Savills nervy despite profits beat

11th January 2016 13:31

by Harriet Mann from interactive investor

Share on

It took just four months for to offload a pile of German assets acquired when it bought SEB Investment Management in August, and the upmarket estate agent now reckons 2015 results will beat already high expectations. Brokers rushed to upgrade forecasts, but there was a warning here, too, and rising interest rates could hinder profit growth.

As part of the liquidation of multiple funds managed by SEB, Savills sold its Berlin-based Potsdamer Platz assets at the end of December, sooner than expected. This influx of cash should drive pre-tax profit to £120 million, up 20% on the year, taking earnings per share (EPS) to 63.5p, says Numis analyst Chris Millington. We'll get confirmation on 10 March.

A diverse company with both defensive and growth elements, Savills' global reach has supported it in the face of obvious risks from the London property market and Asia. But now that interest rates have started their climb from rock-bottom lows, in the US at least, transaction volumes are at risk in 2016.

(Click to enlarge)

"In the light of heightened uncertainty over global economic prospects and rising interest rates, we expect a tempering of the strong transaction volumes of recent times in certain markets, notwithstanding that market fundamentals remain sound," warned management.

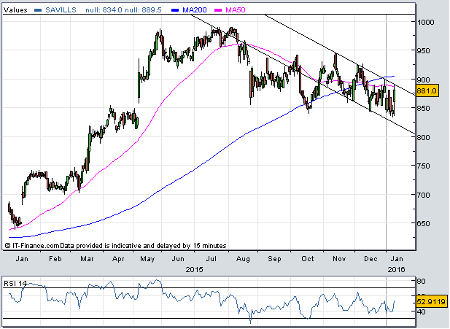

This is why Savills shares are meeting resistance at the top of a negative trading channel, which has directed the shares 6% lower since mid-November (see chart above). With concerns now focused on the industry backdrop this year, it's going to take a significant catalyst to spark a breakout.

Although Savills' shares surged 5% to 888p on this news, Millington thinks recent weakness is an opportunity and upgrades Savills from 'add' to 'buy', with fair value unchanged at 1,086p.

Given the estimated £157 million of cash on the balance sheet year-end 2016, diversified business and potential for growth, a price/earnings (PE) multiple of less than 14 times appears undemanding.

"Savills remains well placed to make progress in 2016 despite the more uncertain economic outlook, given its geographic diversity and support from its non-transactionary income streams," says Millington.

Despite management retaining their original 2016 forecasts, Numis has increased expectations for pre-tax profit from £120.8 million to £122 million, giving EPS of 64.3p.

"This increase in upgrades now means that we have increased 2015 estimates by 60% since we first published them in Aug 2013, reflecting underlying outperformance and also the impact of acquisitions (mainly Studley, SEB AM and Smiths Gore)," explains Numis.

"Whilst 2016 has only increased c.5% since our first publication in March 2015, we think it is set at a rightfully conservative level in light of global economic uncertainty."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.