The big Brexit questions answered here

19th July 2016 12:45

by Lee Wild from interactive investor

Share on

A month after the Brexit vote and we're still none the wiser. Theresa May has her cabinet in place and a team devoted entirely to making the leaving process work, but they still have no idea what the final outcome will be. Here, some of the brightest financial minds attempt to answer five of the biggest unanswered questions for financial markets.

After spending the past two weeks on a marketing trip across Europe and the US, investors have been asking analysts at UBS the same questions. Americans are still worried about the political uncertainty in the UK and across Europe following the EU referendum.

Like many over here, they wonder whether the UK might not actually end up leaving the EU; that there might be a second referendum or general election, or a deal that looked similar to the existing situation.

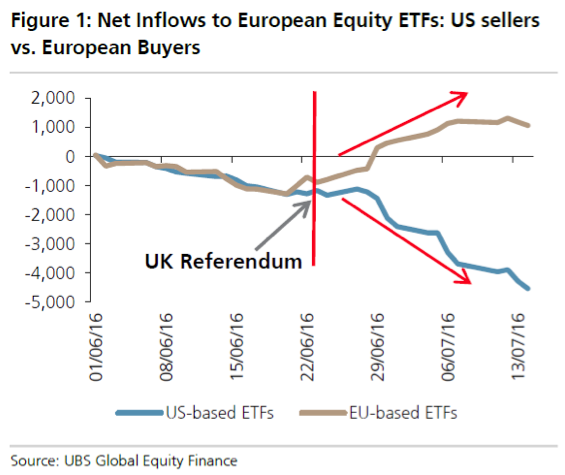

It's why they're concerned about the banking system, which explains big outflows of cash from US-based ETF's investing in European equities, according to the UBS Global Equity Finance team (see chart below).

So, first question is just what will the macro impact be post the Brexit vote? UBS has already downgraded 2017 GDP growth forecasts for the UK from 2.2% to just 0.5%, but it's also cut estimates for Europe and the US.

"Just three weeks in, it is too early to judge the full impact – but there are some early "canaries in the coalmine"," says the broker. "UK consumer confidence fell the most for 21 years, the UK construction PMI is at a post-2009 low and new buyers' enquiries for UK housing have fallen to the lowest since 2008."

Investors also keep asking what's the impact on earnings? Well, this year might actually be better than expected in Europe, reckons UBS, although 2017 could be worse, tipping EPS growth of 8% versus consensus estimates of 13.6%.

"But we suspect after five years of no earnings growth whatsoever and with upgrades in just two out the last 63 months, any growth will be a surprise to investors," writes the broker.

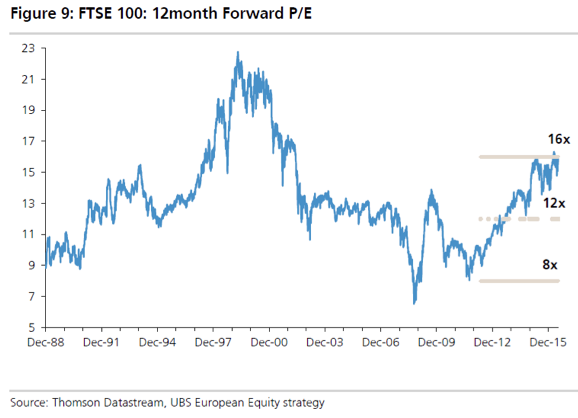

"For the UK, there is a clear upgrade to EPS given that 75% of revenues for the FTSE 100 come from overseas (but as highlighted in Figure 9, there is a large amount of upgrades already implied in the multiple). Historically, each 10% fall in the pound versus the dollar and euro has boosted EPS by c.6%."

With that in mind, but also considering the recent spectacular rally, is there value or are markets expensive?

Currently, the FTSE 100 is trading on 15.8 times forward earnings, but strip out the tech bubble in the late 90s/early 2000s and it's near its highest since records began in 1988. The long-run average is just 13.4 times, and we'll need far more upgrades before the market gets anywhere near that again.

"We see this as already baking in a lot of upgrades (it already includes a 3% upgrade since the vote)," writes UBS. "Indeed, on the consensus numbers the PE ratio does not drop below the long run average until end-2018E (and this assumes EPS down 7% in 2016 but then up 16% in 2017 and 14% in 2018)."

In Europe, however, valuations look "less stretched" with the market trading on 14.4 times 12-month EPS forecasts, below the long-run average of 14.8 times.

Defensives have been the main beneficiaries of the post-referendum flight to safety. They tend to have reliable earnings streams, pay attractive dividends and are less-affected by macro events, especially the UK's future participation in the European Union.

That's clearly made them a more expensive proposition right now, but investors are still asking UBS whether there any value still exists among the defensives. The short answer is "yes".

"The lower macro growth backdrop and the 'lower for longer' forecast for yields points towards defensives. We look for those that may do well when PMIs slow, but that are also relatively inexpensive.

"Whilst we struggle with the valuations of consumer staples, we upgraded Pharma to 'overweight' in April and last week upgraded Utilities to 'overweight'. Utilities benefit from lower bond yields and rising energy prices," explains UBS, which also rates Telecoms highly.

It's also worth noting that rarely have oil prices been rising in a period of falling or ultra-low bond yields – it's because of the inflationary impact of oil and usual correlation to demand. But they are now, and utilities have tended to "outperform sharply" whenever it's happened in the past.

And there is a silver lining for equity markets in the shape of ultra- low corporate bond yields, which is something investors keep badgering UBS about.

"The gap between dividend yields (3.6%) and corporate credit yields (1%) is at decade highs, putting new pressure on companies to review their capital structure," it says, either by shareholders, activist investors or maybe even other companies.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.