Profit warnings spike in second quarter

26th July 2016 11:12

by David Brenchley from interactive investor

Share on

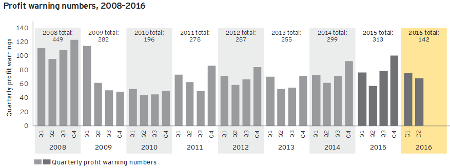

Brexit uncertainty has pushed second-quarter profit warnings from UK-listed companies to their highest level since the financial crisis in 2008, according to a report from Ernst & Young (EY).

In total, 66 profit warnings were issued in the second quarter of 2016, the accountancy firm's latest Profit Warnings report found, 16% up from the second quarter of 2015 when 57 companies warned. This brings the year-to-date figure of total profit warnings to 321, compared to 297 in 2015.

The support services sector was hardest hit with 14 companies warning, while travel & leisure (eight), general retailers (seven) and media (six) were also affected.

The research found that only 11% of these warnings, which are often seen to precipitate a cut in a firm's dividend, were Brexit-related, with slower-than-expected sales still the primary concern for most companies.

Disrupted picture

As EY points out, though, the challenges brought about by the UK's decision to leave the EU will continue to weigh on businesses.

Alan Hudson, head of restructuring for UK & Ireland at EY, says: "It's been a dizzying, unpredictable time since the EU referendum. The initial impact of this uncertainty appears to have pushed profit warnings to their highest second-quarter total since 2008.

"But ultimately it's hard to separate the Brexit effect from the underlying issues that brought high levels of warnings in previous quarters. Many UK companies still face sluggish, disrupted and competitive markets, with Brexit adding further layers of challenge, but also opportunity."

Hudson adds that while Brexit will disrupt company operations and business models, this is part of a "bigger disrupted picture".

Dividend crunch

Indeed, predictions of a forthcoming dividend crunch have been around since before the EU referendum threw up its surprising result, with geopolitical worries and the fall in the oil price affecting the ability of the larger blue-chip UK firms to sustain their yields.

This culminated in high-profile cuts from the likes of , and during the first quarter of the year.

Latterly, there have been warnings around dividend cover in the FTSE 100, although the latest UK dividend monitor for Capita Asset Services found the dramatic fall in the value of sterling is likely to net income investors a "dividend windfall".

However, these firms' dividend cover has fallen by and large to under two times earnings, suggesting the yields, some of which range from 8.1% to 6.6%, are unsustainable. As a rule of thumb a dividend cover figure above two times generally means a dividend is safe.

"The need [for companies] to adapt, innovate and capture limited growth in constantly changing markets continues unabated," Hudson concludes. "Companies will need an integrated response to help them navigate their way through this period of immense change.

"The winners will be those that demonstrate clear thinking about their priorities, build in resilience to cushion the knocks and ensure that they can take advantage of opportunities. It's all change again, but upheaval and transformation are becoming the norm."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.