Confident to double-up on this share

31st March 2016 12:04

by Richard Beddard from interactive investor

Share on

Last Thursday I doubled-up* on the Share Sleuth portfolio's biggest loser, .

I believe Goodwin is a very good company enduring difficult market conditions. Those conditions will change, probably for the better over the long-term, and so will Goodwin.The trigger for the trade was not Goodwin's third quarter interim management statement published a week earlier. In fact, it worked against me, causing the share price to end its recent declines with a bounce.

Interim management statements are routine updates explaining how a business has performed, and, often, guiding investors' expectations for the future.

Such statements can be infuriatingly ambiguous, requiring investors to read between lines of doublespeak and, unless they contain very dramatic news, I rarely pay attention. The aim of the Share Sleuth portfolio is to invest in companies for the long-term, at least five and preferably ten or more years. Inevitably there will be hiccoughs along the way, so there is little point worrying about them.

Before the oil price crash, the booming oil trade earned Goodwin half its revenuesGoodwin's statement attracted the attention of other investors, I suspect, because it signalled that the business is stabilising after a dramatic fall in demand from oil and gas companies.

The company is diversified, but a significant portion of revenues comes from check-valves, which, like giant, car-sized taps, control the flow of fluids in pipelines, oil rigs, water desalination and chemical plants for example. Although Goodwin supplies all manner of industries with valves, prior to the oil price crash the booming oil trade was earning Goodwin almost half its revenues, and a bigger proportion of profit.

Goodwin reported it received considerably more new orders in the first nine months of this financial year (it ends in April) than it did in the corresponding period in the previous financial year, not only from its separate refractory engineering business and a small radar antenna manufacturer, it also received new orders for valves for Liquefied Natural Gas (LNG) terminals.

The company is adapting, inventing and acquiring new products and seeking out new marketsThe company revealed it does not expect next year, the financial year ending in April 2017, to be as bad as it had feared. I asked John Goodwin, the company's longstanding chairman, about those fears, and he referred me back to the annual report for 2015, in which the company reported that it was competing more intensely for business, and the resulting pressure on prices would impact profitability. If competitive pressure is easing, that is surely good news.

In deciding to add more shares to the portfolio, I find it helpful to list out what I need to believe to invest with confidence. I must believe that there is more to Goodwin's impressive growth in the 20 years to 2014 than an impressive boom in the oil and gas industry.

One indication that Goodwin is a strong company, regardless, is that it should still earn a respectable profit despite, perhaps, the worst year for oil and gas investment in its recent history. I reckon return on capital will be about 10% in the full-year to April 2016. A second factor may be technical expertise evident in the patents it holds, and in the vertical integration of its businesses, jargon which means some of its businesses supply others, giving Goodwin more control over price and quality.

Adapting profitably needs management to take a long-term view, even if it means short-term hardshipI must also be confident that the adoption of 3D printing by high-end jewellery manufacturers doesn't herald the first wave of obsolescence for Goodwin's refractory engineering businesses. These operations supply casting powders consumed in the casting of jewellery, a process that 3D printing is replacing. Goodwin does not believe that 3D printing is likely to be quick or cheap enough to replace casting in the manufacture of high volume brass, silver and low karat gold jewellery, which represents 70-80% of global sales, in the next ten years.

The company has also diversified, supplying tyre manufacturers with powder for moulding tyres, other vehicle part manufacturers, and also fire resistant minerals used in paint and fire extinguishers. In other words, the company is adapting, inventing and acquiring new products, and seeking out new markets.

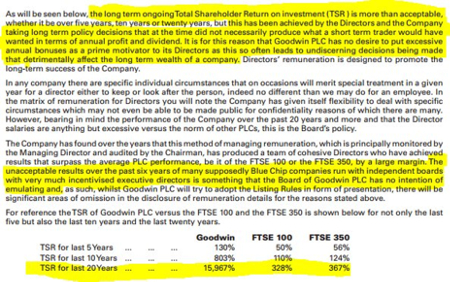

Adapting profitably requires management that can take a long-term view, even if it means short-term hardship. Recently, on Twitter, I shared an extract from the company's remuneration report, the note in its annual report that deals with salaries and bonuses, as evidence of management's commitment:

The directors can be this bold because the company is still controlled by the founding family. It can resist pressure from fellow shareholders with short-term objectives: to shore up profitability and the share price by cutting investment and trained staff for example. Such action ought to be a last resort because it's likely to leave the company weaker in the long-run.

Over the long-term, I expect Goodwin to do substantially better.A share price of £19.50 values the whole enterprise at about £156 million. The earnings yield - adjusted profit in the year to April 2015 as a percentage of the market valuation - is 11% of that. Since profit belongs to shareholders, that's a pretty enticing return. It will not be sustained in 2016 though.

Profit could fall by up to a half, which would leave Goodwin on a less attractive earnings yield of 5-6%, or, to put it another way, the forecast price/earnings ratio isn't a lowly 9 as it is now, it may be in the high teens. Goodwin must recover somewhat to be worth that much.

Over the long-term, I expect Goodwin to do substantially better.

That's not to say recovery will happen in a straight line. Low oil prices make the industry less profitable and reduce investment in pipelines, rigs and refineries. Prices have risen modestly from their lows, but there's absolutely no guarantee they have bottomed out, and Goodwin's share price could still be influenced by negative sentiment in the short-term.

---

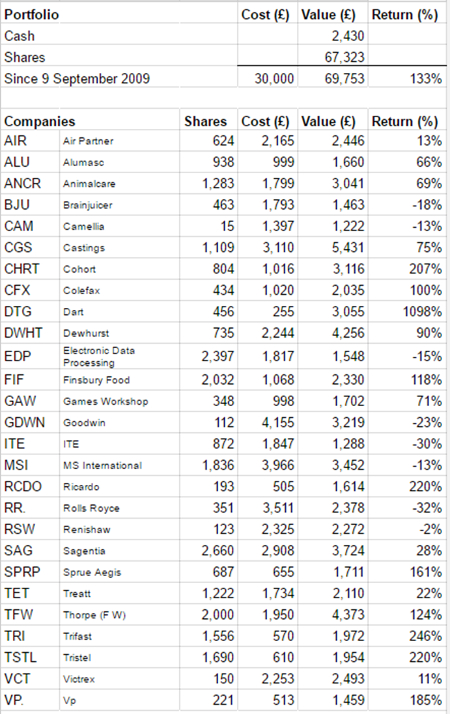

*I added 112 shares at a price of £20.49, the actual price quoted by a stockbroker. The spread, the difference between the price to sell the shares and the price to buy them, was £19.50 - £20.50. After adding £10 in lieu of broker fees and £11.50 in lieu of stamp duty, the trade cost £2,316, approximately one thirtieth of the overall value of the Share Sleuth portfolio.

I restrict myself to trading one thirtieth of the portfolio at any one time, in case I've made a big mistake.

---

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.