Our Winter Portfolios keep making money

8th January 2016 17:45

by Lee Wild from interactive investor

Share on

Seasonal investing is nothing new. Statistics going back 20 years show that share prices do best during the long winter months. This anomaly has made smart investors substantial profits for two decades, and last year we launched our own model portfolios based on the simple trading strategy. They were so successful we've done it again.

Known as the six-month strategy, all investors need do is buy a basket of shares on 1 November and sell on 30 April. Investing in the market between these dates only for the past 20 years would have turned £100 into £316. Over 10 years, it would have made twice as much profit as staying invested all year round.

A year ago, we screened the FTSE 350 for the five stocks with the best record of returns between November and April over the past decade - the Interactive Investor Consistent Winter Portfolio. Last year it made a 14% profit compared with 8.7% for the FTSE 350 benchmark index.

We also relaxed the rules slightly to include companies with a track record of at least nine years, but which must have risen at least three-quarters of the time over the past 10 years - our higher-risk Aggressive Winter Portfolio. Last year, it returned an impressive 16.9%.

Investing in this year's Consistent portfolio every winter for the past decade would have generated an average gain of 24% (excluding dividends) compared with an average of 5.4% for the FTSE 350. Gains for the Aggressive portfolio wold have averaged over 35%, seven times more than the benchmark.

Here's a round-up of the highlights and lowlights from the second month of this six-month strategy.

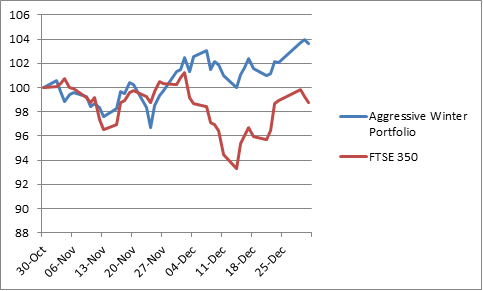

Aggressive Winter Portfolio

Our Aggressive Winter Portfolio had a decent first month, but lagged its Consistent cousin. It staged a fightback in December, though, almost tripling a 1.3% gain the month before to just shy of 4%.

That compares very favourably with the FTSE 350 benchmark index, which fell 1.5% in December having failed to recoup a 6.4% plunge achieved in the first half of the month.

And after a quiet start to the portfolio, did what we expected it to, surging 7.2% over the month. That's down to the high street sportswear chain's unscheduled trading update on 3 December, which we mentioned last time. Holding onto the lion's share of initial gains made on the news was impressive, and bodes well.

Housebuilders all did well in December, among them our star pick . The shares rose more than 4%, and there's lots of optimism ahead of the historically strong spring house-buying season.

Humphrey Singer also celebrated his new job as Taylor Wimpey non-executive director with the purchase of 25,000 shares at 196.6p.

There were strong gains for gaming software specialist , too. Its shares jumped 3% despite the collapse of its acquisition of Israeli CFD broker , and are now down less than 3% since the portfolio began in November. A deal to run the Sun Bingo website helped.

Meanwhile, equipment rental company demonstrated how to survive exposure to the current oil and gas rout. A focus on construction markets, well-executed capital expensiture (capex) budget and margin improvement, meant half-year underlying pre-tax profit jumped 21% to £343 million. That nudged the shares up 2.2% in December.

Workspace provider was the only blot on the copybook, falling 4.9%.

Despite an upgrade to its price target by Credit Suisse from 310p to 400p, the share price fell steadily afer peaking at 365p earlier in the month. The shares are expensive, but profits are tipped to grow fast.

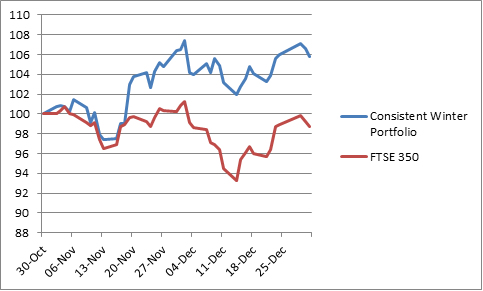

Consistent Winter Portfolio

That dip at Regus and a poor month for catalytic converter maker weighed on our Consistent Winter Portfolio in December. Still, despite a small decline last month, the basket of reliable performers is still up 5.8% overall.

Johnson Matthey, which had a stunning November, fell 6% last month, although it's 2.8% higher since Day One of the portfolio. And high-flying speciality chemicals firm hit a four-month high. Paying €155 million (£109 million) for Dutch seed enhancement firm Incotec Group was well-received.

Analyst Charles Pick at Numis Securities said the "purchase looks a good move with c.2.2x sales and 11-12x earnings before interest, tax, depreciation and amortisation (EBITDA) being paid for a concern that has a compound annual growth rate (CAGR) for sales from 2007-15 of 15%".

Ashtead was obviously a help for this portfolio, too, and Irish building materials firm kept its nose clean. It inched up 0.3% over the month, and Investec Securities thinks the current valuation is undemanding.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.