12 ideal trusts for long-term regular savers

10th February 2016 10:49

For those without generous maiden aunts or lottery wins, "little and often" remains the best way to build up a savings pot.

Investment trusts can claim some pedigree as regular savings vehicles: their low costs, stable management and strong long-term performance make them a good option for building a diversified portfolio over time.

Although for many it will be the only option, it is also worth looking again at some of the inherent advantages of saving regularly.

Investors were painfully reminded in 2015 that stockmarkets can be volatile. The value of investments has certainly gone down as well as up, and bounced around a lot to boot.

Pound-cost averaging

Regular savings is a means to manage this volatility. Gavin Haynes, investment director at Whitechurch Securities, says: "The key is 'pound-cost averaging'.

"If the price of the investment falls, investors are able to buy more shares. This can smooth out the price of the initial investment over time."

Investors buy in at a variety of prices, rather than all at one price, which means they take less risk on the current level of the market. In contrast, putting a lump sum in the market all at once leaves an investor vulnerable to buying when share prices are at their highest.

Putting aside an amount every month, with the power of compounding, can build up a decent nest eggThis is surprisingly common - the stock market is one of the few places where people are reassured by high prices. This means that the natural inclination is to buy at the top of the market. Saving regularly helps avoid this.

For investment trusts, managing volatility can be even more important. The movement in the discount or premium to net asset value (NAV) can create additional volatility. Saving regularly ensures that this is less of an issue, because investors are buying at different discount levels.

Haynes also believes that regular saving imposes a good discipline on savers. It means they are putting aside an amount every month, which - with the power of compounding - can build up to a decent nest egg.

The cost of investing

However, investors need to approach regular savings into investment trusts in the right way. Some platforms and stockbrokers charge a fee per transaction, in the same way as they would with standard shares.

If an investor is only putting in, say, £50 per month, but then paying £5-£10 in transaction costs, it will quickly erode their savings pot.

In general, investors will have the UK as the core of their portfolioIt can be better to look for options where fees are charged as a percentage of assets, and where one-off transaction fees are not charged.

Some investment platforms charge a special, reduced fee for regular savers, whose contributions are pooled with others to buy at a specific time of the month.

Many of the investment trust groups have regular savings schemes with competitive charges.

The Baillie Gifford scheme, for example, has no initial or annual plan charges and regular savings can be made for as little as £30 per month. Investors just pay stamp duty, the dealing price spread and the cost of managing the trust.

With this in mind, certain trusts may be better suited for regular savings, notably those trusts with a good long-term track record but where volatility might otherwise deter investors.

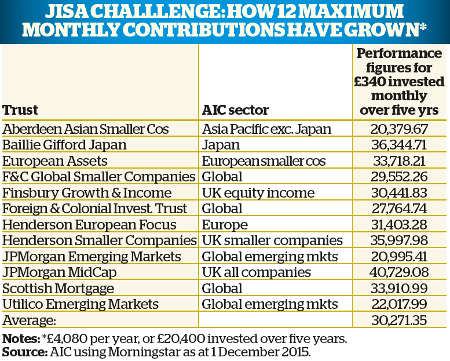

Below, we revisit a selection of trusts from our sister magazine Money Observer's regular savings awards, from which investors can create a mix-and-match portfolio.

In general, investors will have the UK as the core of their portfolio - and we profile a number of trusts that might fulfil this - perhaps with a balance between trusts focusing on larger companies and those focusing on smaller companies.

For a little spice, investors can introduce global smaller companies or emerging market exposureThis would normally be balanced with a global trust such as or .

From there, the choices are myriad. Investors might decide that "Abenomics" will generate real, long-term change in Japan and top up there, or that Europe will finally recover and take selected holdings there.

For a little spice, they may want to introduce some global smaller companies or emerging market exposure. In this way, even those without wealthy relatives or lottery luck can build up a nest egg.

UK trusts

Henderson Smaller Companies

The has rested in the capable hands of Neil Hermon since 2002, supported by the well-respected Henderson smaller companies team.

Hermon has a flexible style, holds around 100 stocks and is agnostic on index benchmark weightings.

The trust's ongoing annual management charge of 0.89% compares relatively favourably with the rest of the sector.

The trust is trading at a discount of 8.6%, a little narrower than its 12-month average (11.04%). Over five years, the share price is up 173.2%, against a sector average of 114.1%.

Consumer cyclical companies currently make up the largest sector in the portfolio, including kitchen-maker , housebuilder and technology group .

JPMorgan Mid Cap

If an investor had to pick just one part of the market on which to focus, medium-sized companies would have been the most successful option over the past decade.

The has reaped the rewards of astonishing growth in the sector, rising 147.34% over the past five years.

Of course, the management team of Georgina Brittain (since 2012) and Katen Patel (since 2014) has also done its bit, and the trust has also outstripped its mid-cap peers.

Its discount has now narrowed to 1.98%, ahead of its 12-month average of 9.62%.

The mid-cap growth story has taken a pause of late, but this has brought valuations down to more realistic levels.

Finsbury Growth & Income

Nick Train is one of the most successful investors of his age, but even he has his difficult moments.

Long-term holding has had a rough year (down 33%), which has dented returns for this year. But not by much, and the trust is still up 97.47% over five years.

Perhaps more importantly, he is rare in achieving this performance principally through judiciously selected large companies. 2015 was also unique for Train in that he found a new stock to buy, adding to the trust.

He famously trades infrequently, preferring to buy structural growth businesses and hang onto them for the long term. There are no bargains to be had here, however - the trust still trades at a small premium to its NAV.

Global trusts

Scottish Mortgage

Managed by James Anderson since 2000 and Tom Slater since 2009, Scottish Mortgage has been reshaped as a "best ideas" fund, firmly focused on global growth businesses.

It is also relatively concentrated, with 30 of the holdings accounting for 80% of the trust.

The focus on the businesses of tomorrow is clear from the top 10 holdings - , , , , and all feature. This can make performance lumpy, but it is good over the longer term: the trust is up 108% over five years.

The trust tends to trade at a premium, but at the time of writing was trading at or near par value.

Foreign & Colonial

There has been a change of guard at the helm of Foreign & Colonial, as Jeremy Tigue, who had managed the trust for 28 years, retired in 2014.

Paul Niven's first year appears to have been a successful one, with the trust ahead of its sector and benchmark, and comfortably on course to deliver a 45th year of increasing dividends.

The trust invests across 500 holdings, comprised of a mixture of F&C and external managers.

For example, the trust uses T Rowe Price and Barrow Hanley in the US and HarbourVest for private equity exposure. The trust trades at an 8.38% discount, a little wider than its long-term average.

Regional specialist trusts

Baillie Gifford Japan

After many years of disappointing investors, Japan is becoming a better place to invest as Abenomics slowly has an impact.

The team has been there in the bad times and still made money, but is thriving in this new environment.

One of the strongest and most stable Japan teams in the market, over one, three and five years the trust has only been beaten by its Baillie Gifford stablemate , which tends to take a racier approach to stock selection.

Managed by Sarah Whitley since 1991, Baillie Gifford Japan has a firm "growth" flavour, looking for companies that will deliver stable long-term returns to shareholders.

Henderson European Focus

John Bennett took over from the departing Roger Guy in 2010. He has proved himself a worthy successor, with the trust ahead of its benchmark and sector over three and five years.

Eschewing the more fashionable "pure stockpicker" approach, Bennett draws from his macroeconomic analysis to identify long-term structural trends and their beneficiaries.

For the past 12 months, the trust has consistently traded at or near its NAV and is currently at a small premium.

Utilico Emerging Markets

In an unloved sector, has stood out. Its focus on listed companies involved in infrastructure, transport and similar sectors has helped it to avoid the worst of the emerging market sell-off.

It is managed by a specialist team at Ingot Capital Management, led by Charles Jillings, who look for businesses with strong management and the potential to grow.

They also want to see a good appreciation of and ability to manage risk. The portfolio typically holds 60-90 stocks. It has a dividend yield of over 3%, which it pays quarterly.

JPMorgan Emerging Markets

The granddaddy of the sector and one of its best-performing, has been run by Austin Forey since 1994.

Forey holds a portfolio of 50-75 stocks, drawing on the expertise of JPMorgan's global bank of analysts to make his decisions.

The trust has managed to avoid the worst of the recent falls in emerging market stocks, but its discount is still comparable with the rest of the sector at around 10%.

Non-UK Smaller Companies

F&C Global Smaller Companies

While a global approach is commonplace for larger companies, relatively few trusts do the same for smaller companies.

The fund is a rare - and successful - exception. Managed by Peter Ewins since 2005, it is top quartile in the global sector over one and three years.

It invests predominantly in US and UK equities - almost 40% in the US, and 30% in the UK.

Many of its largest holdings are other investment trusts, including Eastspring Investments Japan Smaller Companies trust, fund and .

However, the trust will also invest in individual companies. It has increased its dividend 44 years in a row.

Aberdeen Asian Smaller Companies

has just celebrated its 25th birthday. The team has looked remarkably stable over that time and the trust still follows the Aberdeen Asian investment process devised by Hugh Young.

The trust's managers pride themselves on the consistency and predictability of their performance, describing their philosophy as one of "patience and trust".

The managers back strong management teams that have shown themselves capable of navigating the idiosyncrasies of Asian markets. Theirs is a long-term approach.

More recently, the trust has had a difficult run of performance, which has seen the discount widen substantially to around 12%.

European Assets

Run by Sam Cosh since 2011, is a concentrated 40-50 stock portfolio of small and medium-sized European companies.

Cosh takes a "quality at the right price" approach, aiming to preserve capital and reduce volatility during more difficult markets.

The trust is a strong performer over the longer term, but has seen some weakness recently because its quality bias has left it lagging in buoyant markets.

The trust also has a relatively attractive dividend yield of over 3%.

Figures in the profiles above were sourced from FE Trustnet as at 1 December 2015.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks