Small-cap dividend stars

28th April 2016 15:15

by Lee Wild from interactive investor

Share on

With low interest rates, low inflation, and low growth, dividend income will typically make up a significant portion of the total long-term return from equities. And if you're looking for the fastest dividend growth this year, don't bother with the FTSE 100, pick AIM, urge the analysts at Stockdale, the new name for Westhouse Securities.

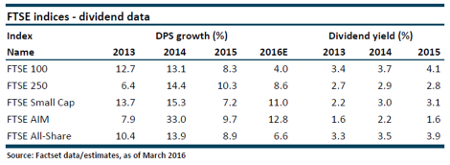

"A segmental analysis for 2013-2016 shows that the further you go down the market-cap scale, the more robust dividend growth, especially in the coming year," writes the broker.

"While there is the potential for short-term performance from 'renting' some of the high yielders in the FTSE 100, overall there is better value to be had from a portfolio of good-quality smaller growth companies, some of which are also capable of delivering special dividends."

According to the broker's statistics, total dividend growth for small-cap and AIM companies is 2.8-3.2 times higher than that of the FTSE 100. Blue-chips, miners and other multi-nationals have been busily slashing their payouts - but financials, which make up over half of the small-cap index, have done well. Perhaps surprisingly, the resource sectors made up only 12% of the AIM index in March.

And, with plenty of first-quarter dividend analysis now in, the generosity of small and mid-cap firms has stood out.

"As well as providing a good indication of a board's confidence in its business, year-on-year dividend increases should lead to stronger share prices - assuming the dividend yield is maintained," writes Stockdale.

"There have been several examples of dividend growth exceeding earnings growth in first-quarter as well as a number of special dividends being declared."

It's picked 11 small companies with attractive dividend characteristics.

- substantial special dividend

-5.8% yield and growing cover

- strong dividend growth based on earnings growth

- 67% increase in 2015 dividend and strong balance sheet

- special dividends and other returns of capital as well as 3% yield

- corporate focus on increasing dividend

- 3.9% yield and improving balance sheet

- 7.2% dividend yield

- long-term growth story

- recent return to dividend list

- growing dividend from 1.9% yield

"As usual, the further down the market capitalisation scale, the more important stock selection is, given the relatively reduced trading liquidity in many shares," says Stockdale.

"But, given that we believe there is greater potential for special dividends and other returns to shareholders in this area of the market, investors seeking income are well-placed to get capital appreciation too."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.