World's cheapest opportunities in Europe

2nd August 2016 13:25

by Graeme Evans from interactive investor

Share on

Playing it safe comes with its risks, as UBS analysts have attempted to show today with another note on Europe's tech-boom sized value gap.

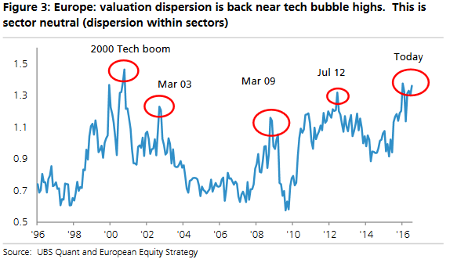

Such gaps open up within sectors when investors desperately crowd around the best stocks and drop the rest. In Europe, the gap between cheap (value) and expensive (growth) stocks remains at the highest since 2000.

Whilst admitting that Europe's politics and lack of profitability mean it is not without risks, UBS asks if much of the negative sentiment is now in the price.

And it believes that if there is any unexpected 'good news', history suggests that the pay-back for value stocks is +20% over the next six, nine and 12 months.

UBS wrote: "You can keep buying defensible growth and quality - but is it hitting the ceiling? For it to rise higher we need things to get much worse from here.

"The upside looks limited - even during the dark days of the crisis - tactical swings into value occurred.

"Is a lack of profit growth in Europe, billions in Italian banking non-performing loans and operating margins at 2009 lows - a new paradigm or the aftermath and after-shocks of a very big financial/sovereign crisis?"

UBS suggests taking some profits and nibbling on Europe relative to the United States, Estoxx 50 relative to the FTSE 100 and to search for value candidates within European sectors.

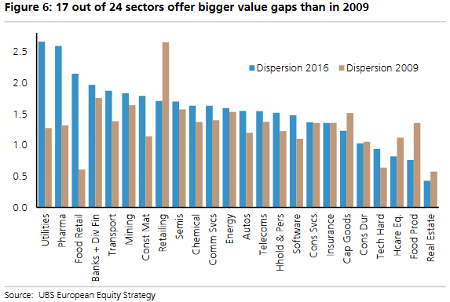

The industries most responsible for the current gap are utilities, pharma, food, retail and the financials, with 17 out of the 24 sectors offering bigger value gaps than in 2009. The valuation gap, or desire to buy the 'best' within a sector, is much higher in Europe than in the UK.

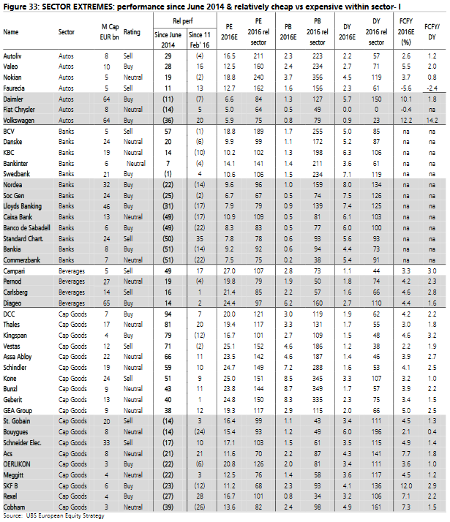

UBS has published a table of stocks showing the relatively expensive and cheap stocks per sector when taking advantage of this value gap theme.

To get into the value pocket, stocks need to be cheaper than sector peers on two out of three measures - price/earnings (PE) ratio, Price/Book (PB) ratio, and dividend yield (DY). Entry into the more expensive camp also requires two of these three measures.

Among UK stocks, unwanted companies on the list include , , and . In Europe, the list features Daimler, SocGen and Deutsche Bank, among many more.

It is not the first time this year that UBS has highlighted the extent to which investors do not appear keen on value.

The subject was also flagged in February prior to a big value rally when oil prices rose and US recession fears subsided.

Going back further, UBS posts a reminder of March 2009 when only top quality growth would do until the White House announced the Troubled Asset Relief Program to purchase toxic assets from financial institutions.

It adds: "If you are going to risk buying value, then based on history, we think now may be a good time to risk it."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.