Share of the week: Up 17% and flying

11th December 2015 16:55

Joining two big businesses together is never straightforward, but has made it look easy. The software company smashed first-half expectations and, with such strong cash generation, around half its market value could be paid out to shareholders over the next two years. That's what Investec reckons, and the City likes the story enough to send the share price up 17% this week to an all-time high.

Management had already warned that sales could drop 2-4% in the first half, so a slip of 2% to $604.5 million (£397.5 million) was taken well. At constant currency, its maintenance business performed best, with $327.4 million turnover representing growth of 181%. Although from a lower base, its consultancy division rocketed by 327%.

Adjusted cash profit jumped 164% to $270.6 million, with reported pre-tax profit surging by three-quarters to $98.8 million, giving earnings per share (EPS) of 40.17 cents, up 11%. The dividend rises by 10% to 16.94 cents.

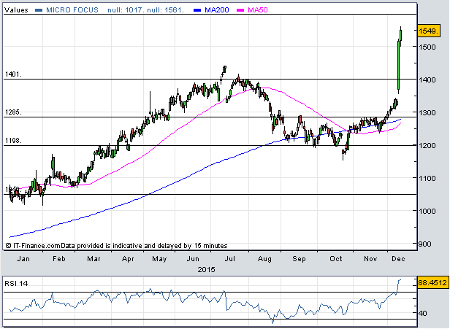

(click to enlarge)

"We estimate a combination of dividends, cash returns from holding leverage at c2.5x and a disposal of SUSE at $1.4 billion could equate to a cumulative cash return of c£1.6 billion over the next two years (assuming the excess cash is not used for accretive M&A)," says Investec analyst Julian Yates.

"This would represent c50% of the current market cap and imply that the stock is trading on an implied cash adjusted FY17E earnings before interest, tax and amortisation (EBITA) multiple of c6x."

A successful merger

After its $2.5 billion 2014 merger with The Attachmate Group of Companies, Micro Focus is now one of two operating portfolios grouping together Attachmate, Novell, NetIQ, Borland and Micro Focus products. SUSE is the second operating portfolio, which provides solutions for business customers.

Joining these two businesses is no easy feat, but with sales growth of 14% to $121.2 million and adjusted operating profit of $43 million, Investec is expecting over $275 million revenue and $90 million profit next year. Barclays thinks SUSE will be worth around a quarter of the Micro Focus' enterprise value.

"Assuming a 15x profit multiple (given the high growth and high profit margin characteristics) we see this implying a potential medium term valuation of c$1.4bn," explains Yates.

After such a strong first half - cash profit already represents over half of many full-year estimates - 2016 guidance looks conservative. With 2016 sales guidance of $1.2 billion, Investec upgrades full-year cash profit estimates by 7% to $538 million, giving year-on-year growth of 17%.

"This is driven by outperformance from SUSE and Host Connectivity, together with good progress on the $90 million cost saving programme," says Yates.

"While there are lots of moving parts, in our view, based on the results presentation, the overall metrics look to be running slightly ahead of plan, which gives us confidence in the outlook."

A phenomenal decade

Micro Focus has had quite a phenomenal decade, surging 744% over the last ten years, 195% over the last five and by over half since January. And Investec has upgraded its price target by nearly a quarter to 1,850p.

There's also a new, redefined management team to drive this expansion, after the joined roles of chairman and chief executive were separated. Kevin Loosemore will retain his place as executive chairman until at least April 2017, and new bosses have been found for the two businesses. Currently, chief operating officer Stephen Murdoch will head up Micro Focus, while the current president and general manager of SUSE will take the helm of the business.

Also bullish on Micro's outlook, Barclays concludes: "We now value Micro Focus at 16x [calendar year (CY)] 17E EPS (from 15x) and versus the sector on 20x. Rolling forward to CY17E at this multiple leads to an increase in our price target to £17.80 from £14.00.

"Equally, this would reflect 14x core Micro Focus and 25x SUSE. The downside risk is further stock placement from Attachmate vendors, which could weigh on the share price."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks