Dull Draghi leaves FTSE 100 hanging

21st July 2016 14:39

A week after Bank of England governor Mark Carney backed off from threatened cuts in interest rates and more quantitative easing (QE), his opposite number in Europe has decided not to loosen monetary policy further.

Back in Frankfurt after last month's trip to Vienna, European Central Bank (ECB) policymakers decided not to pull any surprises, preferring instead to leave eurozone interest rates on hold at zero. It's also stuck with the 0.4% charge to banks for looking after its cash overnight.

"The Governing Council continues to expect the key ECB interest rates to remain at present or lower levels for an extended period of time, and well past the horizon of the net asset purchases," read a brief statement ahead of Draghi's press conference.

It also confirmed that monthly asset purchases of €80 billion will, as planned, run until the end of March 2017, or beyond, if necessary.

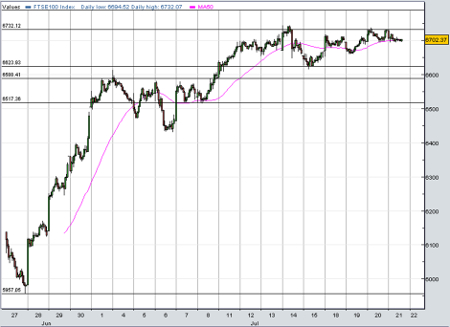

As predicted, stocks had dipped slightly at the open and held station ahead of the lunchtime policy announcement. But there's no catalyst here to give markets another leg-up. Even the post-announcement press conference was devoid of any excitement, and the FTSE is still down around 20 points just north of 6,700.

ECB president Mario Draghi admitted that the UK referendum on EU membership threatened the region's recovery, and growth will have slowed in the second quarter. Slowing emerging markets and lack of urgency over structural reforms could also affect progress.

He said risks remain skewed to the downside, but then he repeats his promise to "act by using all the instruments available within its mandate". While it's too early to assess the need for fresh stimulus, the situation will be considered at the next meeting in September. We kind of already guessed that.

With nothing out of China to cause demand jitters, miners turn from midweek zeros to Thursday's heroes. , , , and always move in a gang, and now is no different with the Big Five littering the list of top 10 risers.

Broadcaster continues to play catch-up ahead of next week's interim results, still filling the gap to 23 June prices at 220p. Kind words from Barclays on the insurance sector nudged big fish a little higher, but most marked time.

There's nothing better to dent a CEO's ego than a sharp rally on news of their departure. But that's what happened when James Henderson, boss since 2014, dropped the bombshell that he wanted to leave straightaway after more than 30 years at the high street bookie.

Hill shares rose 8% Thursday, but there's much to do after an unimpressive three years. Poor gambling results, the government's point of consumption tax and rise in duty on machine games from 20% to 25%, have made things very difficult for bookmakers.

Finance boss Philip Bowcock will take over until a permanent replacement is found, concentrating firmly on the internet business.

No one is buying and after retail sales fell in June by the most for six months. Don't blame Brexit, it was the weather, said the Office for National Statistics. Sales fell by 0.9% in five weeks to 2 July versus May. Experts had wanted a more modest 0.6% decline.

And anything to do with travel abroad remains a no-go. Terror attacks and an attempted coup in Turkey do not make people want to rush out and book holidays, and is bottom of the pile Thursday. Less than a month after the budget carrier issued a third-quarter profits warning, the shares are down 7% back near the recent three-year low after the official gloomy quarterly update.

It clearly doesn't rain, but pours at easyJet. After an incredible four years, it's on the back foot, blaming air traffic control strikes, other industrial action, runway closures at Gatwick and severe weather. Industry capacity growth in short haul is also affecting yields at a peak time of year.

Numis Securities still likes the business, but slashes profit forecasts for 2016 from £612 million to £495 million.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks