Is it time to increase risk?

18th April 2016 09:12

by Lance Roberts from ii contributor

Share on

The short answer is not just yet. However, if the market can muster a rally above the current downtrend resistance, there will be push back to old highs.

The bullish arguments are:

• Earnings estimates are so low, as we saw with JMP and C this past week, that investors are cheering really crappy earnings reports simply because companies are winning the "beat the estimates" game.

• The improvement in oil prices, and decline of the dollar, has taken some of the pressure off of industrials, energy and material stocks which are being pushed higher. The oil/dollar trends, however, will likely reverse this summer – so, be careful.

• There is a very high level of short-interest in the markets. This is not necessarily bullish, but could provide a short-term catalyst for higher prices.

• Share buybacks continue to be a primary support of asset prices currently. However, this support is coming primarily though leverage which has long-term negative consequences.

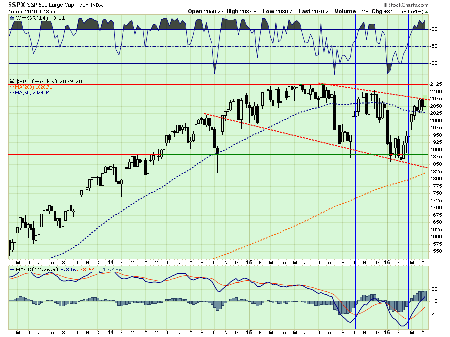

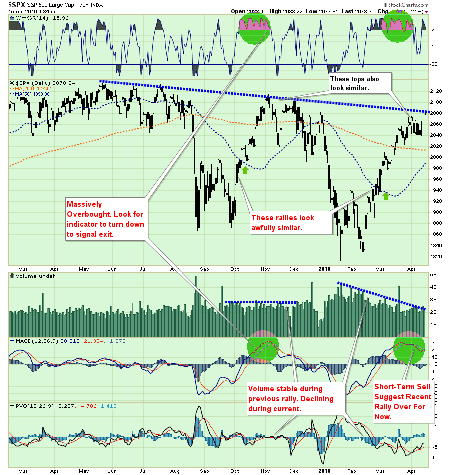

There is also a possibility this is a giant trap waiting to be sprung on unwitting investors. Let me direct your attention to the bottom part of the chart above which defines many of my concerns.

Notice that during the previous rally in October of last year, the market similarly rallied to the downtrend resistance and issued a short-term buy signal (blue vertical line). The rally subsequently failed and established a lower low.

The current rally, which is built on a substantially weaker fundamental backdrop, is behaving in much the same way by hitting downtrend resistance, remaining in overbought territory (top part of chart) and issuing a similar buy signal.

However, unfortunately, what small bit of "oversold" condition that existed earlier this week, has been evaporated.

As I stated last week, the markets have currently registered a very short-term buy signal which dictates that we must consider increasing equity risk in portfolios. I would be remiss in not paying attention that signal, but such signals can be a "false flag" during a larger market topping process.

The markets must break above the current downtrend line in order to increase allocations in portfolios. I have already positioned model portfolios to increase exposure back to 50% should such an event occur.

However, it is extremely important to remember that whatever increase in equity risk that I may suggest next week, could very well be reversed in short order due to the following reasons:

1. We are moving into the seasonally weak time of year.

2. Economic data continues to remain weak

3. Earnings are only positive by not sucking as bad as estimates

4. Volume is weak

5. Longer-term technical underpinnings remain bearish.

6. It is the summer of a Presidential election year which tends to be weak.

7. The 200 & 400-day moving averages are trending down

8. The yield curve is flattening

It is worth remembering that markets have a very nasty habit of sucking individuals into them when prices become detached from fundamentals. That is the case currently, and has generally not had a positive outcome.

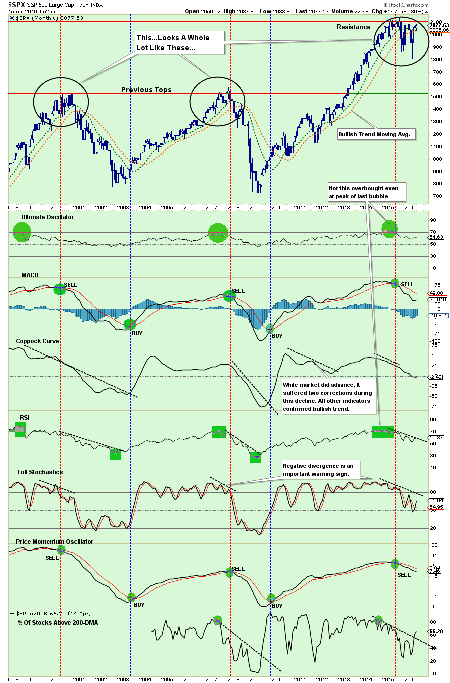

The chart below illustrates point #5 above. There are still way too many negative divergences in underlying indicators to suggest an "all clear" for investors currently.

Let me be very clear – this is very short-term analysis. From a trading perspective, there is a tradable opportunity being developed. This does not mean the markets are about to begin the next great secular bull market.

Caution is highly advised if you are the type of person who doesn’t pay close attention to your portfolio, or if you have an inherent disposition to "hoping things will get back to even" if things go wrong.

What you decide to do with this information is entirely up to you. As I stated, I do think there is enough of a bullish case being built to warrant taking some equity risk on a very short-term basis. We will see what happens next week.

However, the longer-term dynamics are clearly bearish. When those negative price dynamics are combined with the fundamental and economic backdrop, the "risk" of having excessive exposure to the markets greatly outweighs the potential "reward".

Could the markets rocket up to 2,100, 2,200 or 2,300 as some analysts currently expect? It is quite possible given the ongoing interventions by global Central Banks.

The reality, of course, is that while the markets could reward you with 250 points of upside, there is a risk of 450 points of downside just to retest the previous breakout of 2007 highs

Those are odds that Las Vegas would just love to give you.

Please be careful.

Investing is not a competition.

It is a game of long-term survival.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of "The Lance Roberts Show" and Chief Editor of the "Real Investment Advice" website and author of The "Real Investment Daily" blog and the "Real Investment Report". Follow Lance on Facebook, Twitter and Linked-In