Winter Portfolio trio rocket 10%

4th December 2015 16:58

by Lee Wild from interactive investor

Share on

Seasonal investing is nothing new. Statistics going back 20 years show that share prices do best during the long winter months. This anomaly has made smart investors substantial profits for two decades, and last year we launched our own model portfolios based on the simple trading strategy. They were so successful we've done it again.

Known as the six-month strategy, all investors need do for this play is buy a basket of shares on 1 November and sell on 30 April. Investing in the market between these dates only for the past 20 years would have turned £100 into £316. Over 10 years, it would have made twice as much profit as staying invested all year round.

A year ago, we screened the FTSE 350 for the five stocks with the best record of returns between November and April over the past decade - the Interactive Investor Consistent Winter Portfolio. Last year it made a 14% profit compared with 8.7% for the FTSE 350 benchmark index.

We also relaxed the rules slightly to include companies with a track record of at least nine years, but which must have risen at least three-quarters of the time over the past 10 years: our higher-risk Aggressive Winter Portfolio. Last year, it returned an impressive 16.9%.

Investing in this year's Consistent Portfolio every winter for the past decade would have generated an average gain of 24% (excluding dividends) compared with an average of 5.4% for the FTSE 350. Gains for the Aggressive Portfolio would have averaged over 35%, seven times more than the benchmark.

Here's a round-up of the highlights and lowlights from the first month of this six-month strategy.

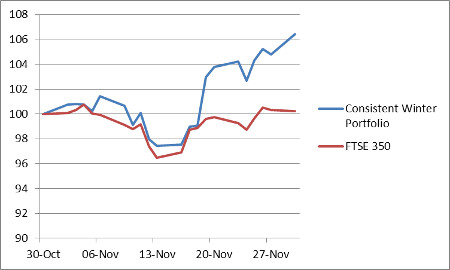

Consistent Winter Portfolio

(click to enlarge)

What a spectacular first month's trading for this year's Consistent Winter Portfolio! It took a few weeks to warm up, but when it did, this basket of historically reliable shares flew.

Having traded down 3% at one point, the portfolio consistently outperformed the FTSE 350 benchmark index, ending the month up over 6%, compared with just 0.2% for the 350. Incredibly, three of the constituents registered double-digit gains.

Irish building materials firm just edged it, surging 10.3% over the four weeks as economic recovery in the Americas kept driving construction industry demand. The acquired assets of LafargeHolcim could also generate bigger savings than expected. Acquisitions and improving margins should keep driving earnings, too, which is why Numis Securities thinks the shares are worth 2,100p, 7% more.

Equipment hire company and , which makes catalytic converters, tied for second place. Third-quarter results from US peer implied that the rental industry is not oversupplied, which is good news for Ashtead. Next week's interim results are expected to reveal a 29% increase in revenues to £1,272 million and 27% rise in underlying pre-tax profit to £337 million.

Johnson Matthey thrives on tighter emissions legislation, and reductions in nitrogen oxide levels in diesel cars underpinned profits in the six months ended 30 September. True, it made a little less than last year, but results could have been worse, and confirmation of a 150p per share special dividend has clearly boosted sentiment.

And workspace provider reported "good trading" in its third quarter. Revenue rose 17.3% at constant currency - slightly less at actual exchange rates - and is up over 16% on both measures for the nine months. Investec thinks shares in highly-rated, fast-growing company are worth 370p.

That leaves . We know from last year that shares in the speciality chemicals giant have risen every winter since at least 2004, yet this time it's the only constituent underwater at the end of month one.

A 2.3% increase in third-quarter like-for-like sales was a smidge lower than expected, and the weak euro - Croda makes a slug of profits on the Continent - keeps nobbling profits. Even so, the shares, which were down as much as 5% mid-month, ended just 1% lower.

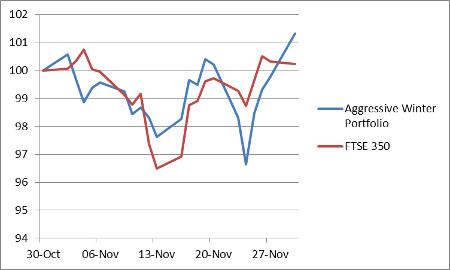

Aggressive Winter Portfolio

(click to enlarge)

Ashtead's heroics and big gains at Regus are reflected in the Aggressive Winter Portfolio, too, but the normally runaway higher-risk portfolio lagged its consistent cousin this time.

Up 1.3% in November, this dependable basket of shares still easily beat the FTSE 350, but was upended by shenanigans at online gaming platform company . Dilly-dallying by UK regulators meant its £460 million acquisition of Israeli CFD broker would not complete by the 31 December deadline. The deal was called off.

Playtech shares plunged as much as 14% intraday, although they clawed back a slug of those losses to end the month down 5.5%. Crucially, it has almost £700 million to spend on other acquisitions, so the next five months should be interesting.

A downbeat broker note on the housebuilders had all the major players skidding lower for a few weeks. But trading update mid-month struck an optimistic note and the high-yielding shares were chased back up to finish just 2% lower - they had been down 12% at one point!

It seems strange that is left till last, given the high street sportswear chain has gone like a rocket since the spring. This, it seems, was just a pause for breath.

In an unscheduled trading update on 3 December, the firm says it will make about £10 million more than expected this year. That should guarantee a big contribution to the Aggressive Portfolio this month.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.