Patient investors can cash in on commodities

8th January 2016 14:15

by Max King from ii contributor

Share on

There is a pervasive belief among many investors that what goes down must go back up again. Investors find it easier to believe a share price that has halved can climb back up, than a share price that has doubled can double again.

They may eventually be right to bet on a bounce, but this usually takes much longer than expected and the fundamental drivers that pushed prices down have to reverse before those prices can change direction.

But there is no mean reversion when it comes to globalisation, technological change, losing a competitive position or changing patterns of demand. Contrarian investors who seek out such opportunities have found success much more elusive since 2000.

With this in mind, commodity or resource equity bulls need to think very carefully before they rush to buy into the recent collapse. The falls in commodity prices were not an aberration but the result of a fundamental change in demand and supply.

A few years ago, China accounted for more than half of global demand for many base metals, and mining companies invested heavily in additional output - the same capacity that they are now cutting to bring supply into balance with lower demand than previously expected.

Lower production costs

"There is no reason for output to fall. Instead, other countries with significant deposits, such as the UK, may be tempted to exploit them."

The drop in the prices of oil and natural gas has been widely attributed to the exploitation of shale deposits in North America, but this is only part of the story. Technological advances mean that North American output is only modestly below recent peaks, but the number of rigs operating has more than halved.

The significant increase in productivity, combined with lower labour costs, means extraction is now profitable at lower prices, so there is no reason for output to fall. Instead, other countries with significant deposits, such as the UK, may be tempted to exploit them.

Meanwhile, growth in the demand for oil and gas has been much more sluggish than expected, not just because economic growth has been only moderate, but also because hydrocarbons are being used more efficiently. Modern aero-engines consume less fuel than before, the mileage per gallon of road transport has increased significantly and the heat insulation of modern buildings has vastly improved. Economic growth has become less energy-intensive, let alone hydrocarbon-intensive.

Overall, whether for base metals, precious metals, energy or agricultural output, higher prices have prompted a supply and demand response that has brought prices back down again. Eventually, lower prices will slow this process, reserves will dwindle, demand will pick up again and prices will rise, perhaps even to new peaks, but this could be decades rather than years or months away. Prices will probably not fall further and should even recover somewhat in the next year - but they will remain way below peak levels.

Commodities can thrive on price troughs

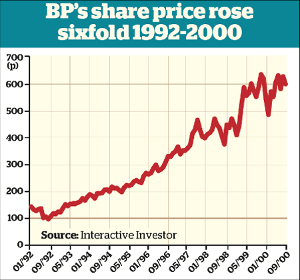

This, however, does not mean that resource equities will be a poor investment. Many companies prospered in the 1990s when commodity prices were flat in nominal terms and falling in real ones. The share price of , for example, multiplied more than sixfold between 1992 - when it took drastic action to reduce costs, rationalise, raise efficiency and de-gear - and 2000 (see chart below right, click to enlarge).

Many companies are treading a similar path now, helped by currency depreciation, lower labour costs and energy prices (a major cost in mining and agriculture) and better technology. For example, is generating a 62% margin from iron ore production, despite a price fall of nearly two-thirds.

Investors need to seek out companies with high-quality reserves, proactive management, strong cash generation and the ability to acquire assets at distressed prices. Unfortunately, scale is no guarantee of quality. Many investors have bought for its blue-chip familiarity and high dividend yield, but that yield is now at risk after $7 billion (£4.6 billion) of fruitless expenditure on exploration in the Arctic.

BP has struggled to recover from the Macondo disaster, while has been knocked back by a lethal mudslide at a Brazilian mine. This is a sector in which major companies can appear much safer than they really are, while the casualty rate among the newer companies is higher than ever.

We believe patient, long-term equity investors with a contrarian bent should be making a moderate commitment to the sector, but reducing risk by investing in a well-diversified fund rather than gambling on individual stocks.

Max King is portfolio manager of the Multi-asset Protector fund at Investec Asset Management.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.