More BHP dam deaths confirmed

22nd December 2015 12:19

has had an awful year. Commodity prices have plunged again and profits are tipped to more than halve. Talk of a dividend cut grows louder by the day, and now BHP confirms that at least 17 people died when a dam burst at one of its mines in Brazil last month. Two workers are still missing.

Tragedy struck at the Samarco Mineração iron ore operation in Minas Gerais province on 5 November - BHP and Vale each own 50% of the mine. A breach of both the Fundão tailings dam and Santarém water dam is now understood to have killed five locals and 12 workers.

A New York-based law firm is investigating the cause of the disaster, but the Brazilian government has already frozen BHP's assets in the country. It has also been ordered to place 20 billion Brazilian real (BRL) (£3.36 billion) in a fund to cover clean-up costs and damages - BRL 2 billion must be deposited in a court-managed bank account within 30 days of 18 December.

(Click to enlarge)

That's a big outgoing BHP could do without. Profits are expected to have halved in the year to June 2016, taking the plunge since 2014 to around 76% - from $22.2 billion to just $5.3 billion. And Moody's has just placed BHP's credit rating on review for possible downgrade.

Five years ago, BHP Billiton shares traded at over £26. As recently as summer 2014 they were worth almost £21. A week they plunged to a 10-year low at 665p, and now change hands for a measly 723p.

According to data provided by Sharepad.co.uk, BHP trades on a forward price/earnings (PE) ratio of a colossal 27 times, dropping to a still hefty 17 times a year later. And a prospective yield of 10.7 just screams "cut me!".

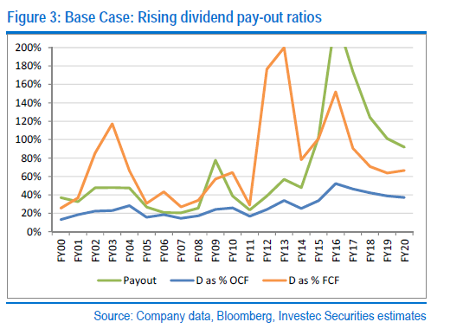

BHP has increased the dividend every year since 2000 and currently spends $6.6 billion on the payout which is covered just 0.3 times by earnings. Investec thinks the payout ratio will be an unsustainable 234% in the year to 30 June 2016. Costs at Samarco will further damage cash flow, already pressured by record low iron ore prices and slump in other commodities.

Investec concluded last month that BHP could maintain a progressive dividend policy under the broker's own current commodity price assumptions, but not at spot prices, "a scenario the board will need to consider when it proposes the next interim dividend, in February".

"We believe a 25% dividend pay-out on sustainable operating cash flows, i.e. operating cash flow less sustaining capital, would offer a resilient minimum base for ongoing shareholder returns," says the broker. "This would return BHP Billiton to more normalised pay-out ratios, akin to historical levels."

Under this scenario, BHP would spend a more modest $2.7 billion on dividends in the current financial year, yet still yield over 3%. Future dividends would then increase in line with cash flows.

and have already made the difficult, but sensible, decision to axe the dividend. If BHP wants to start buying up distressed assets at rock-bottom prices, as reported, it should do the smart thing and cut the payout.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks