Accrol cleans up on AIM debut

10th June 2016 12:55

by Harriet Mann from interactive investor

Share on

Toilet paper ain't sexy. Or rather, yesterday it wasn't. Today, tissue paper has captured the market's imagination with the IPO on AIM of Blackburn-based family business , a leading supplier of toilet paper to retailers like and .

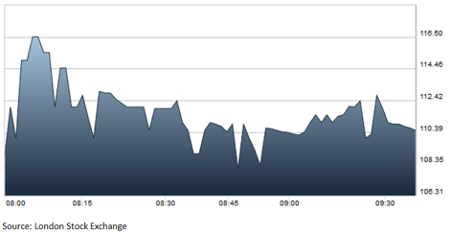

Institutions gobbled up 63.5 million shares at 100p each as part of the float, valuing the business at £93 million. That money will help bankroll expansion and underpin annual profit growth of 13% and a promised dividend yield of 6%. Up 10% to 110p in just a couple of hours Friday morning, investors clearly like the feel of Accrol.

The three Hussain brothers who own the company netted a cool £3 million each by trimming their combined 46% stake down to just 15%. The toilet roll manufacturer's major shareholder NorthEdge Capital raised just under £10 million selling its stake down from 47.6% to 15%. , and have all invested and will benefit from that fat dividend yield in 2017.

Sales have grown by 16.2% each year for the last three on a compound basis, with operating profit jumping 13.7%. Cash generation has also been strong, with committed capital expenditure of £18.2 million.

Helping the group finance organic growth in the discount market, grab market share make other improvements, the IPO cash will also pay off shareholder loan notes and refinance existing debt. Management hope coming to market will raise the profile of the business and incentivise staff.

The family business was started in 1993 by the brothers' father Jawid and now makes 16 million units of toilet roll, kitchen roll and facial tissues each week, supplying some of the largest retailers on the high street. Nearly three-quarters of Accrol's revenue came from private labels last year and it's increasingly popular in the discount market, which is growing by 10% a year. Management are confident none of its rivals can offer the same flexibility.

Instead of manufacturing so-called Parent Reel from pulp to then turn into different tissue products, Accrol buys the reels ready-made. This keeps overheads lower and gives it greater financial flexibility to take advantage of low manufacturing costs and increase margins. A global over-supply of pulp and parent reels is only likely to increase with extra capacity scheduled before 2019.

The 15 converting lines in operation give Accrol capacity for 118,000 tonnes of tissue each year, which will grow by 25,000 tonnes when two new machines are installed.

Representing a new era for the group, chief executive Majid has made way for new boss and former Unigate and Northern Foods man Steve Crossley. With over 30 years in the food and manufacturing industries, Crossley has most recently helped drive the restructuring and refinancing of Bright Blue Foods.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.