Investment gifts for the family this Christmas

22nd December 2015 10:28

by Fiona Hamilton from interactive investor

Share on

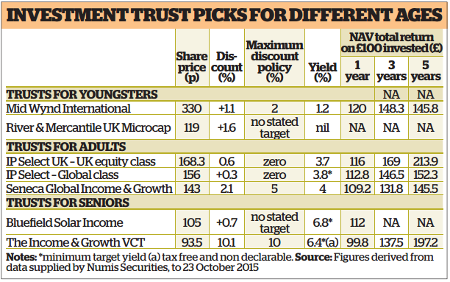

An investment trust makes a generous and long-lasting present for friends or relatives of any age, so – with an eye to the requirements of the festive season – we have stepped away from sector analysis this month, to make some trust suggestions for loved ones of different generations.

If you invest a few hundred pounds in a trust for a beloved grandchild, possibly through a low-cost Junior ISA (JISA), it could be worth far more by the time they need funds for a gap year or help with higher education. On this basis we have picked a couple of trusts which invest in equities for long-term capital growth, not worrying that they might suffer from short-term setbacks along the way.

Tuck a few thousand pounds into a trust for an adult relative, and they will hopefully treat it as a special reserve – something to be left to accumulate while they balance their day-to-day budget, but readily realisable in a crisis. A mix of security plus potential capital appreciation seems the best mix for this group, so we have picked defensively managed equity trusts that keep their discounts tight. Grandparents and other older recipients, meanwhile, are likely to be more interested in extra income than in long-term growth.

So, we have concentrated on trusts with high and hopefully sustainable yields for this age bracket.

Youthful good looks

Our first choice for young investors, appropriately enough, is a young trust managed by an impressive young manager investing in small and often young companies.

Launched in December 2014, targets long term capital growth from an actively managed portfolio of companies capitalised at less than £100 million at the time of investment.

This end of the market has proved exceptionally rewarding over the long term, and manager Philip Rodrigs has the credentials to make the most of it. He has been investing in Alternative Investment Market (AIM) stocks since 2002, and achieved top-quartile returns for the fund during eight years with Investec Asset Management.

He joined River & Mercantile in April 2014, and engineered a 12.6% net asset value (NAV) total return for R&M UK Microcap over its first 10 months, compared to a 7.3% return on its benchmark, the Numis Smaller Companies plus AIM (excluding investment companies) index.

Rodrigs says he likes "exciting growth companies", so it is no surprise that the technology sector accounts for a quarter of R&M UK Microcap's portfolio, nor that it has almost nothing in utilities, telecoms or consumer goods. He adds that the lack of exchange traded funds covering the smaller end of the UK market leaves it much less vulnerable than the larger end to swings in sentiment stemming from macroeconomic events.

The trust's premium rating was trimmed by the recent issue of new shares. Holdings should be accumulated when the share price is close to NAV.

Global alternative for the youngsters

is our global alternative for youngsters, having picked up impressively since Artemis Asset Management won the mandate in May 2014. Managers Simon Edelsten, Alex Illingworth and Rosanna Burcheri have achieved top-quartile returns for since its 2011 launch, and should do at least as well for Mid Wynd, as its closed-ended structure means it can gear and invest in less liquid companies.

Mid Wynd focuses on much larger companies than R&M UK Microcap, and its portfolio is internationally diversified, with only 7% in the UK. It is built around themes such as healthcare cost moderation, retiree spending power, mobile data and e-commerce, infrastructure and emerging market consumers, and the emphasis is on "high-quality companies with records of profitability and high cash generation". The managers say such companies are liable to lag in strongly rising markets but prove relatively resilient in more testing times.

Seneca Global is a trust with low volatility, attractive total returns and a growing dividend

For mid-life recipients our main choice is , which keeps its share price very close to NAV by offering investors the option to switch between share classes in four different portfolios at NAV every quarter. The most popular of the four is the Select UK class, a top-performing UK equity portfolio managed by the defensively oriented and highly regarded Mark Barnett.

The Select Global class of shares has also been doing well since Nick Mustoe became manager in December 2012. Mustoe looks for companies that can sustain profit margins and deliver positive returns through the economic cycle; he has been finding the best value in Europe.

As with the other three classes, Select Global distributes substantially all its net revenue as quarterly dividends, which boosts its yield but leaves it with negligible revenue reserves with which to smooth dividends. However, Select Global recently committed to supplementing its payouts with a small percentage of capital, if need be, in order to distribute a total of at least 6p a year. The other two share classes are Balanced Risk and Managed Liquidity, both of which are very small and have no yield. The latter invests in very short-dated high-quality bonds, and could prove a safe refuge if the financial world is in turmoil.

Low volatility and a growing dividend

Those who would prefer a single trust with low volatility, attractive total returns and a growing dividend could consider . Managed by Liverpool-based Midas Capital Partners, it invests in an actively managed mix of UK and overseas equities, alternative assets, fixed interest and property, and claims to off er a one-stop shop for smaller investors.

Asset allocation is critical and is said to be benefiting from the November 2014 appointment of Peter Elston, formerly at Aberdeen Asset Management, as chief investment officer. The Midas team deploys a value-oriented approach, identifying cheap assets and markets. The trust's UK equity portfolio is directly invested, while the rest is subcontracted to "best of breed, alpha generating specialist" managers.

Solar income shines

For older recipients, the choice is a well-established venture capital trust (VCT) with an attractive tax-free yield, or an investment in a renewable energy trust which is heavily incentivised to raise its yield at least in line with the Retail Prices Index (RPI).

is our renewables choice, as it offers a prospective yield of at least 6.8% and its shares trade on a negligible premium. Launched in mid-2013, it has built up a well-diversified portfolio of 61 individual solar assets across the southern half of the UK, nearly all of which are fully operational. Most are ground based, but the trust recently invested in its first commercial rooftop solar installation, an area the government remains keen to encourage.

Income & Growth VCT has achieved some of the best total returns in the sector

Regulated income accounts for around 60% of income, and is linked to RPI. The other 40% comes from selling power to distributors via Power Purchase Agreements with Bluefield so far negotiating competitive rates. Higher irradiation and plant efficiencies helped the trust perform ahead of budget in the year to 30 June 2015, despite a 10% fall in peak power prices. Taking into account revenues accrued, it could more than cover a total dividend of 7.25p, which was ahead of its 7p target for the year, rising annually by RPI.

The surge in solar generating capacity over the past three years has prompted the UK government into a series of regulatory changes which have undermined investor enthusiasm for the sector.

However, the trust's chairman says that while the regulatory outlook for new assets "is still evolving", it remains stable for existing assets, underpinning a large portion of Bluefield Solar Income's current cash flows and facilitating a buoyant secondary market in accredited assets.

An added attraction is that returns should have a very low correlation with equity markets. Shares in can be bought on the stockmarket at a discount of around 10% to NAV. There is no upfront tax relief on such purchases, but distributions – which VCTs can fund from a mix of income and realised capital gains – are tax-free. The trust has distributed a total of 41p per share over the last three years, equal to a yield of 14.6% with the share price at 93.5p.

Impressive realisations

This has been financed by an impressive flow of realisations, which is unlikely to be matched in the short term. However, the board is sufficiently confident about the outlook to have raised its target minimum annual distribution from 4p to 6p, equal to a yield of 6.4%.

The Income & Growth VCT has achieved some of the best total returns in the sector since Mobeus Equity Partners was appointed sole manager in 2010. Like other VCTs it may have to adjust its remit following proposed changes to the VCT regulations. However the regulations are not expected to affect VCTs' existing venture capital holdings, which are their core drivers.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.