How to avoid capital destruction in a bear market

18th January 2016 10:32

by Lance Roberts from ii contributor

Share on

No bull, no bear

Let me clarify something before I go further into this week's missive.

In the media, and on Wall Street, there is an overwhelming push to classify views as either bullish or bearish. This is a VERY dangerous thing for investors.

The reason I say this is that since, in the words of Bob Farrell, "bull markets are more fun than bear markets," investors tend to seek out "bullish" commentary to support their "hopes" of a continually rising bull market. The danger, as I have addressed in the past, is that individuals become "willfully blinded" to data that does not conform to their personal biases. This bias of seeking out only "confirming data" - known as confirmation bias - leads to decision-making that is ultimately prone to error.

While I am personally tagged as a "bear" because I discuss not-so-optimistic views of the market and point out inherent risk, I assure you I am NOT a bear. I am also NOT a bull. I simply look at the relevant data and make determinations of risk based on historical precedents and statistical data.

As a portfolio manager of OTHER PEOPLE'S money, my biggest concern is not how much money I can make during market advances, but rather how much I keep from losing during market declines. While this seems counter-intuitive, in reality it is where long-term gains are actually generated. As William Lippman once quipped:

"Better to preserve capital on the downside rather than outperform on the upside."

However, it is this focus on capital conservation and risk management that gets me habitually tagged as a "bear". If that is the case, so be it - I will gladly wear that moniker if that leads to better outcomes for those I work for.

The reason, I say this is because it simply comes down to the math. As I wrote last week:

"The reason that portfolio risk management is so crucial is that it is not 'missing the 10 best days' that is important; it is 'missing the 10 worst days'. The chart below shows the comparison of $100,000 invested in the S&P 500 Index (log scale base 2) and the return when adjusted for missing the 10 best and worst days."

(Click to enlarge)

"Clearly, avoiding major draw-downs in the market is key to long-term investment success. If I am not spending the bulk of my time making up previous losses in my portfolio, I spend more time compounding my invested dollars towards my long-term goals."

Let me reiterate this point. A strict discipline of portfolio risk management will NOT eliminate all losses in portfolios. However, it will minimize the capital destruction to a level that can be dealt with logically, rather than emotionally.

In the end, it does not matter IF you are "bullish" or "bearish." The reality is that both "bulls" and "bears" will be owned by the full-market cycle. However, what is grossly important in achieving long-term investment success is not necessarily being "right" during the first half of the cycle, but rather not being "wrong" during the second half.

Don't panic, walk to the exits

I know as I write this, that come Monday morning my inbox will be flooded with emails asking if it's time to go to "all cash".

No. I NEVER suggest being in "all cash". From a management standpoint, this is never a good idea. Trying to "time the market" is impossible over the long-term and leads to very poor, emotionally-based decision making. However, as I regularly write, it is our job to reduce portfolio risk to manageable levels to preserve capital over time. We can do that by increasing and reducing our exposure to equity-related risk by paying attention to the price trends of the market.

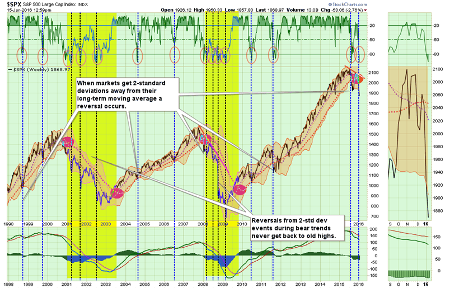

By the time the markets register important "sell signals" denoting a change from the bullish to bearish trend, the markets are generally oversold from the previous selling. This is, as shown in the chart below, always the case.

(Click to enlarge)

(Note: I am using weekly data to smooth volatility)

The top section of the chart is a basic "overbought/oversold" indicator with extreme levels of "oversold" conditions circled. The shaded area on the main part of the chart represents 2-standard deviations of price movement above and below the short-term moving average.

There a couple of very important things to take away from this chart. When markets begin a "bear market" cycle (which is identified by a moving average crossover [red circles] combined with a moving average convergence divergence [MACD] sell-signal [lower part of chart], the market remains in an oversold condition for extended periods [yellow highlighted areas]).

More importantly, during these corrective cycles, market rallies fail to reach higher levels than the previous rally as the negative trend is reinforced. All of these conditions currently exist.

Does this mean that the markets will go straight down 20% without a bounce? Anything is possible. However, history suggests that, even during bear market cycles, investors should be patient and allow rallies to occur before making adjustments to portfolio risk. More often than not, it will keep you from panic selling a short-term market bottom.

The Monday morning call

Markets at support

As noted above, the markets are registering the first confirmed set of monthly SELL signals since the peak of the market in late 2007. As I have stated repeatedly: don't panic sell.

Take a look at the chart below.

(Click to enlarge)

In particular note the top and bottom portions of the chart. These two indicators measure the "overbought" and "oversold" conditions of the market. You will notice that when these indicators get stretched to the downside, there is an effective "snap back" in fairly short order.

As I stated last week, chart updated from then:

With the markets having issued multiple sell signals, broken very important support and both technical and fundamental deterioration in progress, it is suggested that investors use these "snap back" rallies to reduce equity risk in portfolios.

Let me provide you again with the rebalancing rules that I reiterated through the majority of last year's newsletters as markets deteriorated from the May-June highs. That period also marks the point where I reduced equity risk in portfolios by 50% (which is where it remains currently).

1) Trim positions that are big winners in your portfolio back to their original portfolio weightings (i.e. take profits).

2) Positions that performed with the market should also be reduced back to original portfolio weights.

3) Move trailing stop losses up to new levels.

4) Review your portfolio allocation relative to your risk tolerance. If you are aggressively weighted in equities at this point of the market cycle, you may want to try and recall how you felt during 2008. Raise cash levels and increase fixed income accordingly to reduce relative market exposure.

How you personally manage your investments is up to you, I am only suggesting a few guidelines to rebalance portfolio risk accordingly. However, the risk of being long a tremendous amount of equity risk is no longer as advantageous as it once was.

This could all change, of course, if the Federal Reserve leaps into action with a rate cut, another liquidity programme or direct market intervention. However, until that happens, it is better to be safe than sorry.

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of "The Lance Roberts Show" and Chief Editor of the "Real Investment Advice" website and author of The "Real Investment Daily" blog and the "Real Investment Report". Follow Lance on Facebook, Twitter and Linked-In.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.