FTSE 100 makes 11-month high

11th July 2016 14:50

by Lee Wild from interactive investor

Share on

In the City they say "let the trend be your friend", and sometimes you just have to go with the flow. It's what traders have been doing since the FTSE 100 began its miraculous post-referendum rally a fortnight ago. Central bankers and politicians are the centre of it this time and investors are betting that policymakers will do "all it takes" to keep global demand bubbling away.

Investors, still celebrating Friday's strong US jobs data, poured themselves another following Japanese Prime Minister Shinzo Abe's election victory overnight. His Liberal Democratic Party won enough seats to guarantee the success of constitutional reform and an expansion of market-friendly stimulus, or Abenomics.

Expect a cut in UK interest rates this week, too, so say most City insiders. The odds of a 25-basis point drop at Thursday's Monetary Policy Meeting are currently 80%, greatly increased following last week's dovish comments from Bank of England governor Mark Carney. UBS strategists expect a 50 basis-point reduction overall and resumption of quantitative easing (QE).

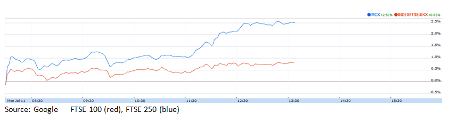

With a hike in US rates already discounted until December at the very earliest, a big jump in non-farm payrolls has soothed concerns about the strength of the American economy. This heady mix triggered enough 'buy' orders Monday to get the FTSE 100 up above 6,657, a 67-point gain and the best price since mid-August 2015.

But, for a change, it's the turn of domestic players to take centre-stage. Interest picked up late last week, but news Monday that 'Leave' campaigner Andrea Leadsom had pulled out of the Tory leadership contest came as a huge relief for markets. Naming EU-friendly front-runner Theresa May as Prime Minister far earlier than expected at least brings some certainty in a very uncertain world.

"With Leadsom pulling out there is one less question mark," Nigel Green, head of financial consultancy deVere Group, tells us. "It can also be expected that Theresa May, a Remain supporter, will not be as aggressive in the Brexit negotiations as Andrea Leadsom would have been."

Article 50 paperwork could easily remain in the pending file, or may not even be triggered at all, reckons Green. "This kind of 'Brexit-Lite' might well please the markets."

Again, bashed-up housebuilders like and are top of the pile, up around 7.5% but still down 27-30% since Brexit. Other domestic strugglers , , and B&Q-owner are on the menu, too, as are the banks, led by , but closely followed by and .

And, at last, the mid-caps are winning the game of catch-up. The FTSE 250 has started the week with a 2.7% rally, taking its three-day surge to over 1,100 points, or 7.2%. It's now little more than 700 points away from pre-Brexit levels.

Only four mid-cappers – , , and are in negative territory. The rest have raced away, fronted by housebuilders , and .

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.