Why experts favour European risk assets

29th January 2016 13:48

by Jim Levi from interactive investor

Share on

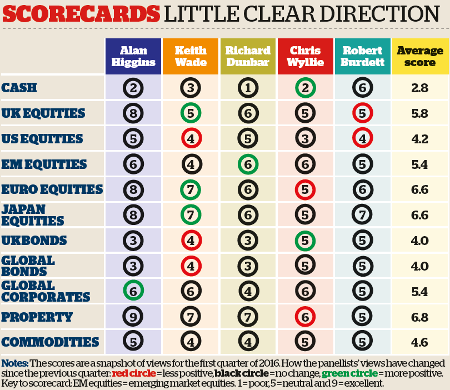

The start of 2016 finds our panel of asset allocation experts increasingly jaundiced about the prospects for Wall Street in 2016. For the second quarter in a row, the five experts have produced another average underweight score for US equities, down from 4.6 to 4.2.

Two members of the panel have edged their scores a notch lower this time around, and none of them is actually still overweight in US equities.

All this could easily be read as an ominous sign. If Wall Street is going to sneeze this year, could the rest of the world catch a cold? In the increasingly febrile climate, it is a question being asked more and more.

When you look at the state of global equity markets at the dawning of 2016, the picture could hardly be more varied. US markets have enjoyed a long bull run dating back to the beginning of 2009. But that bull run showed distinct signs of flagging in 2015, with the S&P 500 index showing little change over the year and ending up well down on its peak in May.

US markets have also, some would say, been unhealthily reliant on just a few stocks: either the so-called FANGs (, , and ) or a slightly wider band of companies that includes , and , known collectively as the "nifty nine".

In contrast to US equities, emerging market equities have been in the doldrums for nigh on four years, while European and Japanese markets have performed moderately well.

Meanwhile, the UK's major indices, the and the , have effectively flatlined and are again well below the peak last April.

All this partly reflects the extraordinarily varied state of the world economy. The US and UK have enjoyed a prolonged recovery, falling unemployment and rising consumer confidence.

Europe is, in many respects, still struggling to get a real recovery going after the 2008-09 financial crisis. The Japanese economy seems to be back on track, while major emerging markets, including Russia, South Africa and Brazil, are in recession.

Generally speaking, the panel still favours risk assets over government bondsIn China the manufacturing sector appears to be shrinking - a trend only partially offset by growth elsewhere in the economy. On the opening day of the new year, Chinese shares lost most of the gains they had made in the previous three months.

If the global picture looks confusing, the differing responses to it by our panellists may help one clarify one's thoughts.

Generally speaking, the panel still favours risk assets - equities and property - over government bonds. There is also a clear trend towards switching out of US equities into European, Japanese and (to a degree) emerging market equities.

Property - still the panellists' favourite sector - may now have peaked in popularity. In the hunt for a decent inflation-beating yield there is renewed interest in the corporate bond market. But nobody is yet brave enough to predict a recovery in commodity prices.

Optimistic view

If the overall mood is cautious, there is, however, one chirpy optimist in our midst. Alan Higgins keeps smiling through the general gloom. His scores of eight for three equity sectors, the UK, Europe and Japan, and a nine for property - all put out three months ago - are maintained for early 2016.

His employer, Coutts Bank, where he is chief investment officer, published an investment outlook circular at the beginning of December. It was entitled "Reasons to be cheerful".

To some, that title might suggest whistling in the dark to keep the spirits up. However, Higgins and his team are confident global growth "will be surprisingly strong" this year, as consumers continue to gain from a lower oil price.

He says: "We are not talking about growth of 4% or anything like that, but our key point is that when commodity prices fall - particularly the oil price - eventually it is positive for global growth. We see signs of that already coming through. So we believe global growth this year will be at least as good as in 2015."

Banks aren't going to be lending like they did before the crash any time soonThat view is not shared by Keith Wade, chief economist at Schroders. His prediction is for growth to slow further in 2016, from 2.9% to 2.6%. One reason for this, he believes, is the changed attitude of banks towards their borrowing customers, both corporate and private, across the globe.

"It does not look as though banks are going to be lending again in the manner they did before the crash, at least not any time soon, and maybe not for a generation," he says.

Another factor he cites is the increasing importance of the developing world in the overall global mix. "The world economy is now much more orientated to what happens in emerging markets than perhaps we realised," he adds.

For the first time, Wade has gone underweight in US equities, cutting his score from five to four. "Overall, the US market did little last year, and I think this year could also be difficult, because corporate earnings growth has already slowed. I am looking for only 3 or 4% this year," he says.

He cites the already high stockmarket valuations, the strength of the dollar, a background of gradually rising interest rates and US energy industry cutbacks as other factors prompting his score reduction.

Meanwhile, Rob Burdett, co-head of multi-manager at F&C Investments, has also moved underweight in the US, reverting to a score he gave last August. But he hopes this may prove temporary and now has a higher short-term cash position.

Richard Dunbar, deputy head of global strategy at Aberdeen Asset Management, remains cautious about sounding too bearish on the US. "I can see the arguments now being made that we are coming to the end of a long bull run in the US," he says.

"But I think higher profit margins might persist there for longer than many people think. The shape of the US market has changed compared with 10 years ago. It is an entrepreneurial economy, and it's dangerous to bet against it."

Consistent bear

Regular followers of the panel's predictions will know that Chris Wyllie, chief investment officer at Connor Broadley, has been bearish on US equities for some time. He keeps his score at three - a number he has stuck to for four years. Until last year that bearish stance looked wrong, but now it appears to be coming right.

If Higgins is the most bullish of our panellists, Wyllie has become the most bearish. He is now neutral or underweight in all equity sectors except emerging markets, which he scores a six. He has edged his score for UK bonds up from four to five to match his global bonds score.

He says: "With inflation now so subdued, 10-year gilts offer a modest real yield that could be some comfort in a year when things could be quite tough for global equities."

Wyllie was earliest to tout the merits of the property sector: he first put his score up to seven back in 2011 and it has stayed there until now. He led the pack upwards and he may now be leading it down, edging back to a six.

This reflects signs that the flow of foreign money into the London property market is slowing. Wade adds: "The falling oil price means investors from places such as Russia and the Middle East are feeling the squeeze, but for now, we will keep our score at seven."

Japan ticks the right boxes

Japan seems to tick all the right boxes again for Burdett, who considered increasing his score from seven to eight. In the end, he decided against it.

Nevertheless, he says: "Of all the equity markets, Japan has got the most going for it: stable government, supportive monetary and economic policy, and a programme of reforms supportive of stockmarket investors. It was the best-performing equities sector last year, but valuations are still cheap."

Higgins already has a score of eight for Japan. Abenomics, the economic policies of prime minister Shinzo Abe, includes a vital corporate structural reform programme that seeks to encourage improved dividends, more non-executive directors and efforts to push pension funds in Japan to invest more in the stockmarket.

Abenomics is less about the economy and more about making sparks fly in the stockmarket

Indeed, Higgins argues that these days Abenomics is "less about what it does for the economy and more about what it does to make the sparks fly in the stockmarket". In addition, adds Wade, as Japan imports all of its oil, it is a major beneficiary of lower oil prices.

Dunbar has made only one change to his scores: he has moved overweight from five to six in emerging market equities.

"The upturn in my score is a reflection of attractive market valuations, but also of the almost universal bearishness on the sector," he says. Overall, Dunbar describes himself as "not gloomy, but [not] ragingly optimistic about equities".

Dunbar's position means three panellists are now overweight in emerging market equities. But their enthusiasm is hardly of the euphoric kind. He says: "Like everyone else, I can see the impact of falling commodity and oil prices, and the strong dollar on these markets. But even a small change in sentiment would have quite a dramatic impact."

Wyllie agrees: "These markets have been in a downward trend for four years, and there have been many false dawns. But the downside leverage has now gone, and valuations are at levels where they are primed to perform. All they need is a catalyst."

European equities: Questions remain

Once again, Chris Wyllie is the odd man out in European equities (ex UK). This month he has cut his score for the sector from seven to five. All other members of the panel are overweight, with Keith Wade notching up an increase to seven.

Wyllie is preoccupied by worries over where we are in the global economic cycle. He notes that there is now a worldwide recession in manufacturing, reflected in the weakness of metal prices and international trade volumes.

"It could lead to a lack of momentum in the global economy," he says. "Europe is already struggling to grow, and in any case European shares are no longer cheap."

Rob Burdett recognises the crucial role of Europe if the world is to get out of its low-growth phase.

Everyone is fussing about China, but Europe is crucial

"We really do need Europe to continue to improve and to take up the slack that is appearing elsewhere," he says. "It is, after all, the second-largest economic bloc and in some respects the largest. Everyone is fussing about China, which is, of course, important, but Europe is crucial."

Richard Dunbar says one of the major themes running through 2016 will be the impact of monetary policy and quantitative easing (QE). "It will continue to have a massive impact on markets as it is withdrawn in the US and the UK, but continues to be available in Europe, Japan and other countries," he says.

It is no coincidence, Keith Wade comments, that Schroders has switched its attentions from the US (score down from five to four) to Europe and Japan (both scores up one to seven) at a time when QE is being withdrawn in the US but still has the potential for further stimulatory increases in Europe and Japan.

Alan Higgins, who scores an eight for European equities, suggests they offer "better value than they [did] a year ago".

He thinks the region will grow steadily throughout this year and next, with central bank monetary stimulus, a competitive currency, falling energy prices and improving consumer demand all combining to deliver the cheerful outcome he is expecting.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.