Insider: Three big buyers

17th June 2016 14:41

by Lee Wild from interactive investor

Share on

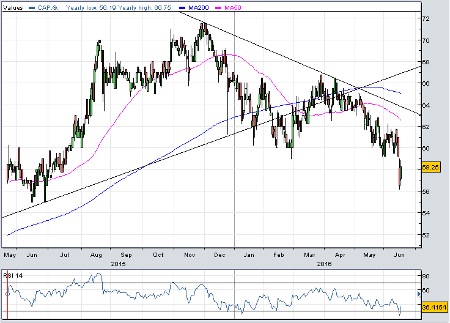

Capital & Regional

After a three-year recovery, UK shopping centre-owner share price turned lower late last year. It's headed south ever since and the real estate investment trust (REIT) has underperformed peers in the FTSE 350 Real Estate index.

Direction typically coincides with share-dealing activity of non-executive director Louis Norval. In December, Arctospark, in which the South African property magnate has an interest, sold or transferred its 29.1 million shares at an equivalent of 68.5p. Norval's PDI Investment Holdings and Mstead vehicles bought much of it.

Having fallen to just 56p this week, near a one-year low, PDI leapt into action again, spending £300,000 on 500,000 C&R shares at 60p. It had already bought 4.5 million shares in two tranches at 60p or thereabouts earlier this month, and now owns 9.3% of the business.

Norval's ownership of C&R is complicated, however, and his beneficial interest in the firm is now almost 137 million shares, or a 19.5% stake. Factor in all parties connected to him and that increases to 175 million and 25%.

But what's his motivation? Well, final results in March were decent enough, and there's a prospective dividend yield of about 5.7%. Management also aims to grow the payout by 5-8% a year. Numis Securities reckon even that may be conservative.

Analyst Robert Duncan also pencils in steady profit growth and net asset value (NAV) of 75p.

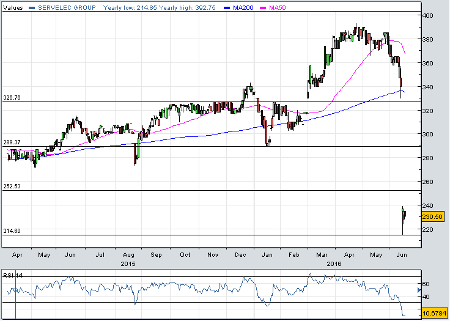

Servelec

Technology and software firm plunged by a third this week close to a new low. It warned it would make less money this year than in 2015 and "significantly" less than market forecasts. Procurement delays at both its healthcare and automation divisions take the blame.

"Some end markets are currently challenging and timing of order entry has become a short term issue," moaned chief executive Alan Stubbs. "As such the management has adjusted our outlook and have taken swift and prudent action to reallocate the resources of the group and reduce costs."

Broker N+1 Singer slashed its earnings per share (EPS) forecasts for 2016 by 26% to 15.9p and by 22% for next year to 19.5p. Fair value estimates slump from 417p to 258p in response.

"We remain hopeful these are timing issues rather than a permanent deterioration, however, it is likely to take some time to prove this either way," warns analyst Chris Glasper.

Trading at 392p last month and 340p just prior to the warning, Servelec shares, which listed in 2013 at 179p, could be bought for as little as 228p this week.

Non-executive director Roger McDowell is betting the worst is over, though. The serial director has just bought 100,000 Servelec shares at 234p each, taking his stake to a tad more than 186,000.

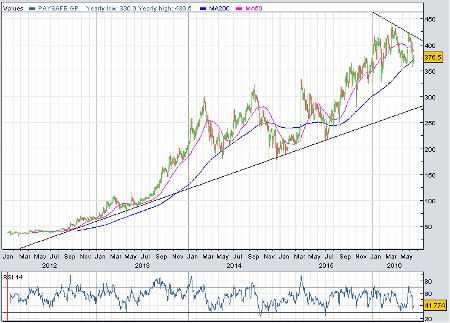

Paysafe

, known as Optimal Payments until last November, delighted investors with an encouraging four-month update in May. The digital payments and transaction firm said positive momentum from last year had spilled over in to 2016.

Its Payment Processing and Digital Wallets businesses had done particularly well. So well, in fact, that management has given guidance for the full-year which topped City estimates. Look for revenue of $950-970 million (£665-679 million) and adjusted cash profit of $270-276 million. Analysts were looking for $911 million and $260 million respectively.

The shares have fallen back since, which perhaps explains why chairman Dennis Jones has splashed out almost £144,000 on 40,000 shares at 359.7p each.

Michael Goltsman thinks it's a good call. The analyst at broker Citi believes the shares are undervalued, trading on a forward price/earnings (PE) ratio of about 14 times, and offering an EPS compound annual growth rate of 22% between 2015 and 2018.

"We believe that a higher multiple is justified given its strong growth profile and improving earnings quality," says Goltsman. "The group's major merchant accounted for 23% of group sales in 2015 vs. 37% in 2014."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser