How our Winter portfolios keep beating the market

6th May 2016 17:28

by Lee Wild from interactive investor

Share on

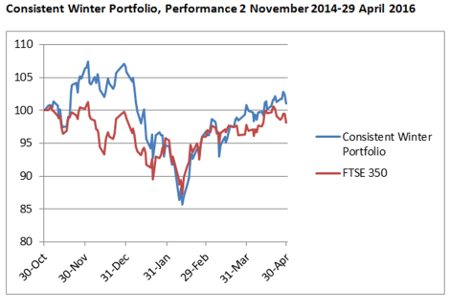

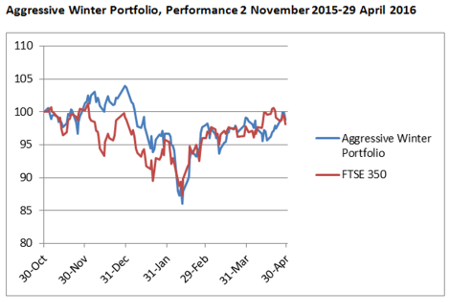

Our inaugural seasonal trading strategy thrashed the wider market in 2014/15, generating fat profits for investors who bought either of Interactive Investor's Winter Portfolios. We ran new portfolios this year in what turned out to be one of the most volatile periods in recent stockmarket history. Both beat the market again.

Known as the six-month strategy, all investors needed to do was buy a basket of shares on 1 November and sell at the end of April. Investing in the market between these dates only for the past 20 years would have turned £100 into £316. Over 10 years, it would have made twice as much profit as staying invested all year round.

We screened the FTSE 350 for the five stocks with the best record of returns between November and April over the past decade - the Interactive Investor Consistent Winter Portfolio. Last year it made a 14% profit compared with 8.7% for the FTSE 350 benchmark index.

We also relaxed the rules slightly to include companies with a track record of at least nine years, but which must have risen at least three-quarters of the time over the past 10 years - our higher risk Aggressive Winter Portfolio. Last year, it returned an impressive 16.9%.

Conditions were clearly much tougher this time.

A recovery following the second Chinese stockmarket crash of the year quickly ran out of puff, and the FTSE 100 failed to make a move above 6,400 stick.

Then, in December, European Central Bank (ECB) president Mario Draghi failed to deploy his "Big Bazooka" having prepared the market for a further wave of monetary stimulus. A first US interest rate rise for almost a decade destroyed what nerves remained in December.

As it turned out, that was merely the hors-d'oeuvre. The first few months of 2016 go down in history as among the worst ever starts to a calendar year. Oil prices hit a 13-year low, commodity prices crashed and bank shares dived, tossing the FTSE 100 to levels not seen since summer 2012.

China, currency markets, negative interest rates and the European Union (EU) referendum in June guaranteed that the VIX - a measure of volatility often referred to as the "fear index" - hit levels not seen since the financial crisis in 2008.

Once the dust had settled, and even after a wild rally in the commodities sector - a classic (and ongoing) short squeeze - both the FTSE 100 and FTSE 350 benchmark index ended the six-month period down 1.9%.

Incredible, then, that our 'consistent' portfolio actually rose by 1%, and that the much higher risk 'aggressive' portfolio capped its decline at a modest 1.2%. It would have been in positive territory too had it not been for a savage final session both of April and our six-month strategy.

Add on dividends earned during the period, however, and the 'aggressive' basket of five shares was within a fraction of breaking even.

Here's how it happened.

Consistent Winter Portfolio

| Consistent Winter Portfolio | Ticker | 10-yr Avg (%) | 2015/16 (%) |

|---|---|---|---|

| CRH | CRH | 24.9 | 11.6 |

| Croda International | CRDA | 17.5 | 3.9 |

| Johnson Matthey | JMAT | 15.8 | 11.7 |

| Ashtead Group | AHT | 34.7 | -9.5 |

| Regus | RGU | 29 | -12.7 |

Beating the market in the six months to April was a perfect demonstration by both the Consistent and Aggressive winter portfolios of the benefits of diversification. That's because each contained and , two companies which fell seriously out of favour with investors during the period.

We had expected big things from workspace provider Regus. It had fallen just once in the past 10 years - in 2007 - and returned an average annual gain of 29%. Instead, and despite hitting a 15-year high in December, the shares ended the strategy down almost 13% as a four-year rally ran out of steam.

While results have been decent enough, growing concerns about the global economic outlook are clearly having an impact. Any downturn would seriously impact earnings because of its large fixed cost base.

Ashtead looked like a fair bet, too, and its share price had risen 13% by New Year. But the equipment rental firm is also heavily exposed to economic growth, and declining revenue at US-peer , announced in January, sparked a rush for the exit.

Thankfully, there was plenty to cheer elsewhere. Irish building materials firm and catalytic convertor maker were both up almost 12%, extending their run of positive returns over the winter months to at least 11 years! Speciality chemicals , a star of last year's Consistent Winter Portfolio, can claim at least 12 years following a near-4% gain this time.

And, of course, investors in the Winter Portfolios would also have received dividend income, too.

Aggressive Winter Portfolio

| Aggressive Winter Portfolio | Ticker | 10-yr Avg (%) | 2015/16 (%) |

|---|---|---|---|

| Taylor Wimpey | TW. | 56.6 | -6.9 |

| Ashtead Group | AHT | 34.7 | -9.5 |

| Playtech | PTEC | 29 | -6 |

| Regus | RGU | 29 | -12.7 |

| JD Sports Fashion | JD. | 28.6 | 29.3 |

Things were closer with the Aggressive Winter Portfolio. Yet, despite four of the five constituents ending lower, the basket of higher-risk shares still beat the benchmark. For that, thank .

We've been fans of shares in the tracksuits-to-trainers chain since 2014 when they could still be bought for just 433p. They ended the portfolio period up over 29% in six months at 1,249p. It's just beaten consensus forecasts for the sixth time in a year, and Panmure Gordon thinks the upgrade cycle has further to run.

"Forecast risk remains firmly on the upside for the foreseeable future as we see no signs of a slowdown," says analyst Peter Smedley.

But elsewhere there was disappointment. This is typically the best time of year for housebuilders, ahead of the key spring buying season. But serious concerns about a housing crash and rising labour costs left nursing a 7% loss. A modest price/earnings (PE) ratio of around 10 is a trap, say some. We have the summer to see.

Lastly, there's , which failed to live up to expectations. To be fair, it was the riskiest inclusion of the lot, having risen in only seven out of the past nine years. It got the nod because the average annual gain was irresistible 29%.

Founded by Israeli billionaire Teddy Sagi, the gaming software company failed to complete two acquisitions - and Ava Trade. It was only partially forgiven following a wider market rally and OK full-year results in February.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.