Use these three AIM shares as Brexit hedge

7th June 2016 11:16

by Andrew Hore from interactive investor

Share on

The EU referendum vote is less than three weeks away and the wide variations in some of the opinion polls means that it is difficult to be sure what the outcome is going to be. The financial markets do not like this type of uncertainty and transactions and deals have been delayed.

Generally, there can tend to be a shift towards the status quo as any vote gets nearer, so the 'Remain' campaign appears to be more likely to come out on top, but there is still some way to go.

The country will continue to trade on the international stage whichever side wins even though some of the arguments put by either side can appear to suggest that the economy will collapse if one side or the other gains a majority of the votes.

Many smaller companies are focused on the UK market, but there are plenty of AIM companies with significant European operations and sales. For example, is a beneficiary of the cash paid into the EU because it wins work funded by EU grants - roughly one-fifth of its forecast revenues. The engineering consultancy argues that its local offices will help it to continue to win this business even if the UK leaves the EU.

Markets under pressure

The uncertainty surrounding the EU vote is having a negative effect on the financial markets, but there has generally been a mixed experience in recent weeks when it comes to the trading conditions experienced by AIM companies. Some say that they have not detected any difference in business, but others believe that the uncertainty has led to caution and delays.

Foundries and engineering company says that it has not been hit by any perceivable delays in orders. Supplying turbo charger castings to European automotive components suppliers is an increasingly important market for the company, but these orders have continued at the expected levels. Winning new contracts could become more difficult if there is a vote for Brexit.

Although Brexit risk is putting pressure on the markets, the impact on AIM company operations is more mixed

Multi-currency payments services provider says that the uncertainty surrounding the EU referendum has affected travel-related business.

It is tempting to blame any weakness in a particular market on Brexit uncertainty. There has been recent weakness in the property market, but the change to stamp duty rates probably has more to do with that than Brexit concerns.

has made a strong start to 2016, but the financial PR part of the business in particular has been held back by the EU referendum. That is because there is a pipeline of potential flotations that could have already joined the stockmarket, but they have decided to put off their final decision until they know what the result of the vote will be. By the time the result is known the summer will be in full swing and it could mean that these flotations may not happen until the autumn - if at all.

Risks paying off

However, there are companies that are joining AIM at this time. Italy-based graphene products developer and manufacturer has successfully raised £12.8 million - or £11 million after expenses - at 75p a share. Chief executive Giulio Cesareo says that the Directa Plus flotation went to exactly the expected timing and plan.

He says that Directa Plus came to AIM because it wants to become an international business and the junior market has investors that have experience and knowledge of investing in graphene businesses. The potential exposure to a fast-growing sector via a company that is already generating growing revenues appears to have offset any short-term concerns.

Overall, though, it does appear that there has been an effect on the UK GDP figures and this could continue to hold back growth for other quarters whatever the outcome. Consumer confidence appears to have weakened as well.

There is certainly interest in the EU referendum in the AIM community. Douglas Lowe, the chairman and chief executive of one of the earliest AIM-quoted companies , has set out his thoughts on the effect of the potential outcomes of the vote in great detail. Back in March, he wrote more than two thousand words in the property company's interim statement.

Sterling will fall in value after a Brexit vote, making imports more expensive and exports more competitive

A debate hosted by small company broker Peterhouse was attended by more than 200 market professionals and investors and they voted 56% to 44% to remain in the EU. However, when 'don't know' was offered as an alternative there was a significant number that opted for this alternative.

The referendum may not be the end of the debate, though. If the result is close or the turnout is low then this could create continued uncertainty and a clamour for another referendum. It has been pointed out that the parliamentary act that enabled the referendum to be held does not make any legal obligation to take action following the result.

One of the biggest effects of Brexit is likely to be a decline in the value of sterling, at least initially. The lead up to the referendum has already seen some sterling weakness, but there is likely to be a further fall after a Brexit vote. That would mean that imports would become dearer but exports would be more competitive in terms of price.

The flipside of that is companies' that have a significant proportion of their profit outside of the UK will make more in pound terms. The risk is that there could be a recovery in sterling after the vote which would make the overseas profit worth less in sterling terms.

Here are three companies that have significant non-UK and non-EU revenues which could provide a hedge against the uncertainty. None of these companies can be described as cheap but they are involved in growing markets around the world and have good track records so they should continue to prosper.

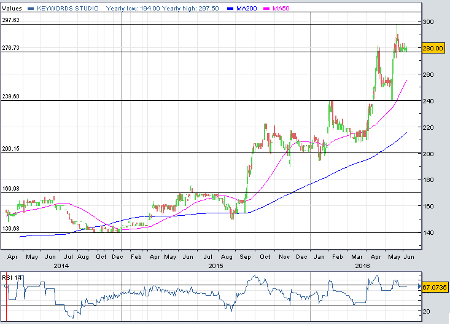

Keywords Studios (KWS)

is a fast-growing supplier of localisation, testing and artwork services to the electronic games sector. It has made a number of acquisitions so it is difficult to keep up with the geographical distribution of its revenues. The 2015 figures provide a guide, but they do not reflect the geography of the underlying customers. Even so, the UK accounted for €650,000 (£509,000) out of €58 million of revenues and the majority of revenues are outside of the EU.

Keywords reported an underlying 2015 pre-tax profit that was 57% higher at €8 million. Edison forecasts a 2016 profit of €11.6 million, rising to €13.9 million in 2017, following the recent acquisition of Synthesis.

The founders have sold shares, but there is plenty of appetite from investors for them even though they are valued at more than 20 times prospective 2016 earnings. This reflects the growing international games market, which is expected to be worth £113 billion globally in 2018, and Keywords' ability to make earnings enhancing acquisitions.

Craneware (CRW)

is based in Scotland, but its market is hospitals in the US. Craneware provides these US hospitals with software that ensures that they charge the correct fees to patients and insurance companies. Hospitals want to make sure that they are claiming all the revenue that they are entitled to, but there are still plenty that do not have the software to do this so the market continues to grow.

Hospitals pay monthly for the software and tend to be on five-year contracts so there are good quality recurring revenues providing 85% of total revenues. At the end of January 2016, the order book was worth $46.5 million (£32 million) covering the financial year to June 2016, which compares with the full year forecast revenues of $50.3 million.

Craneware already trades at a prospective multiple of around 26 - adjusting for cash in the bank - a significant premium to the software sector, but it is still an attractive investment.

accesso Technology Group (ACSO)

Ticketing and virtual queueing technology provider is another international business, with $86.4 million out of total 2015 revenues of $93.2 million coming from North America and Canada. Earlier this year, accesso extended its agreement with theme park operator Six Flags until the end of 2025. This covers 18 theme parks in North America. Another deal with theme parks operator Merlin, where the roll out has already begun, will make a significant contribution in 2017. The company is also trying to grow in Australasia and Asia.

This year's pre-tax profit is expected to increase from £7.2 million to £9.5 million, which still makes accesso the most highly valued of the three companies with a prospective 2016 multiple of 40. The directors sold shares earlier this year at a much lower share price.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.