Six big name laggards to outperform

17th February 2016 12:34

A week ago, analysts at UBS published research revealing that the gap between cheap (value) and expensive (growth) stocks within individual sectors hit the tech bubble high. They claimed that this level of dispersion "does not hang around", and that sector laggards - value - outperform over the six months to a year following a crisis by an average of 20%.

UBS strategists think the valuation stretch in many cases is "extreme and at risk of snapping back on any relief". Of course, we cannot know what the trigger will be. If we did, the value gap would not exist!

In 2000, value hit a "record level of cheap" as investors chased growth before the dotcom crash. Valuation dispersion reversed in 2003 following a return to growth after 9/11 and recession. In March 2009, it was the US Troubled Asset Relief Program (TARP) bailout, and in July 2012 it was Draghi's offer to "do whatever it takes to preserve the euro".

"What will it be this time?" asks UBS. "Oil prices rising, US dollar falling or Draghi stepping in to save the supposedly in-trouble European banks?"

They believe investors should "as a whole participate in some of the more recently unlocked value, because the gap is extreme".

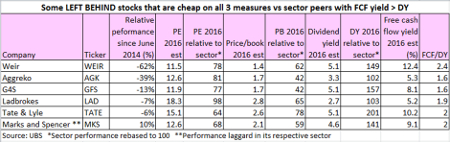

Now, the broker has put together a list of the companies that have underperformed peers since June 2014, are cheap versus sector peers on three measures: price/earnings (PE) ratio, Price/Book (PB) ratio, and dividend yield (DY), and have a free cash flow (FCF) higher than the dividend yield.

UBS's list of "left behind" stocks runs to 30 companies, among them six big name UK firms including Scottish engineer and high-street retailer :

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks