Stocks with serious momentum

13th July 2016 12:37

by Lee Wild from interactive investor

Share on

Forget valuations, forget company profits, forget dividend yield, it's all about momentum right now. An initial post-Brexit plunge was no surprise; the spectacular surge that followed was. Whether it's bargain hunting, Brexit doubts, central bank intervention or first-class income generation, equities have been unstoppable this past fortnight.

There's a saying in the City: "let the trend be your friend", and when markets are like this you don't fight it.

Theresa May's early victory in the Tory leadership race does at least give some certainty to markets, and both stimulus in Japan and a high growth/low interest rate environment in the US underpins confidence in stocks.

Indeed, Wall Street is quite literally on a high. Just last night, the broader S&P 500 hit a best-ever 2,155. And, since bottoming out on the morning of 24 June, we've watched the FTSE 100 rise consistently. It's up as much as 16%, from 5,788 to yesterday's 11-month high at 6,703.

It's a high-risk strategy based on buying high and selling higher - it requires faithDefensive plays have done incredibly well. Already coveted for reliable earnings and dividend payments, the weak pound has given big overseas earners an additional boost. That's been reflected in performance across utilities, tobacco and pharmaceuticals.

Of course, the blue-chip index is jam-packed with these attractive "on-trend" sectors. But, despite all the brouhaha around the Brexit vote and subsequent political turmoil in the UK, the largely domestic earners filling the FTSE 250 index have been attracting buyers again, too, more so since May got her leopard-print kitten heels in the door of 10 Downing Street.

With this in mind, it's worth studying the concept of momentum investing. It's a high-risk strategy based on buying stocks with the wind in their sails - buy high and sell higher. It requires putting fundamentals to one side and keeping faith in companies that have been, and remain in high demand.

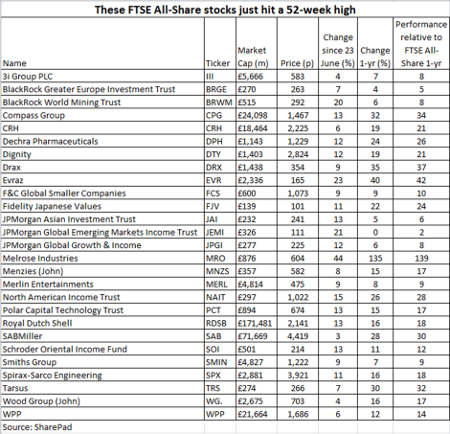

Today, 27 FTSE All-Share companies and investment trusts have just hit a new 52-week high. Over the past week, it's 130, among them almost one-third of the FTSE 100.

Private equity firm is the latest blue-chip to celebrate a new one-year best, joined by caterer , Irish builder , theme park owner , engineering conglomerate and ad giant .

And, playing catch-up, the FTSE 250 boasts nine new 52-week highs Wednesday and 45 in the last seven days. Asset manager and , formerly Bank of Georgia Holdings, are flying. Funeral director , power station operator and miner are, too.

The big question is: will they keep doing it? Up over 20% since the February low, this is technically a bull market, and investing in a cyclical bull market is easy, right?

Well, momentum appears unstoppable right now - share prices have begun to rise again as I write - and certainly events currently underpin demand for equities. They're not cheap, but economic stimulus is keeping borrowing costs down, and you'll struggle to get better income anywhere else.

In a recent article, Is 'mad' FTSE 100 really on its way to 7,000?, technical analyst Alistair Strang told us his charts were pointing at 6,900 for the FTSE 100. He repeated the possibility this week in Key numbers to the FTSE 100 puzzle.

And the reasons behind the rally so far, mentioned previously, still stand. They will inevitably succumb at some stage, of course, either to a simple round of profit taking, or a more sinister market-moving event.

It's impossible to say when and by how much, which is why momentum strategies require an escape route. We've mentioned stop-loss systems here in the past, most recently in an article by Ben Hobson at Stockopedia.

As Ben says: "Shying away from expensive looking valuations can risk overlooking some of the best companies in the market. But it's important to remember that momentum can suddenly turn and quality can deteriorate. Expensive shares are very fragile because the market has high expectations for them."

That's sensible stuff, and the ability to move quickly to protect profits is critical with this strategy.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.