Mining price targets slashed by up to 62%

22nd January 2016 15:52

by Harriet Mann from interactive investor

Share on

As global stockmarkets stage a late comeback after a week of turmoil, investors spurred on by value fever might be tempted to fill their portfolio with "bargains". Market dynamics haven't changed since Wednesday, however, and, despite a dramatic two-day rally, novice investors could still get their fingers burnt. Well-versed in the commodity cycle, Investec Securities thinks it knows how the rest of the year will play out. Surprise, surprise: for the most part, it's not pretty.

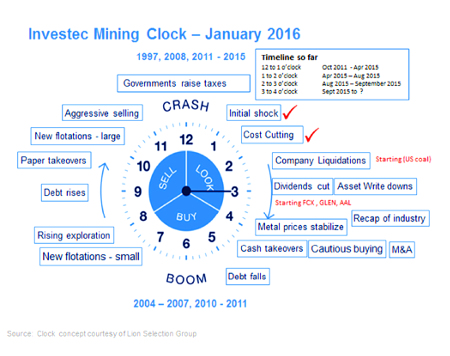

To help, Investec has built a "Mining Clock" to illustrate the fundamental characteristics of the commodity cycle, including when to buy and sell. After this week's global sell-off forced several stockmarkets into technical bear territory, bourses put in triple-digit gains on both Thursday and Friday.

Miners , , and Chile-based copper miner have been among the best performers, up between 10% and 17%. But does that mean the worst is over? Was that the bottom of the market?

Not according to Investec analysts. As the next phase of asset impairments has only just begun, it keeps the hand on its mining timepiece firmly at 3 o'clock - "Watch and Wait".

Most companies had axed most expansion plans by the end of 2015, but the only chance of industry margin recovery lies with further cost-cutting, especially shareholder dividends. As shrinking earnings increase debt concerns, companies must reassure lenders. With little scope for equity growth and dividends diminishing, there is little reward for the risk, argues Investec:

"We still do not believe the sector has arrived at a 'value point' as we consider that many commodity prices have not yet bottomed. Higher interest rates at some stage in the future will only heighten the stress on heavily indebted miners."

(Click to enlarge)

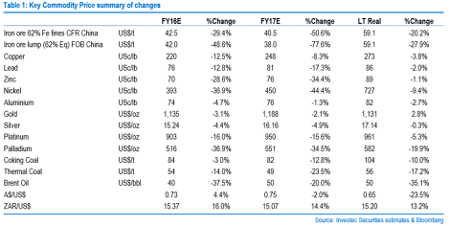

As the commodity Super-Cycle plunges further into the "Super-Bust", Investec has taken a red pen to share price forecasts to reflect the discouraging investment backdrop. Iron ore prices have been slashed by at least 30% to $42.5 per tonne (/tonne) for 2016, copper by 13% to $2.20 a pound (/lb) and nickel by over a third to $3.93/lb (see chart). With little stimulation, any rebalancing of the market looks a way off. In 2017, iron ore is set to average $40.5/tonne.

Even the broker's forecast for gold, typically used as a safe haven along with government bonds in times of uncertainty, is cut by 3% to $1,135/ounce for 2016. This is still Investec's preferred exposure to the sector, however.

"Falling intensity of commodity consumption in China, a strong US dollar and significant over-production in many commodities, lead us to highlight the disincentive nature of our revised commodity price forecasts from 2016 onwards," it explains.

(Click to enlarge)

Given the scarcity of earnings in the sector, Investec has even been forced to change to way it values companies. Analysts now rely solely on net present value (NPV) of a company's assets rather than price/earnings (PE) multiples. This will also be the foundation for any future corporate activity.

Here's a rundown of the major changes to Investec's mining sector coverage. There are even some buy tips!

BHP Billiton ('Sell', target price [TP] 599p)

Downgraded from 'hold' to 'sell', BHP will be under pressure to cut its dividend in a weaker pricing environment and as financial risks remain. Investec thinks the progressive regime will be replaced with a dividend policy that returns a quarter of sustainable operating cash flows, which will still be a reliable base for shareholder returns while the miner recovers. Further cost-cutting will probably see its Jansen potash project in Canada suspended, along with other cash negative operations.

(Click to enlarge)

Rio Tinto ('Buy', TP 1,859p)

Although will still generate positive cash flow under Investec's new price outlook, it won't be able to keep up its dividend policy without breaching its 20-30% gearing targets - reliance on debt in the balance sheet. It won't come as a surprise if the miner cuts its dividend from the second half of the 2016 financial year, with Investec pencilling in a similar scheme to BHP. A 25% pay-out ratio should maintain gearing in the targeted range and give it bid power if acquisitive opportunities arrive. Projects like Simandou in Guinea and La Granja in Peru have been cast aside to lower costs.

Glencore ('Sell', TP 64p)

The cost savings Glencore outlined in early December have been wiped out under Investec's new price outlook. Although management is confident it can reduce debt by $13 million, the broker isn't as confident as the miner must still sell its Lomas Bayas and Cobar copper mine assets.

Anglo American ('Sell', TP 152p)

Adapting to challenging market conditions, Anglo has cut output in South Africa at Kumba and De Beers, and Investec reckons further delays to its Brazilian Minas Rio ramp-up are likely. The analysts say: "The updated lower commodity price outlook, together with continued (albeit lower) capital expenditure spend and a challenged balance sheet, oblige us to downgrade the company from 'hold' to 'sell'."

(Click to enlarge)

Randgold Resources ('Hold', TP 4,608p)

A rare thing in the sector is , a company still generating earnings growth. As volatility wreaks havoc on global markets, the gold miner was the only blue chip to flash green as investors rushed to the safe haven. It's got a structured and conservative investment model, and justifies its premium rating due to a strong balance sheet and quality assets.

Investec's other sector ratings are:

: Downgraded from 'hold' to 'sell'; TP 16p

: Downgraded from 'buy' to 'hold'; TP 192p

: 'Buy'; TP 76p

: 'Sell'; TP 29p

: 'Buy'; TP 123p

: 'Buy'; TP 71p

Antofagasta: 'Sell'; TP 263p

: 'Sell'; TP 113p

: 'Buy'; TP 22p

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.