Market-beating portfolio for Q3

12th July 2016 16:51

by Lee Wild from interactive investor

Share on

There are plenty of experts telling us what to do with our money, where to invest, what stocks to buy. Some are pretty good, others are not. The team at Panmure Gordon have an excellent record over the long-term, and we've followed their respected Conviction List. It's outperformed over the past three months, and a quarterly reshuffle is designed to make sure it does again in third-quarter.

Panmure's basket of 10-15 shares is up by 222% since 2010 versus a very modest 22% gain for a reinvested Datastream UK small companies index. It's outperformed the UK market in 13 of the past 16 quarters, and in second-quarter dipped just 3.2% compared with a 15.5% slump for the small-cap index.

That's not bad given markets were rocked by weak US first-quarter earnings, on-off Japanese economic stimulus, negative-yielding debt and two months of speculation culminating in Brexit at the end of June.

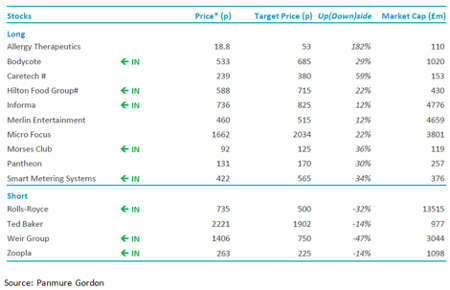

For the third quarter, the analysts have picked stocks which reflect the broker's outlook for a slowdown in UK growth during the second half of 2016.

"Downside risks to domestic growth stem from the uncertainty of the EU referendum result, but cyclical growth was already slowing as a rebound in energy costs and ongoing austerity was set to weigh on growth," points out Panmure.

"A bright spot for equities is the increasingly dovish Federal Reserve, now expected to leave US rates unchanged throughout 2016. The relentless drive lower in corporate and non-corporate fixed income yields continues to provide a valuation underpin for global equities."

Given new Prime Minister Theresa May could cause a split among 'Leave' supporters, Panmure is betting on either a second referendum or a general election to establish whether the government's proposed approach to secession commands public support.

So who's in and who's out this time?

There are five new entrants this time round. Heat treatment specialist , , publisher , doorstep lender and make the grade.

Six stocks make way for this lot. Toy company has taken a tumble and is now worth less than £100 million, below the required market cap. Sector uncertainty gets housing supplies firm kicked out, while mining conveyor belt maker has cut the dividend. Panmure has liquidity concerns around , dislikes uncertainty around financial plays like , and worries about advertising trends post Brexit, so gives the heave-ho.

Panmure doesn't shirk from shorting tips either. This time is reckons is at risk of order cancellations, oil pumps and seals supplier will benefit less from Chinese stimulus, while online estate agent is under pressure post-Brexit.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.