at Stockopedia.com. His background is in business analysis and journalism. Ben researches and writes regularly on investment strategy performance and screening ideas for Stockopedia.com. He is the author of several ebooks including "How to Make Money in Value Stocks" and "The Smart Money Playbook"