19 investment trusts with 4%-plus yields

26th May 2016 10:53

This year income seekers have to deal with a more challenging environment, with some blue-chip payers, including , and , already moving to cut their dividend payments.

Another wave of cuts could be on the way, with analysts flagging that in the mining and oil sectors dividends are far from guaranteed. But there are still plenty of opportunities for income seekers, according to research by stockbroker Stifel.

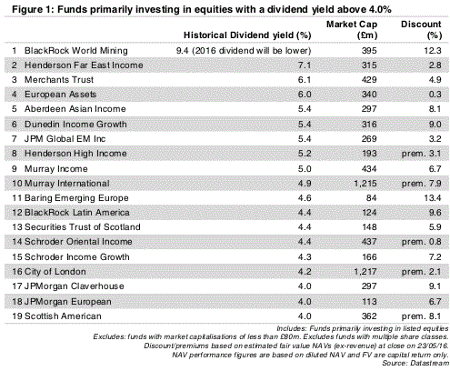

Stifel scoured the investment trust universe and found there are 19 investment trusts that are currently offering at least 4% in annual income. Trusts with less than £80 million in assets are excluded from the screen.

Risky assets

In some cases trusts invest in riskier parts of the market. The highest yield on offer is from , at 9.4%, and is likely to be cut later this year. The trust's objective is to invest in mining and metal assets, which are under the cosh due to the low oil price.

Asian and emerging specialist trusts also feature in the table below, including (yield of 7.1%), (5.4%), (5.3%) and (4.4%).

It is worth bearing in mind, however, that the less mature economies in which these trusts invest do tend to give investors a rollercoaster of a ride, so those who invest need to have a stomach for volatility.

Elsewhere, plenty of UK equity funds feature, including , one of Money Observer's Rated Funds, managed by Job Curtis. The trust has a yield of 4.2% and a good long-term track record with a 50-year record of annual dividend increases.

Fund profile: City of London

Iain Scouller, analyst at Stifel, picked out as having an attractive share price discount to net asset value, at 5%, as well as a high yield of 6.1%.

"The discount is close to its widest discount level over the past year (of 7%). The portfolio focus is on FTSE 100 companies and the trust typically has around 20% to 25% leverage," he says.

Scouller adds that while dividend cuts cannot be ruled out in the UK equity sector over the next year, investment trusts should be able to weather the storm.

This is because trusts can hold back up to 15% each year, which means they can build up a reserve to bolster dividend payouts in leaner years.

During the financial crisis the majority of UK equity income investment trusts were able to either maintain or increase their dividends, as they dipped into their reserves. In contrast the vast majority of UK equity income open-ended funds cut their dividends.

"We do think that by using revenue reserves, these investment trusts should be able to deliver a more robust level of dividend than similar unit trusts, which do not maintain reserves," says Scouller.

This article was originally published by our sister magazine Money Observer here.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks