Gold-Oil ratio at 124-year high

11th February 2016 14:22

by Lee Wild from interactive investor

Share on

The sunk another 173 points, or 3%, Thursday, briefly ducking below 5,500, and a partial recovery since looks unconvincing. That's clearly the feeling among investors who took the latest rout as their cue to buy more gold.

Gold futures rose as much as 3.8% Thursday to $1,240 an ounce, up over 18% since early December to a one-year high. The "flight to quality" really is in full swing.

Investors typically perceive the yellow metal as a reliable store of value; a "safe haven" asset which does well when equity markets get ugly. Being priced in dollars, demand also rises when the US currency weakens as it becomes cheaper for foreign buyers.

At the same time, oil prices appear more likely to fall than stage any kind of sustainable recovery. Brent crude is currently stuck just above $30 a barrel, a stone's throw from multi-year lows, and West Texas Intermediate (WTI) is down 3% today at $26.59.

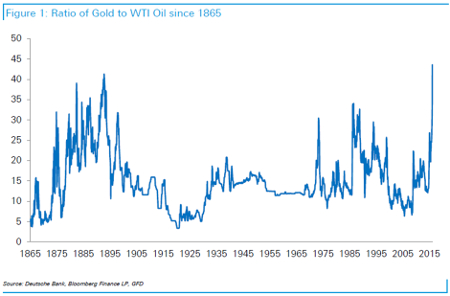

And the vastly differing fortunes of these major commodities have piqued the interest of analysts at Deutsche Bank. After updating its numbers going all the way back to 1865, the broker has found that the Oil/Gold ratio has just hit an all-time high.

Gold is now 44 times the price of oil, according to Deutsche's stats. Updating the numbers using the very latest prices put the gap at 46 times.

"The previous high of 41 in 1892 has just been exceeded," writes strategist Jim Reid. "For perspective, the ratio was at 6.6 in June 2008 and only 12 in May 2014. The long-term average is 15.5."

"While this says nothing about where the ratio is going in the short-term, surely this looks a good trade to exploit over the longer-term for those who care about such things."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.