This list of shares keeps outperforming

21st April 2016 13:20

by Lee Wild from interactive investor

Share on

While not quite biblical scale, the market's recovery from February's multi-year lows has been nonetheless quite stunning. The is up 16% in just two months, hoisted higher by fading US interest rate fears, better news out of China and oil prices back above $40. Panmure Gordon has plenty to crow about, too. Its "conviction list" continues to outperform the market, but it has just made some key changes.

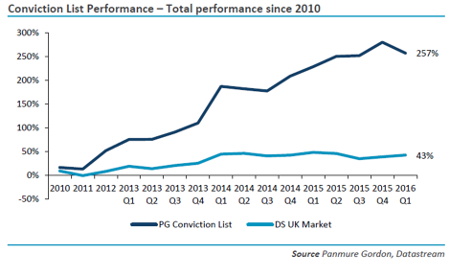

Up and running since 2010, Panmure's list has outperformed the Datastream UK market index by 210% for a capital return of 257%, versus a UK market increase of 43%. It's done better than the market in 13 of the 16 periods since inception, too. Outperformance over the last four quarters meant an absolute capital return of 9.1% versus a 3.4% fall for the market.

"Our refreshed portfolio reflects our outlook for steady if imbalanced domestic UK growth during 2016 with downside risks, namely the EU Referendum and a cyclical slowdown in consumer discretionary income growth, hampering sentiment during the second quarter," write Panmure's head of research Barrie Cornes and chief economist Simon French.

"The UK equity market has returned to a cyclical high valuation since the February sell-off. We remain concerned by stretched dividend cover - 1.6 times cover across UK-listed equities - and a corporate earnings recession confirmed in the Office for National Statistics' fourth-quarter GDP data, but our lower-for-longer thesis on fixed income yields continues to provide a stable underpin for equity valuations."

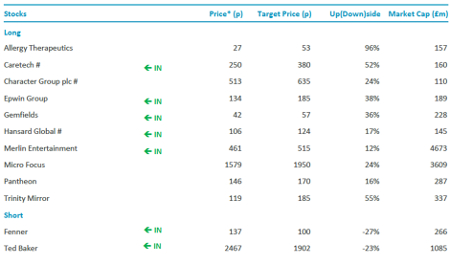

Stocks - typically 10-15 - are picked for the list based on a 12-month investment horizon, but each must justify its place. Weaklings are weeded out in a quarterly review, and replacements found.

This time, there are five new "long" faces. Residential care homes firm is undergoing a transformation and trades at a discount to peers; building products supplier has improved margins; sales are growing at financial services business ; and earnings are picking up again at theme park owner .

There are far more stocks on the way out this quarter. makes way for Epwin and Brexit fears could cause problems in investment markets for insurer . Heat treatment firm and publisher have risen far enough, thinks Panmure, while both and get the boot for underperformance.

is undergoing a restructuring and shares in oil and gas company are suspended pending a corporate action. Elsewhere, property giant lacks short term catalysts, is already up 25% on the oil price bounce, and coverage of online gambling company is under review.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.