When to start buying mining shares

5th January 2016 10:08

Five years ago, the FTSE 350 Mining index reached a post-financial crisis peak at just over 28,000. It currently sits at 7,134, down 75% at an 11-year low, and share prices remain vulnerable.

Global commodities markets remain massively oversupplied and Chinese demand is waning, but there will come a point at which mining shares are a 'buy' again.

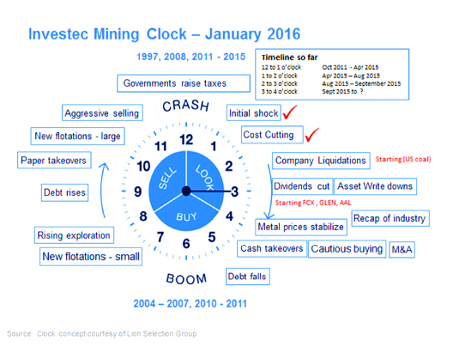

Investec Securities has built a "Mining Clock", which brilliantly illustrates the mining cycle, including when to buy and when to sell. It's a real "cut-out-and-keep" for every investor.

Investec writes:

"Please see the updated Mining Clock below where we indicate that it appears still too early to be buying the mining sector. This is despite five straight years of underperformance from mining equities globally, in every sector, save Australian listed gold equities which outperformed the ASX in 2014 and 2015."

(Click to enlarge)

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks