10 top shares for dividend safety

11th May 2016 13:17

by Ben Hobson from Stockopedia

Share on

When it comes to weighing up the reliability of a company's dividend payout there are all sorts of checks that investors can make. The safest yields are generally found in strong, stable, cash-rich stocks. But another key indicator - and one that's keenly followed by income investors - is a long track record of dividend growth.

Payouts from UK companies have risen strongly since the end of the financial crisis. Figures show that the total pot has risen from around £58 billion in 2009 to a forecast £78 billion in 2016.

Unsurprisingly, the popularity - and the share prices - of dividend-paying companies have risen too. High yield stocks have obvious appeal in a low rate climate where investors are struggling to find decent returns.

Dividends under pressure

This is all very well, but a glance at the financial press hints that the outlook for dividends might be cooling. There are signs that earnings growth is slipping as we enter a slowdown phase in the business cycle. Over the past two years we've already seen some sectors come under pressure. As a result, dividends have been slashed by some of the biggest payers in industries like mining, oil & gas and supermarkets.

In these conditions, income hunters need to use all the tools at their disposal to find companies that can keep their dividends intact. Indeed, simply looking for the highest yields can lead to disappointment if a surprise dividend cut is just around the corner.

This is why a track record of dividend growth is held in such high esteem. It can point to a conservative yet progressive payout policy that's carefully handled by management. Rather than aggressively dishing out earnings, dividend growth companies tend to have more modest yields, but are rather better at sustaining them.

This was precisely point made by ex-Fidelity Investments star fund manager Peter Lynch, in his book Beating the Street: "The dividend is such an important factor in the success of many stocks that you could hardly go wrong by making an entire portfolio of companies that have raised their dividends for 10 to 20 years in a row."

In the UK, finding companies that have grown their payouts over decades is rather harder than in the larger US market. But that doesn't mean that you can't find some reasonable growth streaks.

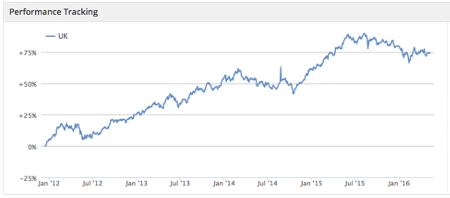

At Stockopedia, we track a strategy that does just this. Apart from dividend growth, it looks for companies that have grown their earnings per share (EPS) by at least 10% compounded over the previous five years. Debt levels have to be below average and, as a measure of liquidity, each company needs to show that it's more than able to cover its short term liabilities with its current assets.

Over the past two years, this strategy has produced an annualised gain of 13-14% - before dividends. Here are 10 companies that currently meet the rules:

| Name | Dividend Growth Streak | Average 5-Year Yield (%) | Dividend per Share Growth (%) | 5-Year Earnings per Share Compound Growth Rate (%) |

|---|---|---|---|---|

| Bloomsbury Publishing | 9 | 4.4 | 0.66 | 13.6 |

| Diploma | 9 | 2.9 | 7.06 | 16.9 |

| Nichols | 9 | 2.3 | 14.3 | 13.8 |

| Brooks Macdonald | 9 | 1.6 | 12.1 | 15 |

| ARM Holdings | 9 | 0.7 | 25.1 | 28.9 |

| Zytronic | 8 | 4.1 | 20.1 | 10.6 |

| Abcam | 8 | 1.7 | 4.6 | 12.1 |

| Portmeirion | 7 | 3.7 | 13.2 | 12.9 |

| Anpario | 7 | 2.1 | 11.1 | 14.4 |

| Brainjuicer | 7 | 1.2 | 4.65 | 15 |

This list has got a distinctly small- and mid-cap flavour, with a median average forecast yield of 2.3%, which broadly matches the five-year average. In addition, the companies have seen a median average compound growth in EPS of 14.1% over the past five years.

Among those with at least nine years of dividend growth is publisher , technical products business , soft drinks firm , fund manager and chip maker .

Going for growth

If you believe the headlines, a strong run for UK dividends could flatten out in the foreseeable future as the business cycle hits a period of slower growth. With returns from alternative assets still far from attractive, the onus is on income hunters to up their game in the search for companies that can sustain and grow their payouts.

A strong dividend growth streak paired with well-managed finances and a record of earnings growth could be a useful starting point in the search for dependable yields.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

About Stockopedia

Interactive Investor's Stock Screening series is written by Ben Hobson ofStockopedia.com, the rules-based stockmarket investing website. You canclick here to read Richard Beddard's review of Stockopedia.com and learn more about the site.

● Interactive Investor readers can enjoy a completely FREE 5-day trial of Stockopedia by clicking here.

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

Ben Hobson is Investment Strategies Editor at Stockopedia.com. His background is in business analysis and journalism. Ben researches and writes regularly on investment strategy performance and screening ideas for Stockopedia.com. He is the author of several ebooks including "How to Make Money in Value Stocks" and "The Smart Money Playbook"