FTSE 100 breakout gathers pace

13th April 2016 13:51

by Lee Wild from interactive investor

Share on

We said yesterday in our morning report that the was squaring up for a rally, possibly the last before the summer and the European Union referendum. Within hours of a languid start, the blue-chip index had hit its highest levels so far this year, and that heavy buying has spilled over into Wednesday, driving the market to a four-month high.

During the morning session, the FTSE 100 traded as high as 6,341, a level not seen since early December. It also takes the advance over the past week to 280 points, or 4.6%.

Clearly, yesterday's decision by the International Monetary Fund (IMF) to upgrade growth forecasts for China both for this year and next is a huge help. A growing service sector should offset a manufacturing decline, triggering 6.5% growth in 2016 and 6.2% next year, both up 0.2 percentage points on previous estimates.

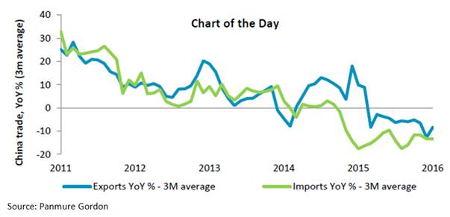

That confidence is backed up by Chinese export data released Wednesday. Shipments abroad rocketed 18.7% in yuan terms in March, or 11.5% on a dollar basis, the biggest increase in over a year. This may indicate a decent first quarter for the Chinese economy. We'll find out on Friday when the GDP number is made public.

It is, however, worth remembering that this data is incredibly volatile - in February, the week-long Chinese New Year holiday meant exports in dollars plunged by 25%, and the three-month rolling average is still down 8.3% year-on-year.

Never mind, commodity stocks needed no further encouragement. , and were bid up. Oil plays were chased higher, too, as the price of Brent crude stuck above $44 a barrel.

The OPEC oil cartel meets in Doha at the weekend to thrash out a possible deal to curb output in a massively over-supplied market. Talk currently is that the Saudis have already done a deal with Russia to freeze oil production.

And it's no coincidence that both oil and equity markets have just hit a four-month high. A correlation between the two asset classes has existed since late summer as investors focus more specifically on risk. Risky, or volatile, assets like oil and shares are bought when they're more bullish on the macro outlook, and sold when confidence dips.

Banking on banks

Elsewhere, some of the big names have reported as US earnings season gets underway, and news for the banks has been good. A 6.7% decline in net income at during the first quarter was smaller than expected, while earnings per share (EPS) smashed estimates.

That's gone some way to soothing fears among leading analysts that this bank reporting season will be the worst since the financial crisis. , and report over the next couple of days.

UK banks are also popular in London mid-week. Far East favourites and put further distance between them and recent lows, while , and are up sharply.

Recent inactivity had frustrated our technical analyst Alistair Strang. "The market is truly awful at present," he said on Monday, but added: "The situation remains that, should the FTSE better 6,225, we now think it shall head to 6,272 initially with secondary 6,395."

Significantly, the index has now broken through both the 200-day moving average and the 50% retracement from last April's record high. That's never a bad sign.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.