Morrisons boots Sports Direct out of FTSE 100

3rd March 2016 12:02

by Lee Wild from interactive investor

Share on

Controversial businessman and football club boss Mike Ashley has just two weeks left as the owner of a sportswear empire. , the company he started and in which he still has a 59% stake, will be kicked out of the blue-chip index at the close of play on 18 March.

Confirmed last night as part of the latest quarterly FTSE index reshuffle, it's been a spectacular fall from grace for the billionaire, who's developed a knack of grabbing headlines for all the wrong reasons.

Only seven months ago, Sports Direct was worth almost £5 billion. Three months earlier, Ashley had told staff and major suppliers that profits would beat expectations. An undercover TV documentary exposing zero-hours pay and questionable business practice had no effect.

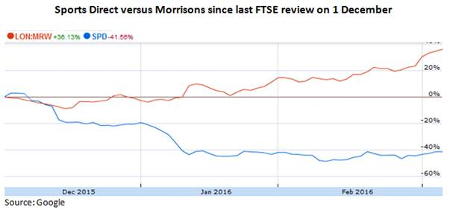

But it all began to unravel at the beginning of December, just before Sports Direct reported much weaker than expected half-year sales and profits.

A drive to promote its own brands, which include Dunlop, Slazenger, Everlast, Lonsdale, Karrimor and Kangol, had clearly backfired.

That's abundantly clear when arch rival is shooting the lights out. A constituent in Interactive Investor's Winter Portfolio, JD just keeps beating forecasts, as shoppers can't get enough of its big brands like and or its shoe chain, Size?.

In January, fears were confirmed with a devastating profits warning which triggered a second lurch lower. Despite a recent bounce, the share price is still half what it was in August and the company is worth less than £2.5 billion.

Some surprising moves

Sports Direct's downfall is not the only exciting move this time.

The mighty conglomerate, which makes medical devices, bomb detectors and specialist tubing, will be fired from the FTSE 100, too, when the changes take place on Monday, 21 March. It's joined in the second-tier FSE 250 index by asset manager and Middle East and North Africa drugs group .

And look who's taking their place.

Supermarket basketcase was glued to a 15-year low in December and wondering whether it could survive the onslaught from discount rivals Aldi and Lidl. But management action on price, cutting costs and store disposals has paid dividends, and the share price is up around 50% since then.

Like-for-like sales only inched up 0.2% in the nine weeks to 3 January, but this was the first positive read in four years, and much better than the 2% decline expected in the City

A deal with this week to sell Morrisons goods through the American firm's website is another step toward assuaging fears that it was late to the "internet delivery" party.

Bookie Paddy Power's merger with has created a £8.5 billion betting colossus, and one of the world’s largest online gambling companies. That's guaranteed it a place among the corporate hotshots.

Also promoted from the mid-cap index are , a publishing and events company, and £6.5 billion , which completed its reversal into UK-listed Abu Dhabi-based healthcare provider just last month.

It beat off fierce competition from rival bidder to create the third-largest multi-country hospital group outside the US.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.