Ten-bagger Ascent Resources unravels spectacularly

1st April 2016 12:12

by Harriet Mann from interactive investor

Share on

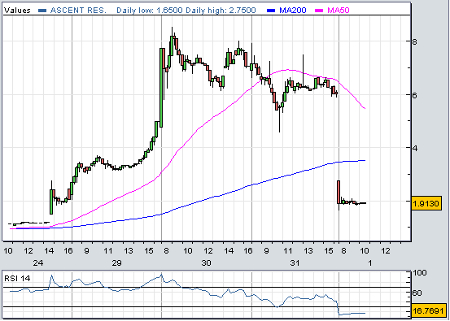

A quiet first quarter for Mergers and Acquisitions livened up last week when a Ukrainian explorer announced it was interested in buying oil and gas firm . In just three sessions, Ascent's share price surged from less than a penny to over 8.5p, a two-year high. But smiles have now turned to tears after had second-thoughts.

At 5pm, after last night's close, Cadogan made the following statement: "Cadogan has conducted extensive due diligence on Ascent and the Petišovci gas project, however this share price rise has taken Ascent's enterprise value above a level that Cadogan was prepared to consider for a potential transaction. As a result, Cadogan confirms that it does not intend to make an offer for Ascent."

Given the volatility of the market, this sharp reversal acts as a stark reminder to investors both of the rewards and high risk of trading the resource sector on the junior market. Remember the City saying, it's never wrong to take a profit.

Just seven days ago Ascent Resources was worth 0.86p. Then, Cadogan confirmed earlier this week it had approached Ascent with a "highly preliminary" takeover offer. The shares peaked at 8.54p, but have now plunged back below 2p.

Under takeover rules, Cadogan can make another offer for Ascent within the next six months, something that could be possible following the share slump and as it gets closer to generating an income from its Petišovci gas field in Slovenia.

Ascent is still waiting to be awarded its Integrated Pollution Prevention and Control Permit to build a new gas treatment works on the Petišovci field, which straddles the Hungarian-Slovenian border.

First applied for in June 2014, the permit was provisionally awarded a year later. Two organisations appealed this decision, which were both rejected in November 2015. Refusing to let it go, one of them has appealed again. Of course, there is no certainty that the Court's decision will be in favour of Ascent, but it hopes to receive a decision either way in the second quarter.

Exploring different ways to sell gas from the field in case this permit falls through, management is discussing new potential routes with industry partners. Currently, they think the most viable route will be through a combination of new and existing pipelines to contract out the processing of gas from the field. Either way, the group seems confident it can pump maiden gas from the ground in 2016.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.