Nifty Thrifty: Magic Formula still has the touch to deliver

15th March 2016 17:22

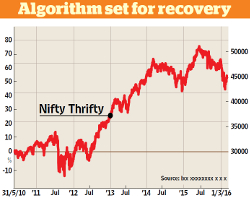

The Nifty Thrifty portfolio has lost money over the last year. The only consolation is that a benchmark investment in an index-tracking fund lost marginally more. The two investments lost 5% and 7% respectively, so the Nifty Thrifty's creeping outperformance continues.

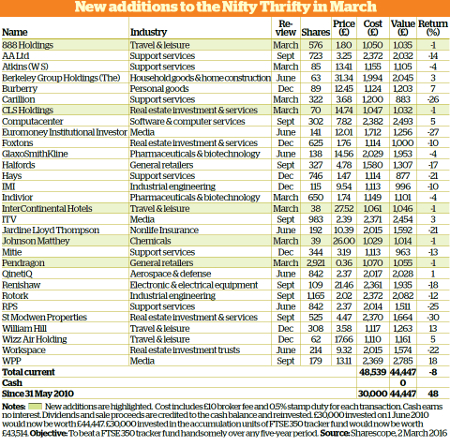

After making the quarterly changes and writing off an investment in bankrupt Afren, £30,000 invested nearly six years ago in the Nifty Thrifty would be worth £44,447 today - a gain of 48%.

£30,000 invested over the same period in the index-tracking fund would be worth £43,514, a gain of 45%. Both the Nifty Thrifty and the tracker reinvest profits from dividends and both select shares from the same index, the biggest 350 companies listed on the main market in London.

How it works

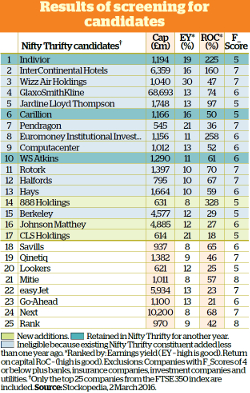

The Nifty Thrifty's algorithm is more selective. It only invests in 30 of the 350 companies, those non-financial companies that are financially strongest according to the F_Score, a nine-criteria rating designed by Joseph Piotroski, an accounting professor, and that have the highest combined profitability and valuation rankings according to a system devised by fund manager Joel Greenblatt.

The F_Score was designed to weed out companies most likely to fail, by identifying those that have become less profitable, less efficient and more dependent on outside sources of finance (either by using more bank debt or by issuing more shares).

Greenblatt called his system the Magic Formula, the idea being to select good companies - those that are highly profitable - at cheap prices. The measure of profitability is return on capital. The measure of value is the earnings yield.

The statistics are not foolproof but they improve the odds of picking good companies at cheap prices, which is why the system only works reliably on large baskets of stocks over long periods of time.

I stagger the share-buying as equally as possible over the year, replacing up to eight shares in March, up to seven in June, up to seven in September, and up to eight in December.

Each share is replaced after one year unless it re-qualifies for the portfolio because it is still in the FTSE 350 index, it still has an F_Score of five or more out of nine, and it is still one of the most highly ranked candidates according to Greenblatt's Magic Formula.

Nigerian oil toil

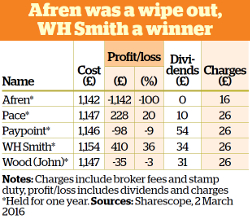

This time, only five of the eight companies due for ejection needed to be replaced. There is still little hope that shareholders will receive any money from Afren, the Nigerian oil exploration and production company that went into administration last summer amid allegations of corruption.

Since then, the company has been valued in the portfolio at just over £200, the value of the shares at the time they delisted; but now it's time to replace the shares and I've written the holding off. The portfolio has taken a 100% loss.

Special mention should be made of WH Smith, which leaves the portfolio having earned a return of 36% over the last year.

Not only was it the best performer of a pretty disappointing bunch, but it has been a stalwart of the Nifty Thrifty since the algorithm first selected it in 2011 at a share price of 480p.

The price today is 1,821p. WH Smith is perhaps a surprise portfolio hero. The high street stores hark back to the previous century, but management has been adept at squeezing every last penny out of them, while growing its estate of more profitable travel convenience stores located in airports, stations and hospitals.

Of the other three companies ejected in March, only Pace earned the portfolio money - a return of 20%. It left the portfolio prematurely, in January, when the US firm ARRIS acquired it.

The acquisition strengthens ARRIS's position in the satellite and cable TV market, and also reduces its tax bill now that it has acquired a domicile in Britain.

PayPoint, the provider of bill payment terminals to convenience stores, and engineer Wood Group leave the portfolio having lost 9 and 3% respectively.

Indivior, which markets medicines that suppress withdrawal symptoms in drug addicts; Carillion, which provides construction services and facilities management; and engineering consultancy WS Atkins were reselected for another year.

This is the third consecutive year the algorithm has selected Carillion, with only losses to show for its perseverance so far.

New additions

Dividends paid in the past six months and the proceeds from the ejections left about £1,050 to invest in each of the five new additions.

InterContinental Hotels franchises its eponymous hotel brand as well as other well-known brands such as Holiday Inn.

Pendragon is a car dealership; 888 is an online casino that also provides services for other gaming companies; Johnson Matthey is a global supplier of chemicals and materials; and CLS is a property investment company.

As I said in the December update, the write-off of Afren marks the end of an ill-fated foray into oil. Hopefully, it marks the beginning of a recovery in the algorithm's performance.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks