How to survive $10 oil

12th January 2016 14:53

by Harriet Mann from interactive investor

Share on

With oil prices hurtling toward $30 a barrel and latest City forecasts screaming lows of $10, the European oil exploration and production (E&P) industry is sweating hard. Global market wobbles aren't helping and investors are taking cash off the table. But analysts at Barclays have named three top share picks and composed a survival checklist for worried investors.

At $30.41 a barrel, Brent crude is already at a 12-year low, just months after Goldman Sachs slapped a $20 target on the black stuff. Now, investment bank Standard Chartered thinks the price could crash to just $10, or 693 pence a barrel, "before most of the money managers in the market conceded that matters had gone too far".

Realistically, few, if any, could survive $10 oil for any length of time. Production costs for the big boys are put at around $15 a barrel, and a little less for the pure E&P companies.

Barclays is a little more optimistic, but even it has downgraded its industry view to 'neutral' from 'positive':

"We continue to believe valuations in the sector are attractive on a medium-term horizon - higher prices and/or greater cost deflation is required to incentivise the future investment needed to avoid a future supply shortfall - but recognise that investors need to see it to believe it, delaying the timing of a recovery in sentiment towards what remains an out of favour sub-sector."

However, it's not throwing the towel in. The broker currently advises investors to look for companies with sustainable balance sheet strength, capital budget flexibility and positive operating cash flow. Barclays has done its own sweep and, while its base case forecasts assume Brent averages $60 a barrel in 2016, its three industry picks boast attributes desirable whatever the oil price.

Pick of the bunch is , which operates in Africa and Asia. After pairing up with Golar LNG, development of Ophir's important Fortuna floating liquefied natural gas (FLNG) project is edging nearer.

In order to benefit from plummeting industry costs while protecting cash on the balance sheet, management want to offload some of the project. Barclays reckons the shares are worth 130p, which represents around 50% upside.

(Click to enlarge)

Kurdish producer looks pretty scary, having halved in value in just six weeks. Norway's does, too. But Barclays is sticking with them both and believes they look strong enough to weather the storm.

London-listed Genel could surge from 135p currently to 350p if Barclays is right. The company is close to receiving a stable payment structure as the Kurdistan Regional Government looks to continue reimbursements. This will finance the group's 2016 commitments.

"We believe Genel is in a strong negotiating position with the KRG to eventually secure increased export payments," say the analysts.

Here, we examine Barclays' own checklist to help oil company investors manage risk.

Sustainable balance sheet strength

Debt isn't always a bad thing. In fact, companies are urged to take advantage of loans to drive growth. But in a sector struggling to make money, it can mean sleepless nights.

For now, Barclays believes lenders will likely provide further flexibility to companies in return for tighter restrictions on discretionary outgoings. Although this should stop too many projects being mothballed, adding to high debt levels will impact capital structure, share price turbulence, cost of capital and future growth, it warns.

"Many E&Ps are already operating with sub-optimal capital structures - as illustrated by the substantial share price volatility in recent months. If Brent was to average $30 a barrel during 2016, sector debt levels are likely to keep rising and capital structures move further away from the optimal blend of debt and equity.

"Without action, the process of balance sheet repair then becomes more prolonged and potentially more challenging."

Those companies able to protect their balance sheets this year will be more likely to survive the bear market, taking advantage of growth opportunities as they arise, says Barclays.

While analysts point to , , , Ophir Energy and as favourites, they note that those with more modest debt levels - DNO, and Genel Energy - should also benefit.

Capital budget flexibility

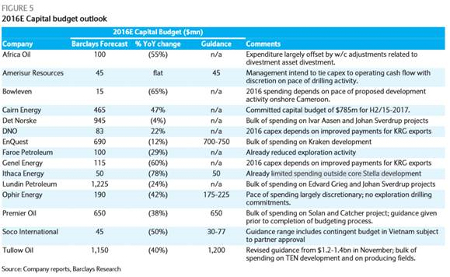

Oil industry budgets must shrink if companies are to survive. Of course, the ability to reduce spending will depend on individual commitments, but Barclays reckons aggregate spending will fall 28% on its base case forecasts of $60 oil in 2016.

As you can see from the chart below, is expected to slash its budget by 78% to $50 million, and Bowleven by 65% to $15 million.

(Click to enlarge)

Positive cash flow

Positive operating cash flow is an obvious bonus, soothing investor concerns about servicing debts while maintaining safe operations. It also means cash is being used for general administrative costs.

Barclays reckons that the companies in its coverage can generate positive cash flow from existing production at current oil prices. The difference in cash flow per barrel is largely down to differing tax regimes, explain the analysts, with UK producers Ithaca, and required to pay negligible cash taxes for several years, while Norwegian producers , and Faroe should benefit from a tax rebate.

"Hedging provides some support (notably for EnQuest, Ithaca Energy, Premier Oil and ) that we acknowledge is not sustainable longer term, but it is operating cost levels that are behind the sector's ability to continue generating the cash flow required to service its debts and (at a minimum) fund maintenance capital expenditures."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.