The banks most exposed to commodities rout

21st December 2015 12:24

by Lee Wild from interactive investor

Share on

Banks have made a fortune lending to miners and oil companies during the good times. But these are not good times, and ultra-low commodity prices are causing serious financial hardship for many drillers and diggers, especially among the smaller fish. Banks had better watch out.

If the supply/demand commodities imbalance is to rectify, mines must close, and many companies are being forced to sell assets. There's only so much cutting oil and commodity players can do, though, and higher-cost producers and those without adequate access to finance on decent terms are vulnerable.

Some have already gone under. Both London Mining and the operating subsidiary of Talvivaara Mining went bust a year ago. And just this month, with no ability to raise equity, US-focused only avoided bankruptcy by selling most of the business to New York-based fund Talara Capital Management.

And the head of corporate banking at Wells Fargo, the world's largest bank, has just warned of "stresses" in its energy portfolio. In a recent Financial Times article, Kyle Hranicky said he'd been talking to clients for "several months" about preserving cash and cutting borrowing limits.

"Some have liquidity to survive the cycle but others will be under significant stress and may be forced to sell assets or recapitalise," he said. "We've been in the energy business for over 30 years, so we're comfortable with cycles. But this one feels deeper and broader and could last longer."

Heavily burned during the subprime mortgage crash, banks are now more tightly regulated than ever, and are desperate to keep distressed assets off the books. They've helped the commodities sector refinance extensively up to now, but 2016 will likely see more banks play hardball.

"The summer 2011 US money market funding crisis was a defining moment for European banks," Deutsche Bank reminds us. "Funding from US money market funds dried up and a number of European banks had to significantly deleverage USD-denominated financing businesses, including commodities."

It means European banks are now relatively defensive to commodities weakness, especially French lenders, previously market leaders - BNP Paribas sold its North American reserved-based energy lending business to Wells Fargo.

Norway's DNB Markets, Dutch giant and have a higher quality franchise bias towards investment-grade, according to Deutsche. , and generally have higher non-investment grade market shares.

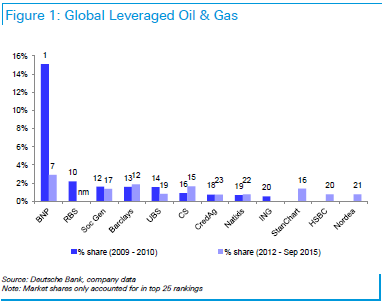

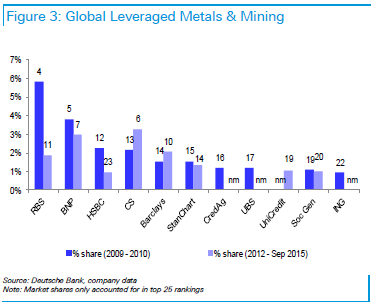

Deutsche uses banks' involvement in syndicated lending across both oil & gas and metals & mining as a proxy of their potential exposure to the sector. Sell-down of underwriting commitments does, however, mean that banks' retained exposures are often much smaller.

A glance at the tables reveals HSBC was involved in nearly $29 billion of investment grade oil & gas deals between January 2012 and 30 September 2015. Barclays took part in transactions worth almost $24 billion, and Standard Chartered $22.7 billion. For non-investment grade oil & gas deals the numbers were $5.3 billion, $12.7 billion, and $9.4 billion, respectively.

For global metals & mining, HSBC did $14.7 billion of business and Barclays $10.9 billion. Unsurprisingly, Lloyds Banking failed to appear on either list. In 2009/10 it had done $7.4 billion worth of business in the sector.

"While the likes of BNP Paribas, CS and Barclays are the most exposed to oil & gas and/or metal & mining, they have relatively low market shares relative to the market leaders," says Deutsche.

Currently, the commodities sector is down 1% year-to-date and trades on price/tangible book value (PTBV) of 1.01 times estimates for 2016 for return on tangible equity (ROTE) of 9.9%.

"Key upside risks include: higher rates, faster pick-up in credit growth and sovereign spread tightening," says Deutsche. On the downside, watch out for persistently low inflation and an even longer low-rate cycle, weak economic recovery, and credit risk in commodities and emerging markets exposures.

Deutsche currently rates Barclays a 'buy' with 303p price target, HSBC as a 'hold' with 580p target, and Lloyds a 'buy' with 91p price objective. Royal Bank of Scotland rates a 'hold' and 349p target.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.