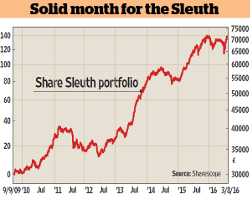

Share Sleuth: A company with staying power

16th August 2016 14:08

by Richard Beddard from interactive investor

Share on

Counting back through my 2016 trades doesn't take long. Up until Midsummer's Day I traded just twice: I added shares in January and topped up the Share Sleuth portfolio's existing holding in in March. Right at the end of June I made a third trade by adding .

Then, in one heady week in July, I equalled my trading record in the first six months of the year by ejecting and from the portfolio and adding .

I wouldn't want you to think I've been opportunistically trading in a volatile market whipped up by the vote to leave the European Union. Always a reluctant seller, I was forced to remove two shares from the portfolio by my desire to add another, because earlier additions had used up the portfolio's spare cash.

Always a reluctant buyer, I was compelled to add shares in Solid State by the "decision engine". It had a role in determining the shares I sold, too.

Different companies

The decision engine is my method of comparing very different companies. To illustrate how different they can be, just consider Next and Solid State, the two companies I've added most recently.

Next is a household name with a market capitalisation of more £7 billion, which makes it the 66th biggest company listed on the London Stock Exchange (LSE). It's a retailer of clothes and homeware in large volumes.

It's a manufacturer of custom high-tech batteries, aerials, walkie-talkies and computers for use in military and harsh industrial environments, mostly in low volumes.

It might seem a hopeless task deciding whether these companies make better investments than an agricultural, industrial and banking conglomerate (Camellia) or tiny software developer (EDP), but that is essentially what investors do every time they trade.

The decision engine ranks the companies I follow and highlights the most attractive. A firm's rank is determined by a judgement about whether it has the qualities I prize most highly in a business, and its market valuation.

It keeps me focused on what matters and, like the proverbial tin hat, it mutes market noise and prevents me being swayed by things that don't matter.

So despite their apparent differences, Next and Solid State must have much in common, as they are both ranked highly by the decision engine.

Much in common

Both companies are highly profitable and have been stockmarket darlings but have fallen out of favour; both are run by owner-managers who have guided them successfully through recession; and both were trading at low market valuations that implied traders thought their growth years were over.

Crucially, I have every reason to believe that both will retain many of the qualities that enabled them to profit handsomely in the past into the future.

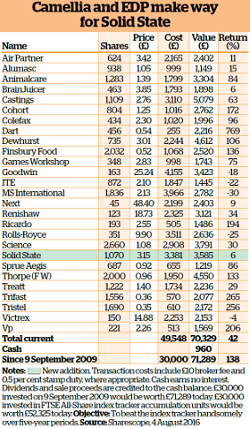

The ejection of 15 Camellia shares, at £80.50 a share, and 2,397 EDP shares, at 70.1p a share, raised enough money after fees for me to invest £3,380.50 (including fees) in Solid State, about one 20th of the value of the portfolio. I added 1,070 shares at 315p.

Although business software supplier EDP has loyal customers, particularly builders' merchants and electrical wholesalers, it has been unable to grow, which suggests I may have underestimated the competition it faces. Since it has put itself up for sale, it was unlikely to remain a long-term holding anyway.

Camellia beguiled me, but I misunderstood it. I thought the group's diversity would give it strength, but a return on capital of 4% in 2015 and 3% in 2014 suggests weakness. Moreover, it seems to be retrenching on its strong long-term vision.

This article was originally published by our sister magazine Money Observer here

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.