Oil contango provides opportunity for the brave

14th December 2015 13:56

by Harriet Mann from interactive investor

Share on

The final regulatory hurdle keeping and from one of the most talked-about mergers of 2015 has been cleared, which is welcome news in an industry dominated by a gloomy outlook. After another week of pain, oil prices are down again, but broker Exane reckons it's found a moment of opportunity.

After Brazil, the EU and Australia waved the tie-up through, the Chinese Ministry of Commerce's unconditional clearance is the final green light required for the merger.

Announced in April, the combined company will be worth £47 billion and synergies of around $3.5 billion should be created from the takeover, with 3% of the combined workforce being cut. This is in addition to Shell's current plans to make 7,500 of global redundancies.

Now it's up to the shareholders.

"This is a strategic deal that will make Shell a more profitable and resilient company in a world where oil and gas prices could remain lower for some time," said Shell boss Ben van Beurden. "We will now seek approval from both sets of shareholders as we move towards deal completion in early 2016."

Shell's share price was flat at 1,461p Monday morning, while BG Group rose 2% to 940p. Although the price of oil fell even further to $37.58, companies held firm with the FTSE 350 oil and gas index staying flat at 5,381.

Sliding 16% this month alone, oil prices have continued to fall on concerns of further oversupply after OPEC refused to lower its production volume. Flooding the market with more oil will only amplify current imbalances, which only worsens the short-term outlook.

'One for the brave'

In the North Sea, unit operating costs need to fall by 30% and capital investment must halve from 2013/2014 levels for companies to be breakeven at $65 a barrel in 2017, Exane warned:

"There are so many moving parts today with inventories, rising production and US dollar that we wouldn't like to try and catch this 'falling knife'," says analyst Aneek Haq.

"However, one area that does indicate some signs of short-term optimism is the widening contango."

Over the last fortnight, spot oil prices have been lower than forward prices - a pattern known as contango. With storage capacity growing and rates still low - for now - the analysts reckon the yield opportunity is opening up once again.

"Traditionally, that corresponds with a near-term trough in prices. One for the brave perhaps," warns Haq.

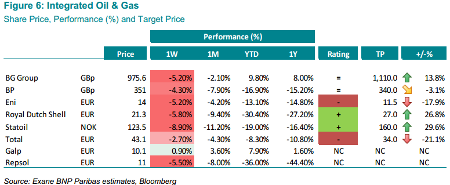

(click to enlarge)

As you can see from the chart above, Haq is bullish on two integrated oil and gas companies: Shell and . Down 27% this year, the analyst is confident Shell can recover from this bear run and, with a target price of [Norwegian Krone] NOK160, reckons Statoil's market value can grow by 30% after its 16% fall. and are in the dog house, however.

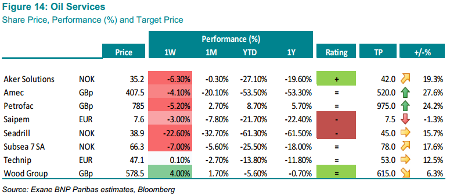

(click to enlarge)

As for the oil services, looks the most resilient, with Haq expecting a 6.3% increase in market value after falling just 0.7% this year to 573.5p. A target price of 615p is flashing above the London-listed group.

Haq is also optimistic on Aker Solutions, with a target price of NOK42 also representing a recovery from this year's slide. and are out of favour.

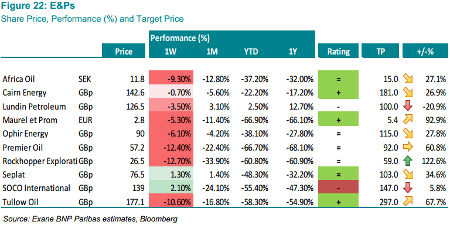

(click to enlarge)

Things look more optimistic on the exploration and production side, with 'add' ratings on , a target price of 181p representing 27% upside, and .

After halving to around 177p this year, the outlook is brighter for Tullow, with a target price of 297p providing the shares with 68% upside.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.