Taylor Wimpey keeps building profits

27th July 2016 14:27

More than a month has passed since the UK decided to leave the European Union and, despite the rhetoric of uncertainty, lots of us are still buying homes. The group is more profitable than this time last year, its new £450 million dividend scheme is safe, and the share price continues to make a comeback, too.

Despite macro uncertainty, demand for homes and the government's Help to Buy scheme have underpinned the housing market since the referendum. There was a brief blip in the average cancellation rate immediately following the Brexit vote, although this is back in line with low levels, and the wider London market remains robust, says Taylor Wimpey.

"One month on from the EU referendum, current trading remains in line with normal seasonal patterns. Customer interest continues to be high, with a good level of visitors," said chief executive Pete Redfern.

"Whilst it is still too early to assess what the longer-term impact from the referendum result on the housing market may be, we are encouraged by the first month's trading and by continued competitive lending from the mortgage providers as well as the positive commentary from government and policymakers."

Taylor Wimpey built over 6,000 new homes in the six months to 3 July and its order book has swollen to over £2.2 billion, with 90% of its properties for 2016 already sold. Its homes sold for an average £238,000, 5.8% higher than this time last year, driving a 9.1% increase in revenue to £1.5 billion and 12% increase in pre-tax profit to £266.6 million. Earnings per share (EPS) rose 14% to 6.6p.

Taking the total payout to around 10.91p per share this year (£356 million), investors will get a 0.53p interim dividend in October. And, crucially, the company said it remained "fully committed" to the dividend policy announced in May.

Shareholders are promised an enhanced ordinary dividend in 2017, representing 5% of group net assets and at least £150 million each year through the cycle. They'll also get a special dividend of £300 million, or about 9.2p a share, next July.

Tangible net asset value per (TNAV) share rose 7.8% to 88.5p in the half-year to 3 July and net cash jumped by a third to £116.7 million. Return on net operating assets has increased by 2 percentage points to 25.2%.

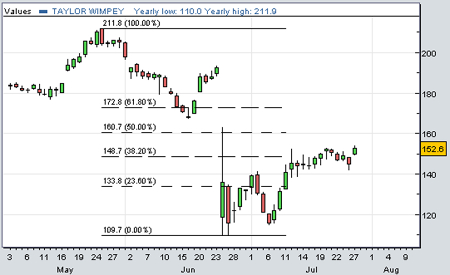

Taylor Wimpey stuck within a solid trading channel for the 12 months before June's referendum, after which the housebuilder collapsed to a two-year low of 109p. Leaping 5% to 153p Wednesday, the shares have now recovered by 40% and are firmly above the significant 38% Fibonacci retracement level from its pre-referendum high.

In a research note yesterday, Deutsche bank analyst Glynis Johnson slashed price targets across the sector. However, she still thinks Taylor Wimpey will be worth 218p target price and offers a 7.4% prospective yield.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks