Time to buy this 'most compelling' business?

7th April 2016 14:06

by Richard Beddard from interactive investor

Share on

is one of the most compelling businesses I've investigated, but I'm not ready to pull the trigger.

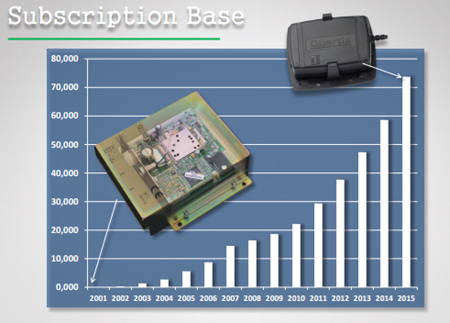

The first thing I think when Andy Walters, Quartix's founder and chief executive, leans over the desk between us pointing at a chart in the company's full-year results presentation, is that the company's growth rate has increased over the last 15 years.

It almost reached 10,000 subscribers in its first five years. By 2010 it had exceeded 20,000, and five years later it has well over 70,000.

The second thing I think follows on from the first. Despite its recent flotation, Quartix is no flash in the pan. I ask David Bridge, the company's finance director, about the goodwill on its balance sheet. To accommodate new investors in 2006 a holding company was created that acquired the existing business.

Goodwill, an accounting sum required to balance the books after one company has acquired another, is usually a sign that a company has bought in technology, or talent, but Quartix is the product of its own endeavours.

It makes GPS tracking devices installed in vans, primarily to reduce fuel consumption by ensuring drivers drive economically and the most appropriate vehicle (often the closest) in a fleet is used for a job. Data from the black box installed behind the dashboard serves other needs too. Quartix automatically generates accurate timesheets, preventing drivers from exaggerating the amount of driving they've done and exposing employees using vehicles for their own purposes - moonlighting, say.

I'm at Quartix to learn what, if anything, makes the business unique and, because of its short record as a listed company, how it performs in more difficult times. The answers will help me consider whether the company will make a good long-term investment. My focus is on fleet rentals, because that is the core business, but Quartix also supplies Wunelli's telematics with devices sold to insurance companies to track young drivers.

The executive duo sitting opposite me, Walters and Bridge, work from a serviced office in Cambridge, but the bulk of the business, its sales and customer service operation is in Newtown in Wales.

Cost at the heart of the story

If you think swanky offices and Bentleys outside are a sign of corporate excess, you'll be reassured by Quartix. The lights are out in the ground floor toilet. Instead, it is illuminated by a pair of dim camping lights. Quartix declined my request to attend the AGM because it lacked room (I'm not a shareholder yet), so instead the directors accommodate me afterwards. The office's photocopying service has printed out the presentations back to front and when I reveal I've parked my pushbike in the ranks on the street outside, Walters tells me theirs are parked out the back.

I think cost is at the heart of the Quartix story, but frugality is only a small part of that. The company started with a £1,000 investment from Walters, matched by three other investors, and has been profitable every year except for 2001, its first. Apart from a modest decline during the Credit Crunch, when Quartix switched to renting units instead of charging an upfront fee, profit has grown resolutely. The company is highly profitable.

That profit has been reinvested in a very particular way: to develop a low-cost generic product to sell to small and medium sized businesses. The most famous customer I can see in the case studies on the company's website is Ginsters, the pie company, but its first customer Broadland Guarding services, a local security firm, seems more typical. Broadland still uses Quartix.

Keeping it simple

The big risk, says Walters is salesmen agree to add bells and whistles to the product, which are expensive to develop and not that lucrative. Large fleets that demand bespoke products can drive prices down, and will put a contract out to tender when it expires. Quartix only develops functionality it thinks will be used by 80% of its customers. Small business and some big businesses like the simplicity. Over 75% of customers, those who have rented for more than a year, could cancel their subscriptions giving only one month's notice. Only about 10% a year do cancel though.

Small businesses grow bigger and I wonder if they grow out of Quartix. They might, Walters says, if they want specific enhancements that would not be relevant to the rest of its customers. Walters thinks one enhancement the company made, the capability to monitor the temperature of vans carrying perishable goods, may have been a step too far. The customer is happy, and Quartix has since sold the product to other customers, but it's more complicated, and to roll it out the company would probably need a large sales force out in the field demonstrating it.

Unlike its competitors, Quartix does not employ an expensive field sales force. It has two travelling salesmen, which is enough. Most of Quartix's sales are made over the 'phone, or on the Internet, a second element in the company's low-cost strategy.

A tech company pre-empting trends

Walters describes a technology company through and through. Not only did it invent an "internet of things" device before the term came into common use, almost half its research and development spending is on business systems: automated marketing and a website that allows customers to agree to rental contracts online. When he founded the business, Walters says, he wanted it to be built on relational databases.

Unlike rivals, who sold software licenses, Quartix was web-based from the outset, pre-empting another trend: subscription based software services. Marrying low cost technology to direct sales and a subscription model has set the company apart. As many of Quartix's customers - construction companies, plumbers, and heating contractors - struggled during the Credit Crunch, Quartix offered to rent them devices rather than selling them on a contract like a mobile phone.

Doing away with the initial sale reduced profitability in the short-term, but it gave Quartix a recurring income and it paved the way for accelerated growth. Before 2010, Quartix converted about 20% of sales leads into customers; now the figure is 40%. In contrast, some rivals had sold their contractual income to finance companies for cash, and, starved of new orders, they went bust.

Like the Quartix product, its databases have been upgraded and replaced and its subscription model has changed. Little of what was original in 2001 can be left, except, perhaps the relentless focus of its founder on a product for small businesses and the low cost culture of the company he created.

He's not about to invent new product ranges, because there's plenty of mileage left in tracking devices in the UK*, and France and the US, two markets Quartix has only just entered. There, as here, it will come up against much bigger rivals, like , but I don't think Walters is overly concerned.

The showstopper for me is valuation. The market has recognised this company for what it probably is, a profitable growth company with proven management and a winning business model. Quartix trades on an earnings yield of 3%, equivalent to a mighty price/earnings (PE) ratio of 33. Conservative accounting may be responsible for some of that - the company's cash flows exceed its accounting profits - but it's still hard for me to contemplate the valuation.

My resistance is crumbling, though.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

*Here's the "math", as Walters explained it to me:

- There are 3.6 million vans and trucks on the road in the UK.

- Three million of them are vans, Quartix's market.

- Half (1.5 million) are one-man owner operators that don't require fleet management. The other 1.5 million are in fleets.

- One third of those vans (500,000) are fitted with tracking devices.

- Quartix has an 11% share of those vans.

- The UK market is more mature than US and France, where only about half the proportion of vans are fitted with tracking devices.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.