Shares to buy, hold or sell this May

12th May 2016 10:30

by David Brenchley from interactive investor

Share on

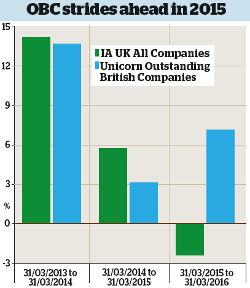

Unicorn Outstanding British Companies (OBC) has delivered top-decile total returns of more than 150% since its launch in December 2009, and has outperformed its sector average in seven of the nine years it has been in existence.

Chris Hutchinson has managed the £28 million fund since inception. He also controls Unicorn's top-performing , which he says acts as a "breeding ground" for OBC stocks.

Indeed, AIM-listed firms represent nearly 40% of the portfolio's 30 holdings.

As a consequence, the fund takes a long-term perspective - typically, a stock is held for at least five years.

Buy: Shaftesbury

Hutchinson is at pains to stress the long-term nature of the fund's approach, which means turnover is deliberately very low.

He held off buying Shaftesbury shares until he could buy them at below the tangible net asset value, a goal he achieved at the beginning of 2016 at a price of around 865p.

The firm was trading at 924p as at 11 April. Moreover, it paid dividends of 13.75p in 2015, a 5% increase on 2014.

Hutchinson says Shaftesbury is "absolutely unique in terms of its ownership of around 14 acres of prime London freehold property", concentrated in the West End of the capital.

It owns property - including residential apartments, retail outlets and leisure space in Carnaby Street, Covent Garden, Chinatown, Soho and Charlotte Street - worth well over £3 billion in total.

"You could argue that I should have just bitten the bullet and paid up, because actually I've lost quite a bit of upside," says Hutchinson, "but this is a business that will be continuing to do something very similar over the next 10, 20 or 50 years.

"I genuinely believe this to be one of the most attractive quoted property companies on the market."

There are few threats to the business on the horizon, he adds. "You could argue that property prices in London are overinflated, but my view is that London is the most dynamic and attractive city to visit and live in in the world."

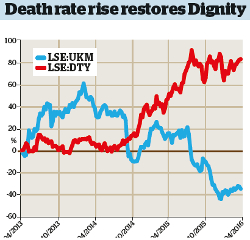

Hold: Dignity

Hutchinson invested in funeral care provider in June 2007, at 728p a share. Its share price has since risen to 2,475p as at 11 April, which represents a 338% gain on OBC's initial investment.

The death rate is predicted to fall back to its usual growth rate of 2% this year, so the firm has warned that profits are likely to be lower in 2016.

Hutchinson is not fazed, though. He says: "It's one of the most remarkable businesses around, in one of the most predictable areas you can come across."

He explains: "Dignity has a fantastic business model whereby it goes around buying up individual family-owned, long-established funeral homes nationwide in small regional towns. It keeps the family name where appropriate, pays them a fair price [and] integrates them into its existing model.

"It gets huge efficiencies through doing that, and it offers those business owners the opportunity to work for a large, well-established, highly regarded plc."

Sell: UK Mail

Hutchinson is candid about his "mistakes', among which delivery company , he says, was a big one. Having bought in at around 500p three years ago, the fund sold out entirely in November 2015 at 365p - a 30% loss.

He says: "The investment proposition was predicated on how rapidly and significantly the online retail sector was growing versus bricks and mortar retail.

"We'd been aware of that for some time, but it was clearly gathering momentum, so we tried to exploit the opportunity from a slightly alternative angle. UK Mail seemed to have a magic formula, and then everything went wrong for it."

A significant investment in automating the company's parcel process failed and "a breakdown in management controls led to poor service levels". The final nail in the coffin for Hutchinson was the emergence and acceleration of "click and collect".

"The customer [can now] make an online purchase but then go to their local store and collect at their convenience," he says."That suits the retailer because they're not paying a delivery company."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.