Ten small-cap value shares for contrarian investors

24th February 2016 14:07

by Ben Hobson from Stockopedia

Share on

Investors have been handed a bearish reality check in 2016, with the share prices of many smaller companies coming under pressure. Among the main small-cap benchmarks, the FTSE SmallCap index and the Alternative Investment Market are both down by 7%. In periods of uncertainty smaller shares can be hit hard as investors run for the perceived safety of larger stocks. But, for value hunters, these conditions can throw up the occasional opportunity.

Benjamin Graham, one of the forefathers of value investing, once said that "in the short run the market is a voting machine, but in the long run it's a weighing machine". What he meant was that short-term market movements are often influenced by emotion and overreaction. But over the longer term, that volatility evens itself out and prices revert to mean. This is one of the foundations of value investing.

Looking for value among the market's smallest companies when prices are under pressure is riskyBut, of course, not everyone agrees about what "cheap" really means and how it should be defined. Over the years, all sorts of ratios have been employed to assess whether companies are trading at a price worth paying. The price/earnings ratio is one of the most common, but you'll also see price/sales, price/book, price/cashflow, dividend yield and the enterprise value/earnings before interest, tax, depreciation and amortisation (cash profit) used to varying degrees.

All of them assess a company based on either what it earns or what it owns, and they tend to come and go like fashion.

Combining value and momentum

Some of the most detailed research into what really works in investing has been done by US fund manager and modern day investment star, James O'Shaughnessy. His in depth studies of historical market data have been documented in a series of books, including Predicting the Markets of Tomorrow and What Works on Wall Street.

One of the strategies he has identified as a successful contrarian approach is called "Tiny Titans". As the name suggests, it's a strategy that targets some of the smallest companies in the market. It uses the price/sales ratio as a measure of value and relative price strength over 12 months as a measure of positive momentum.

This is a contrarian approach to finding potential ideas and spotting areas of value in the marketThe combination of value and momentum has been credited as one of the most powerful predictors of stock market returns. In essence, it looks for cheap stocks that are beginning to re-rate. In the case of "Tiny Titans", O'Shaughnessy insisted that the volatile nature of very small stocks means this is a strategy for finding individual ideas rather than constructing entire portfolios.

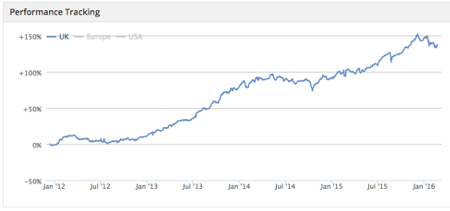

Yet, despite the risks, the strategy - as tracked by Stockopedia - has performed well in recent years, with a notable 22.3% return over the past year.

Interestingly, in his very latest research, O'Shaughnessy has moved away from using individual ratios like price/sales, preferring instead to use a composite of several valuation measures.

At Stockopedia we use a similar concept called the Value Rank. It takes a blended approach by scoring and ranking every company in the market using a combination of six valuation ratios, from zero (expensive) to 100 (cheap). Using the original rules and the Value Rank, Stockopedia screened the market for Interactive Investor.

| Name | Market Cap (£m) | Price/Sales Ratio | Value Rank | One-Year Relative Strength | Sector |

|---|---|---|---|---|---|

| Produce Investments | 33.5 | 0.19 | 97 | 13.9 | Consumer Defensives |

| Caffyns | 15.6 | 0.07 | 97 | 21.9 | Consumer Cyclicals |

| Interquest | 28.2 | 0.18 | 91 | 10.8 | Industrials |

| Jersey Electricity | 59.5 | 0.6 | 89 | 42.2 | Utilities |

| Real Good Food | 30.7 | 0.3 | 89 | 19.1 | Consumer Defensives |

| Volvere | 18 | 0.58 | 89 | 65 | Consumer Cyclicals |

| Avesco | 42 | 0.32 | 87 | 109.7 | Consumer Cyclicals |

| Norcros | 106.7 | 0.46 | 86 | 22.2 | Consumer Cyclicals |

| Dewhurst | 31.8 | 0.7 | 85 | 10.7 | Industrials |

| Braemar Shipping Services | 127.2 | 0.8 | 84 | 2.8 | Industrials |

Among the diverse results are potato farming business , auto retail group and recruitment company .

The largest firms are shipbroker and shower and bathroom accessories group . The strongest price strength of all the companies on the list has been seen at media services firm .

Small-cap value stars

Looking for value opportunities among some of the smallest companies in the market during a period when prices have been under pressure is undoubtedly risky. So it's worth reiterating that this is a contrarian approach to finding potential ideas and spotting areas of value in the market. As always, detailed research is essential.

But the essence of this strategy does have a sound strategic basis, not least because it focuses on shares that may be undervalued, rather than those that are popular and overvalued. On that subject, James O'Shaughnessy summed up the risks like this:

"You'll get nowhere buying stocks just because they have a great story. Usually, these are the very companies that have been the worst performers over time. They often have sky-high price/earnings, price/book, and price/sales ratios.

"They're very appealing in the short term, but they're deadly over the long haul. You must avoid them."

About Stockopedia

Interactive Investor's Stock Screening series is written by Ben Hobson ofStockopedia.com, the rules-based stockmarket investing website. You canclick here to read Richard Beddard's review of Stockopedia.com and learn more about the site.

● Interactive Investor readers can enjoy a completely FREE 5-day trial of Stockopedia by clicking here.

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

Ben Hobson is Investment Strategies Editor at Stockopedia.com. His background is in business analysis and journalism. Ben researches and writes regularly on investment strategy performance and screening ideas for Stockopedia.com. He is the author of several ebooks including "How to Make Money in Value Stocks" and "The Smart Money Playbook"

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.