HSBC tips 20 shares to rebound

9th December 2015 14:19

by Harriet Mann from interactive investor

Share on

It's not just those seeking a healthier and wealthier existence that associate the turn of the year with new beginnings: even some of the stockmarket's worst performers get a new lease of life and stage recoveries over the festive period, according to market watchers at HSBC.

Following heavy analysis of what they call the "loser reversal" phenomenon, HSBC boffins Dr Philipp Kaufmann and Volker Borghoff believe investors can predict which companies are about to rebound:

"History shows that stocks that have underperformed the market during the year often rebound in late December and early January.

"Drawing on our comprehensive backtesting since 1996, we find that this so-called 'loser reversal' is somewhat predictable and depends on a number of factors, which influence the magnitude of the underperformers' short-lived turnaround.

"More specifically, we find that the deeper a stock's decline over the year, the further away it is from its 52-week high and the more positively skewed its daily returns are, the stronger the turn-of-the-year reversal."

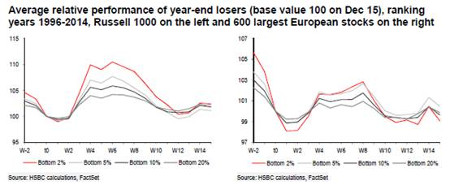

HSBC uses a ranking date of 15 December, but its research shows that losers tend not to bottom out until a few days before Christmas Eve (see charts above).

"We see no reason at the moment why this should change and recommend building first positions in the next few days to be prepared for a potential rebound in the second half of December," write the analysts.

"Also note that the Federal Reserve holds its next policy meeting on December 15-16. Signals at the moment point to the first rate hike after years.

"If a potential tightening of monetary policy is rationalised by a more robust and strengthening US economy over the most recent months, then such a favourable explanation could trigger a year-end rally in the equity markets."

But, as with all these types of strategies, market timing is everything.

Over the past 20 years, the broker has seen losers bottom out as early as the first week of December, or as late as mid-January. Typically, the rally among European losers peaks around mid-February.

For US stocks, the outperformance of the bottom 2% has been 10.5%. In Europe, the returns are a more modest 2.8%, but the strategy does, at least, deliver outperformance in almost all years.

The top 20

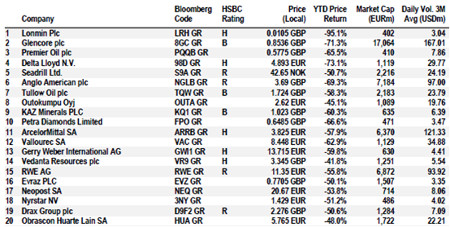

To whittle the original list of 50 stocks to 20, HSBC uses seven criteria: year-to-date price performance, stocks furthest away from their 52-week high, price decline acceleration, previous one-month return, probability of a large pay-off, beta, and volatility.

Each company must also have a minimum market value of $500 million (£331 million) with an average daily trading volume of $2 million (£1.3 million) over the last three months.

From the 20 European stocks (see table below), London-listed platinum miner , which has lost 95% of its value, tops the list, along with Anglo-Swiss miner and commodities trader , down 70%. is down two-thirds.

Sticking to the commodity theme and after its dividend cut yesterday, is also tipped, joined with , and . , and could bounce, too. This is high-risk stuff.

(click to enlarge)

'Loser reversal' phenomenon explained

There are lots of ideas about why the anomaly works. So-called end-of-year "window dressing" is one theory.

"Institutional investors and mutual fund managers often sell the year's worst performers so that they do not appear in their reported year-end portfolio holdings," explains HSBC. "This sell-off leads to additional price pressure towards the end of the year, often leading to significant undervaluation.

"When this price pressure subsides, a technical reaction or even a medium-term price reversal is likely to take place at the beginning of the New Year."

Tax plays a role, too. By creating actual losses and charging them against realized profits, private investors and some institutions can cut their tax bill.

An increase in risk appetite at the begging of the year is also likely to contribute. "Portfolio managers might try to pick up oversold stocks that have fallen to 'bargain' levels," muses HSBC, which also believes short-covering ahead of the holidays creates a "short squeeze".

"As the turn-of-the-year loser reversal tends to occur after 15 December of each year, it is not unlikely that short positions in the year-to-date worst performing stocks are covered to eliminate any exposure around Christmas and New Year's Eve.

"As a result, some temporary buying pressure might occur and generate a short-lived rebound."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.