A blue-chip drugs giant worth 36% more

6th June 2016 12:57

by Lee Wild from interactive investor

Share on

last week succeeded where and failed, getting its $32 billion (£22 billion) cash and shares acquisition of done despite moves by the US Treasury to stop American firms moving overseas to cut their tax bills. Crucially, the Shire deal is not structured as a so-called 'inversion' and, as reward, City analysts are falling over themselves to upgrade targets for the £39 billion pharma firm.

"Shire is now the global leader in rare diseases, with the number one rare diseases platform based on both revenue and pipeline programs," boasts chief executive Flemming Ornskov Friday.

"We have made impressive progress on integration planning since announcing the combination, moving much faster than other transactions of similar size based on benchmarks, to create certainty for our employees and to better serve our patients and customers going forward."

Dublin-based Shire expects to deliver double-digit compound annual top-line growth, driving revenue to over $20 billion by 2020. Last year it was just $6.4 billion. Almost two-thirds of sales will also be generated by the rare diseases portfolio.

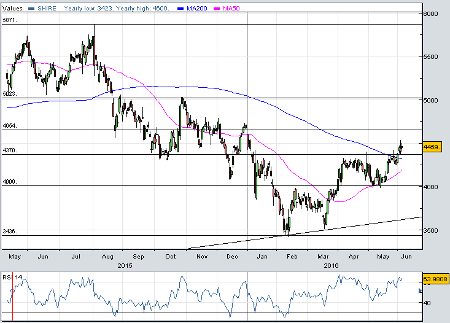

Getting to this stage has not been straightforward, made worse after , which spun out Baxalta last year, decided to sell its 20% stake before the deal closed. Shire shares have underperformed rivals and since last August and are still down 22%, although they've done much better since March and sealing this deal has triggered another wave of buying.

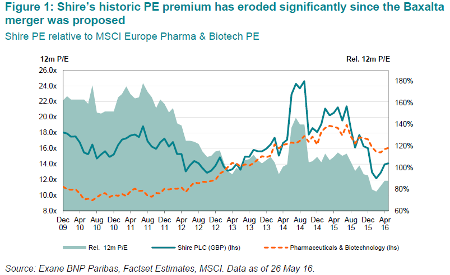

Kerry Holford at Exane BNP Paribas certainly thinks Shire remains undervalued. The shares trade on a forward price earnings (PE) ratio of about 11.8 times versus European large pharma peers on 16.9 times. That's a 30% discount.

"Even factoring in the risk associated with Shire's higher than average leverage, the stock trades at what we view as an attractive 20% discount to peers on 2017 EV/NOPAT [enterprise value/net operating profit after tax]," says Holford. "With the deal complete, now is the time to return to the Shire buy case."

An estimated $500 million of annual cost savings by year three of integration - half could be achieved within 12 months - will seriously improve earnings per share (EPS), and Exane has slapped a £57 price target on Shire, but others go further.

"Shire is one of the most attractive global biopharma stocks and a core holding in UK healthcare, in our view," says Jefferies. "Given the scarcity value for high quality growth companies in the sector, particularly with some long duration assets, we believe the current share price undervalues Shire.

"Hence, we reiterate our 'buy' rating, with the price target hiked 17% to 6,050p from 5,150p per share assuming a 1.1x PEG [price earnings/growth] ratio and 17x 2017 PE multiple with a 16% three-year EPS CAGR [compound annual growth rate]."

Launching more than 30 new drugs with "at least $5 billion cumulative sales potential" will certainly help drive profit growth, reckons the broker.

Of course, we'll hear more on progress alongside second-quarter results on 2 August, and there could be a further catalyst on 22 July when we get the Prescription Drug User Fee Act (PDUFA) decision for Shire's potential blockbuster lifitegrast in dry eye disease.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.